Why is customer service in digital banking so important?

Most banks offer at least basic digital banking services, but when something goes wrong, and customers need just a clear answer, customer service becomes the true test of your bank’s value.

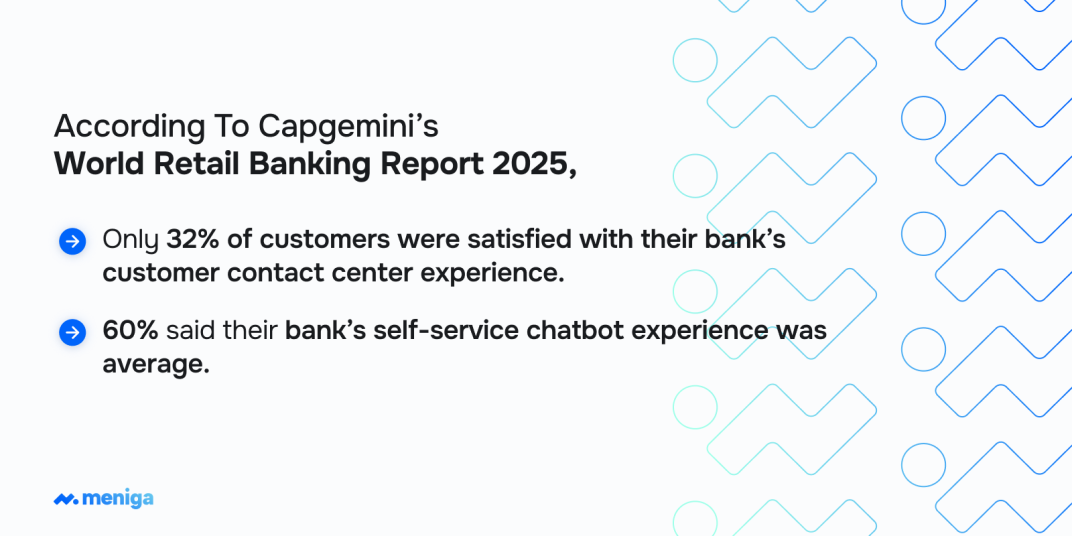

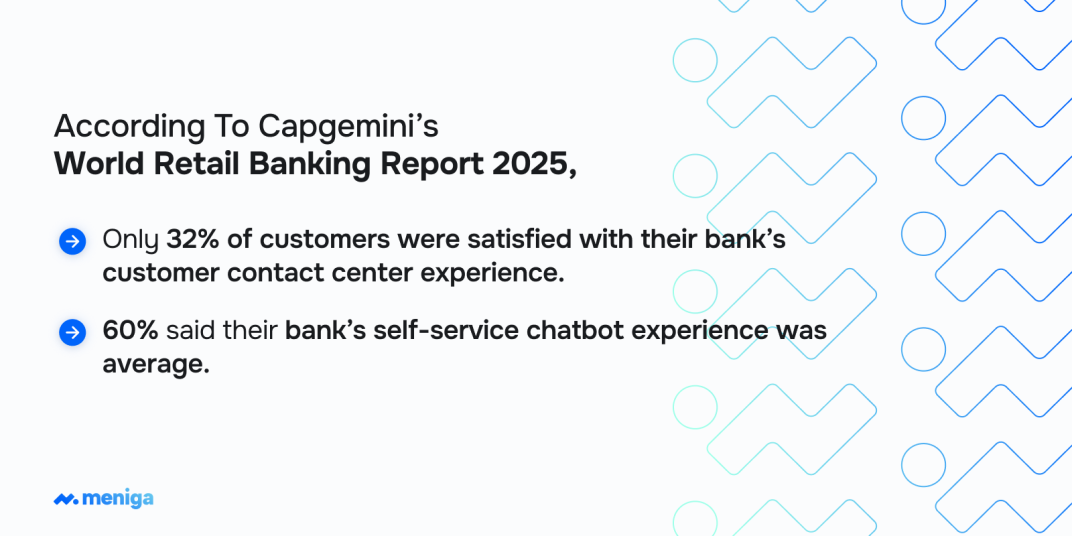

Source: Capgemini

Your competitors may have similar products or rates, but delivering fast, personalised, and reliable support at scale is quite hard to copy. And customers notice these things.

Customers aren’t looking for perfection, but they expect real help in real time, not a chatbot that says, ‘Please contact us during business hours.’

Thus, retention depends less on products and more on the experience tied to them.

Conversational AI helps you drastically improve customer service by combining speed with intelligence and automation with empathy.

Conversational AI in Banking: 5 key benefits to improve customer service

With improved large language models (LLMs), real-time integrations, and regulatory-compliant architectures, conversational AI offers numerous benefits to enhance your customers’ experience.

1. Personalised and proactive experience

Conversational AI leverages customer data, such as transaction history, preferences, and financial behaviour, to deliver:

| How AI delivers personalisation | Description |

| Data-driven insights | AI continuously analyses transaction patterns, spending habits, income streams, and external data via APIs to build dynamic, up-to-date customer profiles. |

| Tailored product recommendations | Based on customer profiles, AI proactively suggests relevant products, including credit cards, loans, savings, and investments, that align with their financial goals and needs. |

| Proactive financial advice | AI spots opportunities to save money or avoid fees. For example, recommending automatic payments if recurring late fees are detected. |

| Contextual cross-selling | When customers inquire about services like travel, AI offers timely and relevant add-ons, such as travel insurance or foreign currency accounts. |

| Personalised alerts and nudges | Customers receive personalised notifications, such as low-balance alerts, bill reminders, and spending insights, tailored to their unique financial behaviour. |

| Seamless integration with financial APIs | Conversational AI connects to external platforms, aggregating and enriching financial data for a holistic view and precise, personalised recommendations. |

For example, your customers can receive:

-

Personalised spend summaries — ‘You spent 24% more on food delivery this month’.

-

Savings nudges — ‘Move $200 to your savings now to stay on track for your vacation goal’.

-

Cashflow forecasting with scenario modelling —’You can afford a new phone next month if you skip two dining-out nights’.

-

Investment guidance tied to user risk profiles and regulatory-compliant advisory rules.

2. Account management

Through automation, personalisation, and always-on service, conversational AI makes interactions faster, smarter, and more human-like.

It handles customer interactions, including balance inquiries, transaction tracking, and card management.

As a result, this shift dramatically reduces wait times and operational costs, freeing human agents to focus on complex or sensitive cases.

Thus, your customers can easily and quickly:

-

Check balances, statements, and recent transactions.

-

Enable fund transfers with built-in multi-factor authentication, such as biometric and OTP.

-

Manage debit and credit cards, such as activation, PIN resets, limits, and travel notices.

-

Handle document requests, such as tax forms and digital bank letters.

Furthermore, conversational AI enables you to provide your customers with:

-

24/7, omnichannel support — AI-powered assistants are available around the clock across voice, chat, and even multimodal channels, such as text, images, and voice notes. Thus, customers can get instant help whenever and however they choose, thereby improving satisfaction and loyalty.

-

Emotionally intelligent interactions — Advanced AI now detects customer sentiment and emotional tone, allowing it to adjust responses for empathy and support. This aspect leads to more human-like and satisfying conversations, even when things go wrong.

-

Smart ticket routing — AI handles and prioritises customer queries by urgency and complexity, ensuring high-priority issues, fraud, or blocked cards reach the right specialist quickly. At the same time, AI resolves simpler requests instantly.

-

Scalable, consistent service — AI can manage millions of queries simultaneously, ensuring consistent, high-quality support during peak times or crises, and supporting multiple languages for global reach.

3. Customer onboarding

Customer onboarding is often the first real test of your bank’s digital experience. If you do it right, you can build trust from day one.

How AI accelerates onboarding

Conversational AI has significantly accelerated and improved the onboarding process.

Automated identity verification

AI handles ID checks in seconds using facial recognition, behavioural biometrics, and document scanning.

It cross-references identities against government databases and fraud watchlists to confirm legitimacy instantly.

As a result, you get fewer manual reviews, fewer errors, and a significantly faster onboarding flow.

Real-time document collection and validation

Customers upload documents directly through the app or web portal.

AI then uses natural language processing (NLP) and machine learning to extract, validate, and match the data against regulatory and internal requirements, without delays or human intervention.

Perpetual KYC (pKYC)

Besides fast onboarding, AI enables continuous monitoring of customer profiles by tracking changes in behaviour, transactions, or risk indicators in real time.

Any significant changes in customer behaviour or data trigger automatic alerts and reviews, ensuring ongoing compliance without repeated manual intervention.

Enhanced compliance (KYC/AML)

AI systems conduct real-time risk assessments, sanctions screening, and politically exposed persons (PEP) checks.

They dynamically adjust the depth of checks based on the customer’s risk profile, ensuring robust compliance while minimising friction for low-risk customers.

Furthermore, some banks use blockchain technology to create decentralised, auditable, and real-time accessible KYC records.

It enables multiple institutions to access up-to-date customer data, further speeding up onboarding and compliance checks.

This capability is especially crucial for customers with relationships that span multiple banks.

By using conversational AI in onboarding, you can provide your customers with:

-

Reduced onboarding time — What once took days or weeks can now be completed in minutes, giving customers immediate access to banking services.

-

Lower error rates — Automated data validation and anomaly detection minimise the risk of mistakes and fraud, improving trust and reducing compliance failures.

-

Improved customer experience — Seamless, digital-first onboarding with minimal manual paperwork leads to higher customer satisfaction and retention.

4. Loan services

Thanks to the great capabilities of conversational AI, you can make the entire loan lifecycle more accessible and customer-centric.

Here’s how the process can look:

1. Instant loan prequalification and application

AI-powered voice and chat agents guide customers through loan prequalification, asking relevant questions about income, employment, and financial goals.

The AI processes responses in real time, instantly assessing eligibility and nudging qualified applicants further down the funnel, all with minimal friction and no paperwork.

2. Automated document collection and verification

Conversational AI helps applicants submit required documents via secure digital channels.

It uses NLP to clarify requirements, answer questions, and validate submissions on the spot.

This automated verification minimises errors, speeds up processing, and ensures compliance with KYC/AML regulations.

3. Personalised loan offers and financial advice

Leveraging customer data and previous interactions, AI recommends tailored loan products, repayment plans, and even proactive financial advice.

For example, it might suggest a refinancing option when interest rates drop or alert customers to better loan terms based on their profile.

This way, you can also identify opportunities for cross-selling or refinancing, adding value for both you and the customer

4. 24/7 support and status updates

Customers can check their application status, upload missing documents, or ask about repayment schedules at any time, through any channel, voice, chat, or app.

AI ensures immediate and accurate responses, and in cases of more complex issues, it directs the conversation to human agents.

Furthermore, after approval, AI continues to support customers with reminders for payments, options for early repayment, and guidance on managing their loans.

5. Fraud alerts

Conversational AI plays a critical role in helping you detect fraud early, respond instantly, and protect customer trust.

AI monitors transactions continuously using advanced behavioural analytics.

When unusual activity is noticed, such as a sudden foreign transaction, multiple failed login attempts, or an unexpected large withdrawal, AI instantly sends alerts through preferred channels.

Furthermore, if a customer loses a card or it gets stolen, they can freeze it right away with a simple command.

They can then order a new one and get a virtual card to use immediately.

4 best practices for implementing conversational AI in banks

Below are some of the strategies you can follow to ensure that AI is not just smart, but secure, reliable, and human-centred.

1. Deep integration with core systems

To be useful, AI needs context. Therefore, you should connect it to your CRM, core banking systems, transaction history, and risk engines.

Context-aware AI can instantly recognise returning customers, reference their latest activity, and complete actions like balance transfers or address updates.

Without integration, chatbots become isolated FAQ bots: high-effort but low-value.

2. Built-in human handoff

Even the best AI can’t, and shouldn’t, replace human empathy. Complex issues like fraud claims, loan disputes, or customer distress need human handling.

Effective implementations use intent recognition to recognise when AI should step back and direct the customer to a live agent, with full context passed along, so the customer doesn’t have to start over.

3. Continuous training using real conversations

Banking language evolves as well as customer expectations.

A great practice is to feed anonymised real-world conversations into your AI models to improve accuracy, understand intent shifts, and avoid outdated responses.

To do so, you need a strong feedback loop, privacy safeguards, and MLOps infrastructure (Machine Learning Operations) for regular retraining and testing to to ensure that ML models are reliable, scalable, and that you can use them and maintain efficiently.

4. Multilingual and inclusive design

Global and regional banks serve diverse populations.

Thus, you must support multiple languages, dialects, and cultural norms.

Besides a language, AI systems can recognise sentiment and tone, adjusting how they respond based on context.

Moreover, inclusive design also means supporting accessibility standards for visually impaired users, for example and ensuring bots are easy to use across devices and connectivity levels.