What are automated savings tools (and how do they work)?

Automated savings tools are banking features or apps that use technology to help customers save money more efficiently by automating the transfer of funds from their checking or transactional accounts to savings accounts.

Automated savings tools help customers build a savings habit by:

-

Removing the need for manual transfers,

-

Reducing the temptation to spend, and

-

Ensuring consistent progress towards financial goals.

In addition, they also improve financial discipline and facilitate compound interest growth by encouraging regular saving.

How do they work?

These tools schedule regular, automatic transfers at set intervals, for example, weekly or monthly, or by rounding up everyday purchases to the nearest currency unit and saving the difference.

1. Automatic transfers: Customers set a fixed amount or percentage of their income to be regularly transferred from their primary account into a separate savings account. These transfers occur without any manual intervention, helping customers save consistently over time.

2. Round-up savings: The tool tracks debit or card transactions and rounds each purchase up to the nearest whole currency unit.

The spare change is then automatically moved into savings, allowing small, frequent contributions without noticeable impact onthe customer’s spending budget.

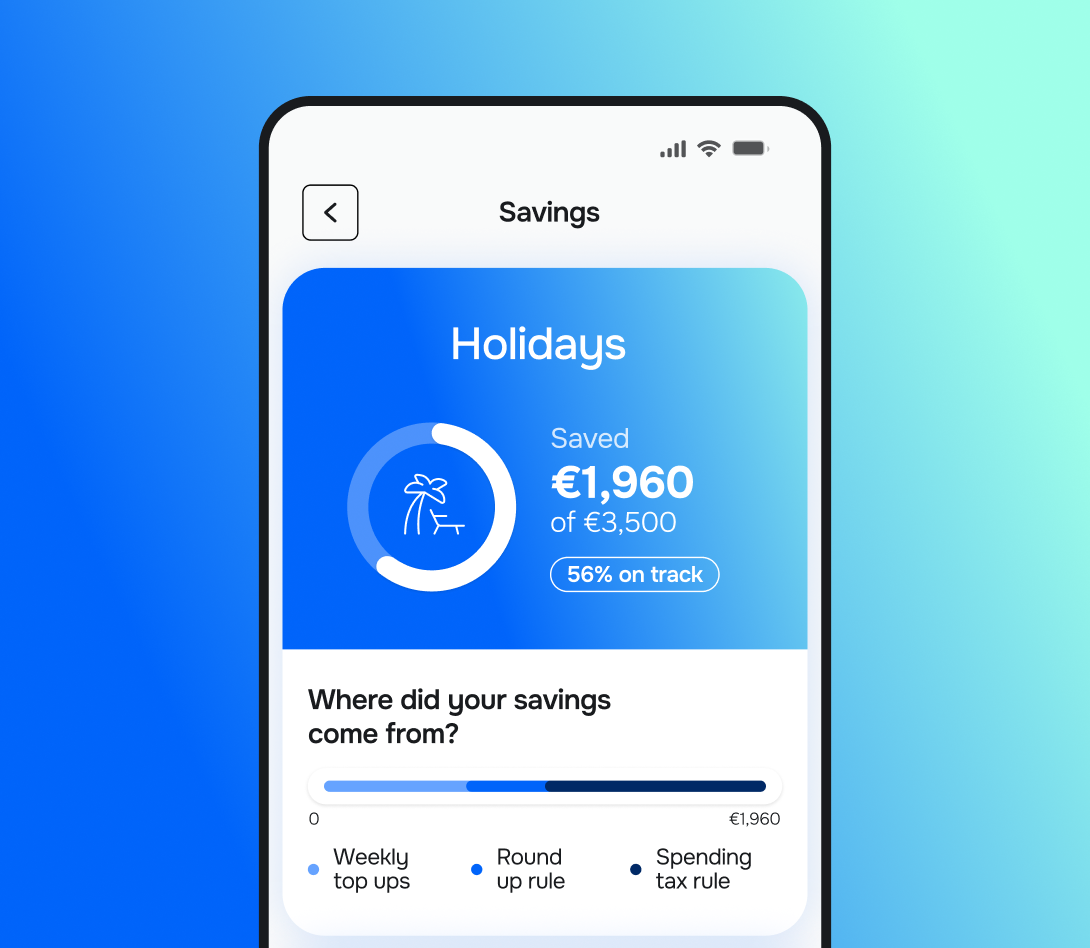

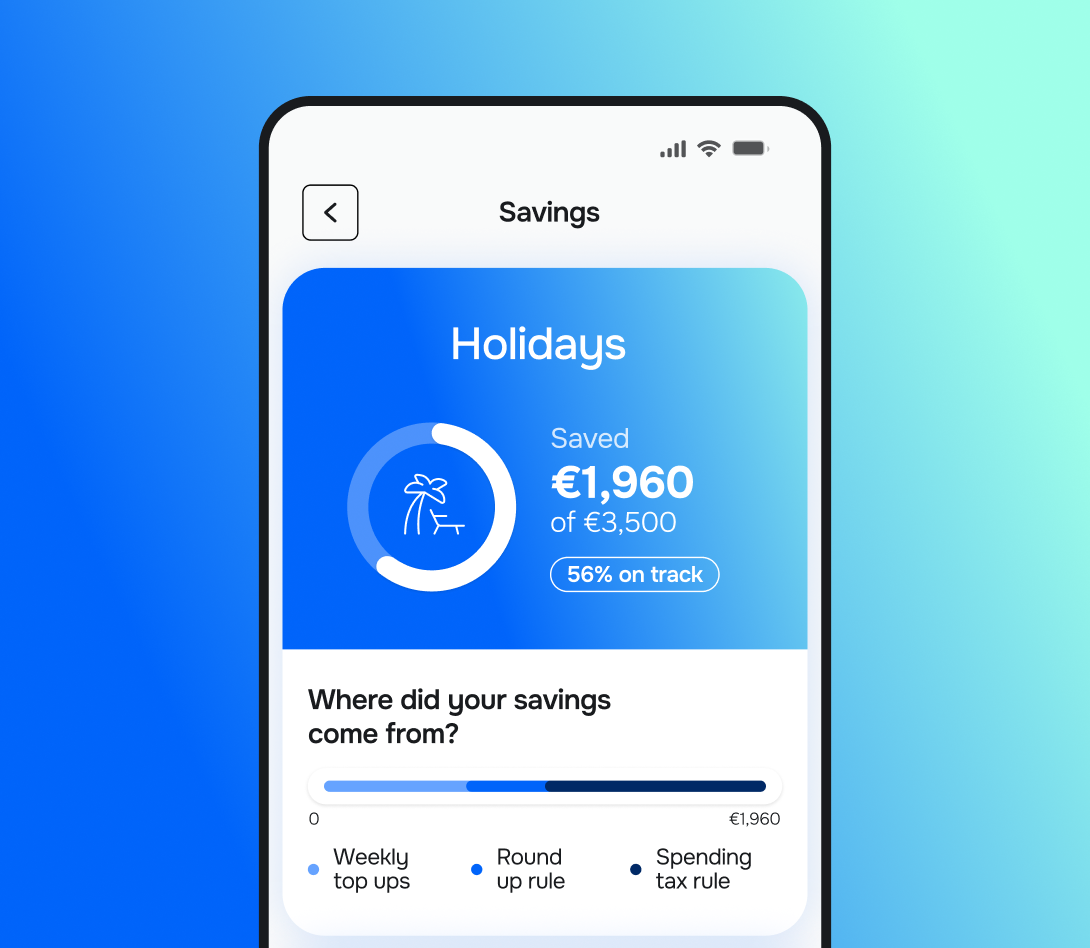

3. Goal-based savings buckets: Some solutions, like Meniga, allow customers to create multiple savings 'pots' or categories for different goals, such as an emergency fund, vacation, and education.

Automated transfers or round-ups can be allocated specifically to these buckets to help customers organise and visualise their savings progress toward various objectives.

4. Adaptive savings suggestions: Advanced tools may analyse spending patterns and cash flow to suggest personalised saving amounts that are affordable.

They automate the adjustment of transfer amounts dynamically to optimise savings without causing financial strain.

5 key reasons why banks should adopt automated savings tools

For banks, offering automated savings tools improves customer engagement, loyalty, and overall financial wellness, while also driving operational efficiency and long-term deposit growth.

1. Create more predictable cash flow

Automated savings take the burden of manual saving away from customers, incorporating saving behaviour into daily financial routines.

By removing reliance on willpower, these tools help customers save consistently.

Also, with rising financial volatility, customers are more prone to procrastination, forgetfulness, or anxiety about starting and keeping up with savings goals.

Automation smooths over those friction points.

For example, if a customer forgets to transfer funds at month-end or if mid-month expenses derail their plan, an automated tool can trigger a smaller transfer or adjust the plan without requiring customer intervention.

Therefore, this ‘set it and forget it’ approach builds a savings habit gradually.

Banks offering these tools help customers grow their savings steadily, while also reducing stress, lowering the psychological cost of planning, and fostering trust.

Over time, these habits result in stronger customer loyalty, higher deposit balances, and more predictable cash flows for the bank.

2. Enhance liquidity management

Regular, automatic saving removes unpredictability from the savings journey, enabling customers to hit milestones with greater speed and certainty.

For example, round-up savings on card transactions funnel small spare change regularly, accumulating surprisingly quickly.

| Which customer segments respond best to round-up savings features? |

| Customer segment | Characteristics | Why they respond well to round-up features |

| Younger, tech-savvy customers | Millennials and Gen Z are comfortable with digital banking | Prefer frictionless, automated saving tools integrated in apps |

| Moderate-income earners with variable cash flow | Gig workers, freelancers with irregular income | Save small amounts consistently without affecting essential spending |

| Beginners or reluctant savers | Struggle to save regularly, prefer effortless saving | Automates small actions, removes reliance on willpower |

| Short- to medium-term goal focused | Saving for emergency funds, travel, gifts, etc. | Incremental saving toward tangible near-term goals |

| Digital-first and mobile-only customers | Primarily use mobile banking | Ease of access and real-time updates encourage engagement |

And while small, these nudges have psychological power: customers rarely notice them, so lifestyle disruption is minimal, yet the momentum is real.

This systematic approach converts scattered, unpredictable saving habits into dependable progress, thereby shortening the time it takes to reach financial goals, such as building emergency reserves or saving for a down payment.

As customers steadily save through round-up savings and scheduled transfers, the bank’s deposit base grows consistently.

This ensures a more reliable and increasing source of low-cost funds that your bank can use for lending or investments, enhancing liquidity management.

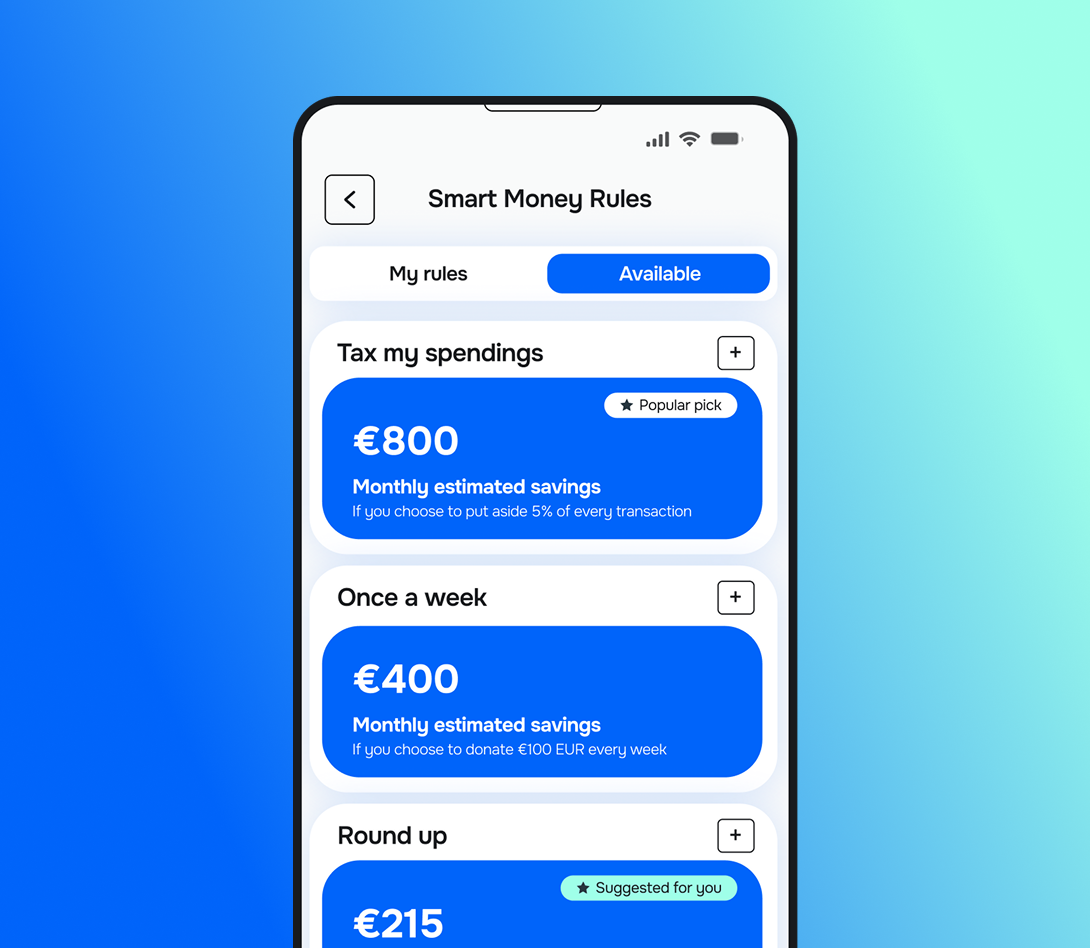

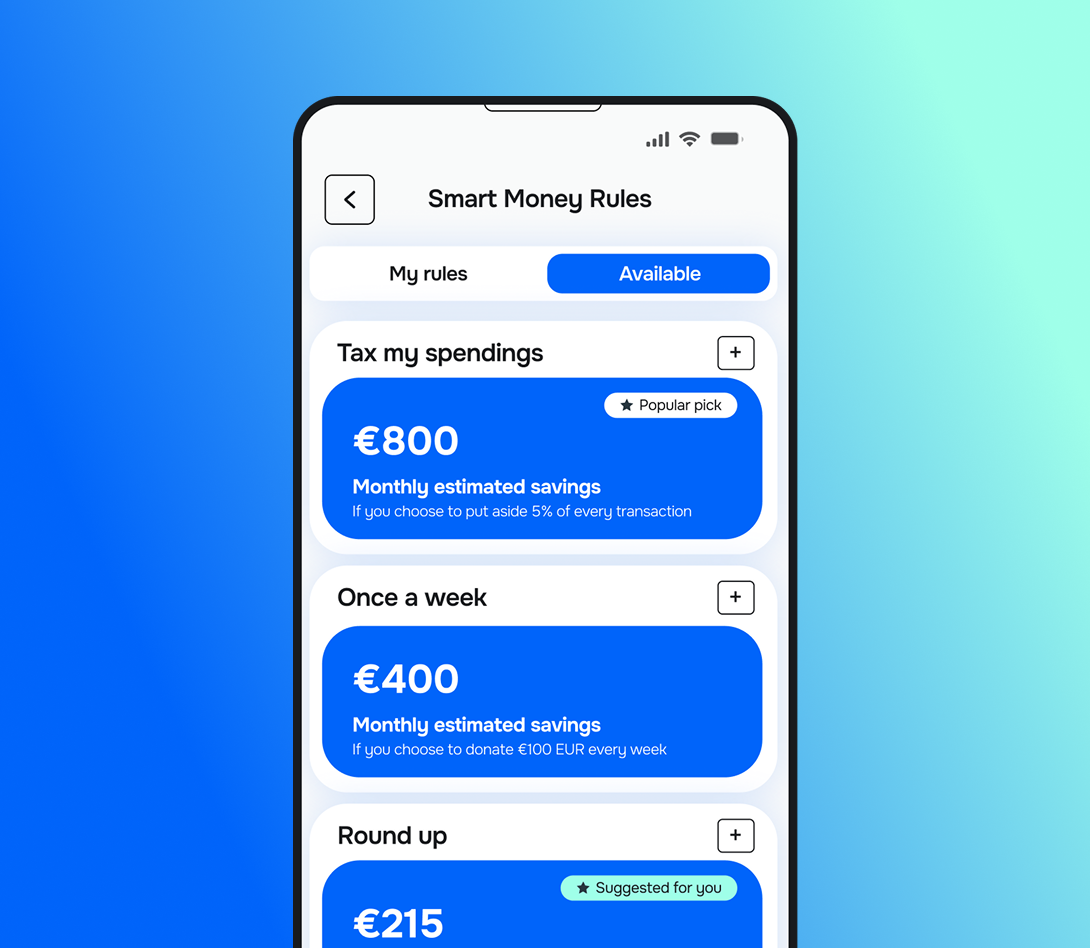

With Meniga’s Smart Savings feature, you can turn transactional data into actionable insights and automate savings with flexible, gamified rules:

Every purchase a customer makes is rounded up to the nearest euro (or other currency), and the spare change is automatically transferred to their savings.

3. Increase and stabilise deposits

Automated systems remove the temptation to spend money that would otherwise remain in a checking account, redirecting funds automatically into savings before customers can use them.

As a result, this helps protect savings from being quickly depleted.

Over time, customers establish a stable and growing savings buffer that enhances financial resilience and reduces stress during economic uncertainty.

Reducing impulsive spending through automated savings systems is highly relevant for banks because it helps increase and stabilise deposits, which are a core funding source.

Customers with automated savings are more likely to maintain positive balances and engage with the bank's financial products over time, increasing lifetime value and cross-selling opportunities.

By offering effective automated savings tools that genuinely help customers achieve their goals faster, you position the bank as a partner in financial wellness, attracting new customers and retaining existing ones.

With Meniga, customers can automatically ‘tax’ specific spending categories.

For instance, a small percentage can be set aside from ‘guilty pleasure’ spending categories, such as dining out or entertainment, converting impulse spending into savings.

4. Offer tailored savings experiences

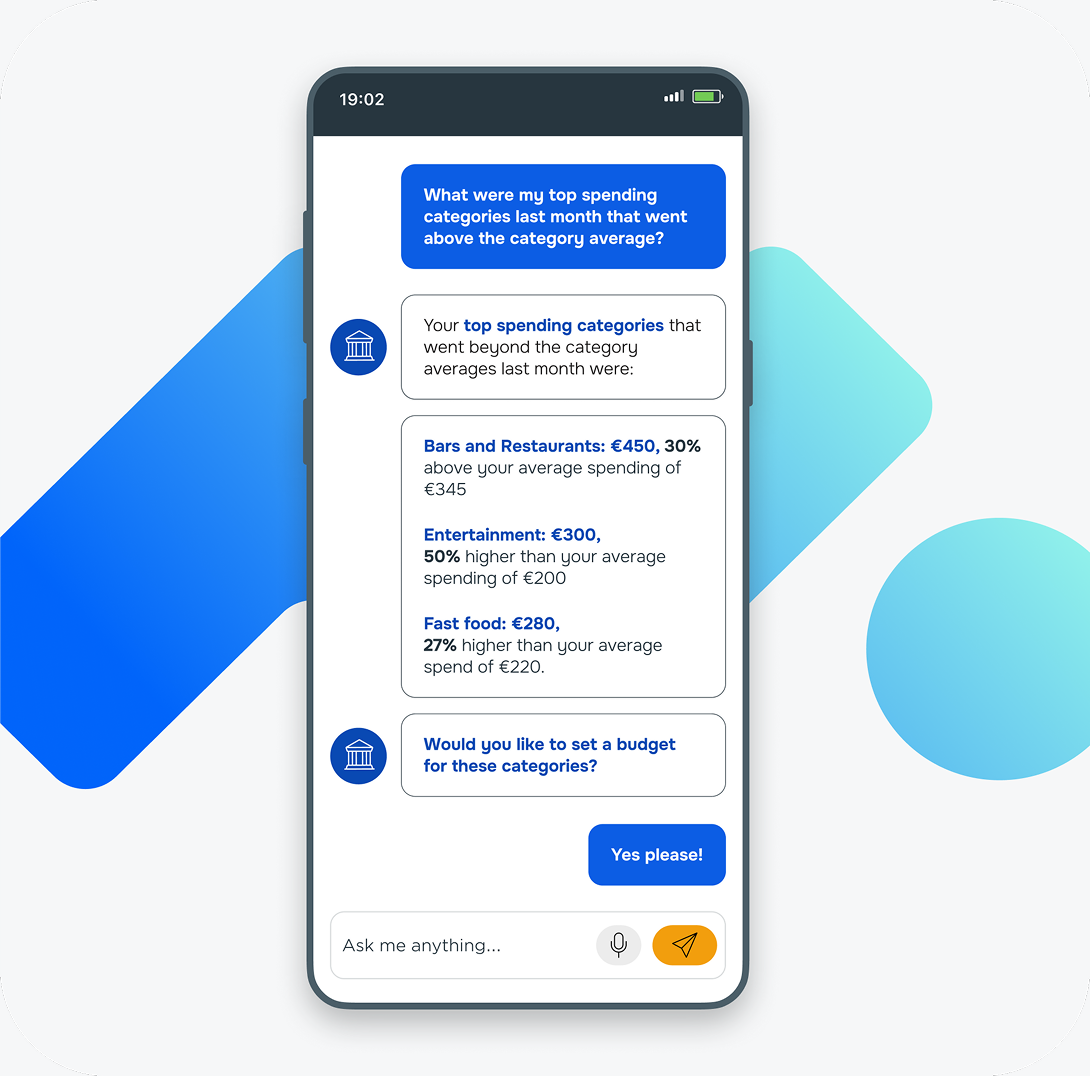

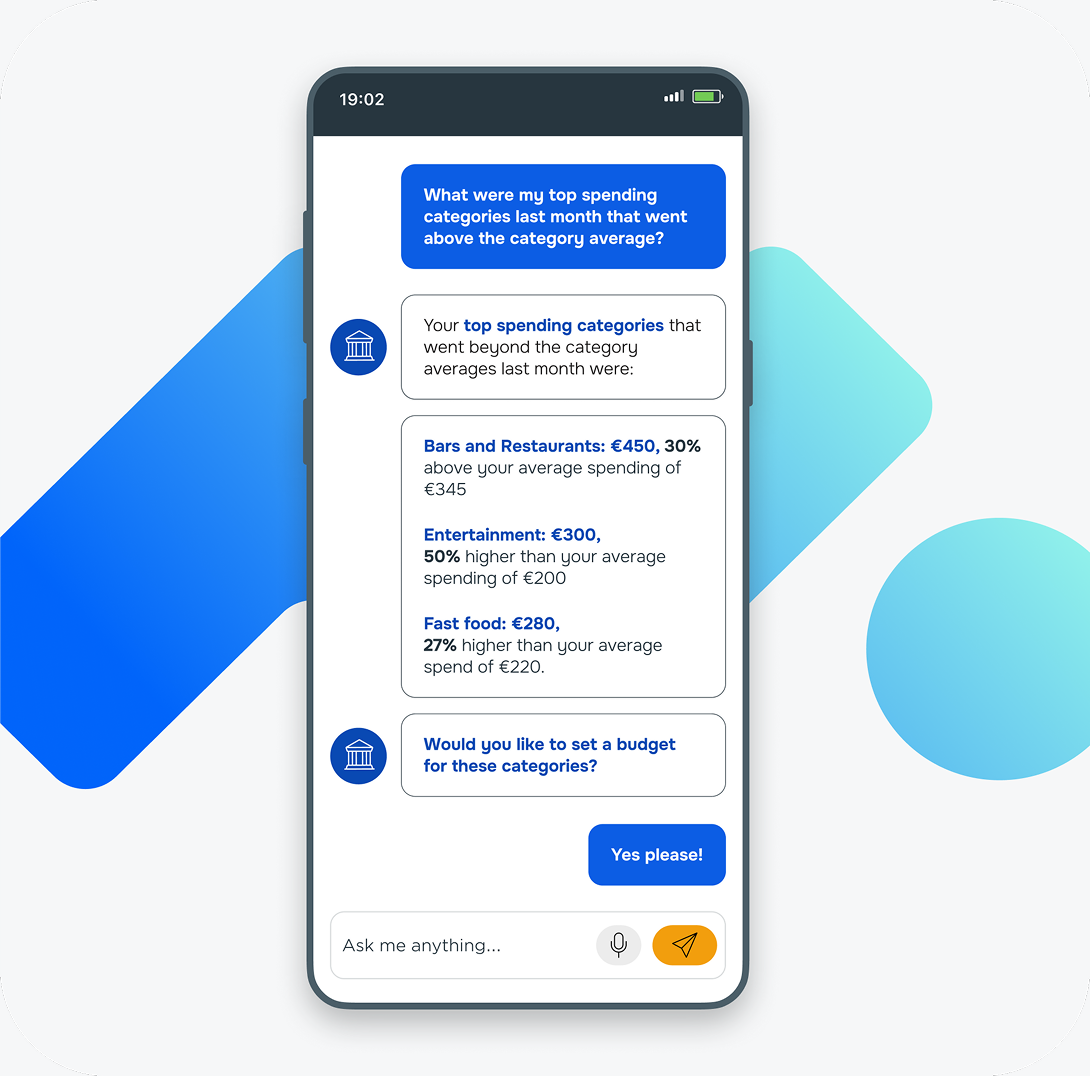

Every time a customer sets a goal, makes automatic transfers, or reaches savings milestones, those actions reveal rich signals about their financial health, priorities, capacity, and readiness for new products.

For example, if a customer regularly hits their emergency fund target, that may indicate lower financial risk.

Similarly, customers accumulating down‐payment savings suggest they may soon be in the market for a mortgage.

By spotting these moments, banks can tailor offers that feel timely and relevant rather than pushy or generic.

As a result, this targeted approach increases engagement and makes saving feel natural.

Get more insights:

Our recent 2025 Meniga Customer Conference reconfirmed that ‘although personalisation has been around for years, the strategy behind it has evolved with advancing technology.

Customers want their bank to predict, identify, and respond to their needs in real-time, and have the same personalised experience they associate with eCommerce giants. Personalisation has a real impact on the bottom line too, as, according to McKinsey, banks that don’t personalise effectively are operating 20% below their revenue potential.’

Thus, customer centricity remains a must when designing banking apps.

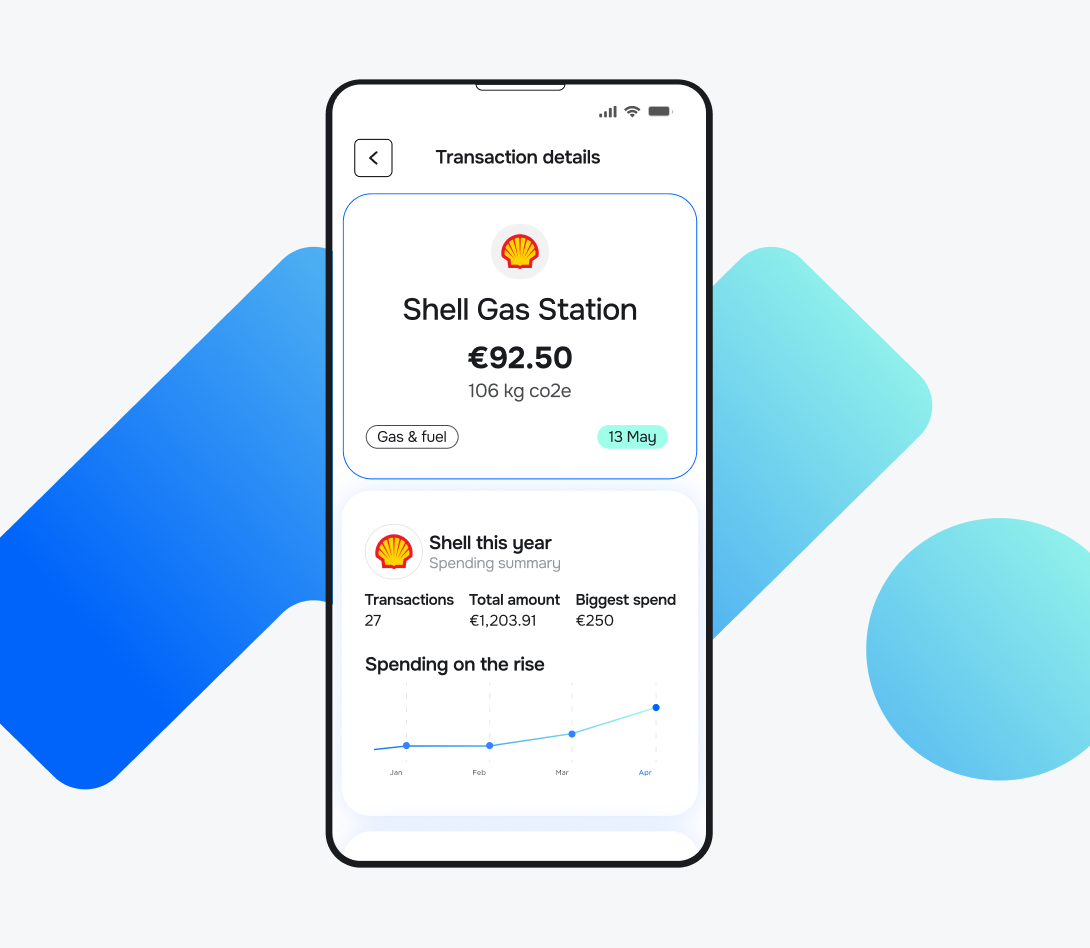

With Meniga’s award-winning Insights platform, banks gain a deeper understanding of their customers by combining transactional data with broader behavioural signals to create complete, real-time user profiles.

The platform enables flexible segmentation based on live eligibility checks and behavioural indicators, ensuring the right message reaches the right audience at the right moment.

By dynamically adjusting content to match each customer’s habits and interactions within the banking app, banks can instantly act on emerging opportunities and trends, driving stronger engagement and more relevant customer experiences.

5. Boost operational efficiency

Besides driving a higher volume of deposits and more consistent balances, automated savings tools reduce manual interventions for savings transfers, interest rate updates, and account maintenance.

By automating routine savings transfers and notifications, banks experience fewer customer queries related to missed payments, transfer issues, or balance questions. This frees up customer support resources and reduces operational costs while improving customer satisfaction and engagement.

Increased use of automated savings correlates with greater digital banking engagement, including internet banking, ATMs, and instant payment platforms. Frequent customer interactions through digital channels strengthen the customer-bank relationship, promote upselling opportunities, and generate fee income from transactions, further improving overall bank performance.

| Bank revenue streams from increased customer savings |

| Revenue Stream | Description |

| Net Interest Margin (NIM) | Profit from lending deposited funds at higher rates |

| Fee income and cross-selling | Revenue from additional banking and investment products |

| Lower funding costs | Reduced reliance on expensive wholesale funding |

| Payment and interchange fees | Fees from increased transaction volume and card usage |

| Subscription services | Premium fees for advanced savings/financial tools |

| Float on deposits | Earnings from invested deposits minus customer interest |

How can Meniga deliver automated savings tools for banks?

Meniga is a digital banking solution provider that empowers banks to modernise their digital banking experience without disrupting day-to-day operations.

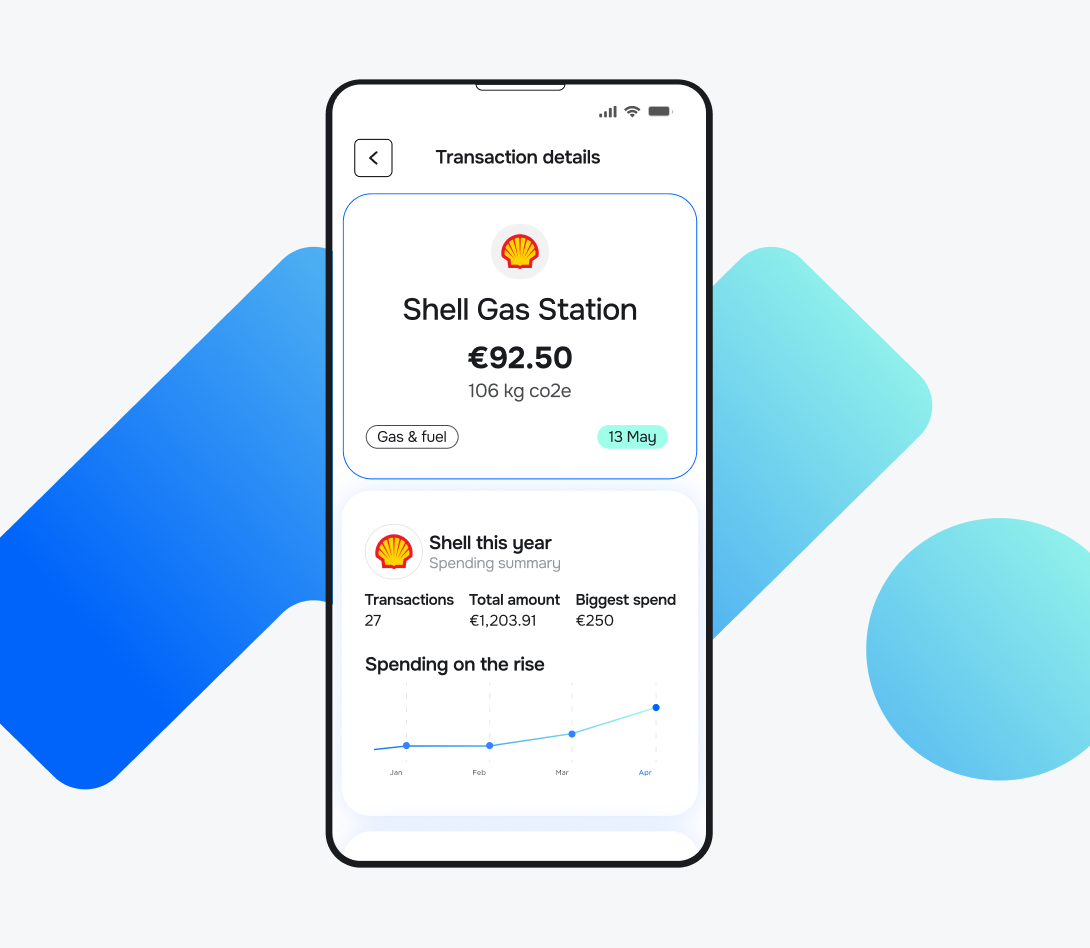

Our core capability lies in transforming transaction data into meaningful, personalised insights that strengthen engagement and fuel growth.

We consolidate data from multiple sources, including Open Banking data and any kind of cards and accounts, providing you and your customers with a 360-degree overview of their finances.

As a result, you can identify customers who earn lower interest rates or hold competing products elsewhere, and proactively offer them better rates or incentives to switch.

With Meniga, banks can:

-

Deliver timely, personalised nudges that encourage smarter saving and responsible money management.

-

Trigger automated savings actions in response to spending patterns or external events.

-

Craft highly targeted product offers and campaigns aligned with each customer’s financial behaviour, driving higher conversion and revenue.

-

Notify users proactively about upcoming payments, low balances, or key financial moments.

-

Offer transparent transaction breakdowns, including category, merchant, and spending history, helping customers understand their finances while reducing support queries.

Enticed to learn more?

Contact us today to see how you can convert passive accounts into active savers and open new cross-sell streams.