Many young adults are entering adulthood without the financial skills needed to manage money effectively.

For banks, this gap in financial literacy represents a business risk.

Customers who lack financial knowledge are more likely to default on loans, avoid long-term investments, and switch providers out of frustration.

By offering products and services that enhance smart savings and budgeting, banks can create financially healthy customers who drive sustainable growth.

This article explores how banks can empower the next generation with financial literacy and turn this challenge into a long term opportunity.

Which age groups should banks target first and why?

Targeting younger age groups, specifically Gen Z (18–25) and Millennials (mid-20s to late 30s), is a strategic imperative. Here are the reasons why:

1. Future wealth builders

Gen Z and Millennials are rapidly becoming the primary drivers of the financial market. Together, Millennials and Gen Z control over USD 3 trillion in spending power.

As a result, Millennials and Gen Z represent future high-value customers.

Millennials, in particular, tend to hold multiple financial products with their primary institution, creating significant cross-sell and retention opportunities.

In addition, these generations are preparing for the largest wealth transfer in history.

As Baby Boomers pass down their estates, an estimated USD 70 trillion will move to Millennials and Gen Z over the next few decades.

With nearly $70 trillion set in motion, financial institutions must better understand the banking behaviours, attitudes, and preferences of these emerging segments.

2. Longest customer lifecycle

The earlier a bank engages, the greater the potential return.

By connecting with young customers through student accounts, mobile-first solutions, and financial education, banks can establish relationships that last for decades and maximise lifetime value and loyalty.

3. Digital natives with high expectations

Gen Z grew up in a digital-first world, and they demand frictionless, tech-driven banking experiences.

Their expectations, such as speed, personalisation, and security, are shaping the future of financial services.

Why is financial literacy important for the next generation?

Managing money today isn’t simple, and for young people just starting out, the stakes are high.

The financial challenges young people face

Today’s young adults are entering a financial environment that looks very different from the one their parents knew.

Rising student debt presents one of the most significant hurdles.

In the U.S. alone, student loan debt exceeds $1.8 trillion, making it the second-largest form of consumer debt after mortgages.

For many, this means postponing milestones such as homeownership or starting a family.

On top of that, living costs continue to rise, while wage growth has been relatively stagnant.

This imbalance forces many young people to rely on credit cards, Buy Now, Pay Later (BNPL) services, or short-term loans to cover basic expenses.

Without strong financial skills, these quick fixes can spiral into long-term debt cycles.

The digital era adds another layer of complexity.

Mobile banking, investment apps, and cryptocurrencies offer new opportunities but also present risks if customers don’t know how to truly benefit from them.

While tools like robo-advisors and digital wallets promise convenience and wealth-building potential, they require knowledge.

Without financial literacy, it’s easy for young consumers to:

-

Fall victim to scams,

-

Make impulsive investment decisions, or

-

Fail to understand the fine print of digital financial products.

The cost of ignorance

A lack of financial knowledge leads to poor decisions with long-lasting consequences. Many young adults fall into debt traps, juggling high-interest credit cards and personal loans without a plan to pay them off.

Over time, this affects their credit scores, making it harder to qualify for mortgages or affordable financing.

The absence of financial planning also means missed opportunities for savings and retirement preparation.

Compound interest is one of the most powerful tools for building wealth, but without early action, its benefits diminish.

By the time many realise this, they’re already behind on retirement goals.

Why banks should care about improving financial literacy?

Banks should care deeply about promoting financial literacy because it creates a positive cycle of benefits for both customers and the institutions themselves.

1. Reduced financial risk

Financially educated customers make better financial decisions, which translates into fewer loan defaults and reduced credit risk for banks.

They are more likely to pay bills on time, manage debt responsibly, and avoid costly financial mistakes.

As a result, this reduces losses for the bank and improves the overall quality of customers’ loan portfolios.

2. Stronger customer relationships and loyalty

Banks that invest in financial literacy demonstrate genuine care for their customers' well-being, building trust and loyalty.

Educated customers tend to engage more deeply with their bank’s products and services, leading to increased retention and the potential for upselling complementary financial products such as mortgages, insurance, and investments.

According to Deloitte’s 2025 banking and capital markets outlook, nearly half of customers who receive relevant financial advice open new accounts or expand their banking relationship.

3. Enhanced customer empowerment and confidence

Financial literacy empowers customers to manage their personal finances with confidence and security.

Thus, customers become more financially stable and independent, which reduces their stress and increases their satisfaction with their financial institution.

Empowered customers are also more likely to recommend their bank to others, boosting marketing efforts organically.

4. Supporting corporate social responsibility (CSR)

By promoting financial literacy, banks contribute positively to economic stability and equity in their communities.

Helping underserved populations gain financial knowledge supports inclusion and reduces inequality.

This fulfils banks’ CSR commitments and strengthens their public reputation, which stakeholders and regulators value.

5. Community economic health and long-term stability

Financial education contributes to healthier local economies by supporting economically responsible consumers and reducing systemic financial risks.

Customers with strong financial skills contribute to the growth and sustainability of the banking ecosystem and the broader economy, ultimately benefiting banks in the long term.

The demand for financial literacy is clear, but how can banks turn this need into action?

The key is to combine technology, education, and personalisation to make learning easy, relevant, and engaging for digital-savvy consumers.

Below are 3 powerful strategies you can leverage:

1. Create digital education initiatives

The smartphone is the primary gateway to financial management for Gen Z and Millennials.

To capture their attention, you must integrate education directly into digital platforms. This goes beyond static FAQs. It’s about creating dynamic, interactive learning experiences.

Here’s what that looks like in practice:

-

Gamified budgeting tools: Instead of simply tracking expenses, apps could challenge users to meet monthly savings goals, offering badges, rewards, or even cashback incentives.

-

Personalised notifications: Imagine an alert that says, ‘You’ve spent 20% more on dining out this month. Want to set a cap for next month?’ This way, you turn information into actionable education.

-

Micro-learning modules: Bite-sized lessons on credit scores, investment basics, or debt management, embedded within the banking app. For example, after opening a new credit card, a customer could receive a quick video explaining how using it impacts credit scores.

Why it works: Digital education meets young customers where they already are, on their devices, making learning feel natural, convenient, and even fun.

Real-world example: How to create interactive learning experiences with Meniga?

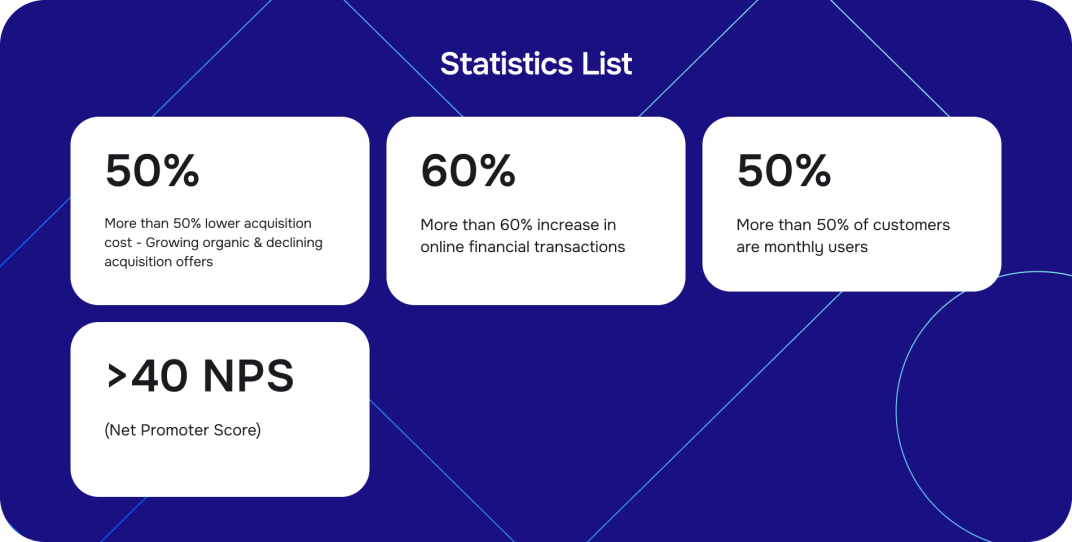

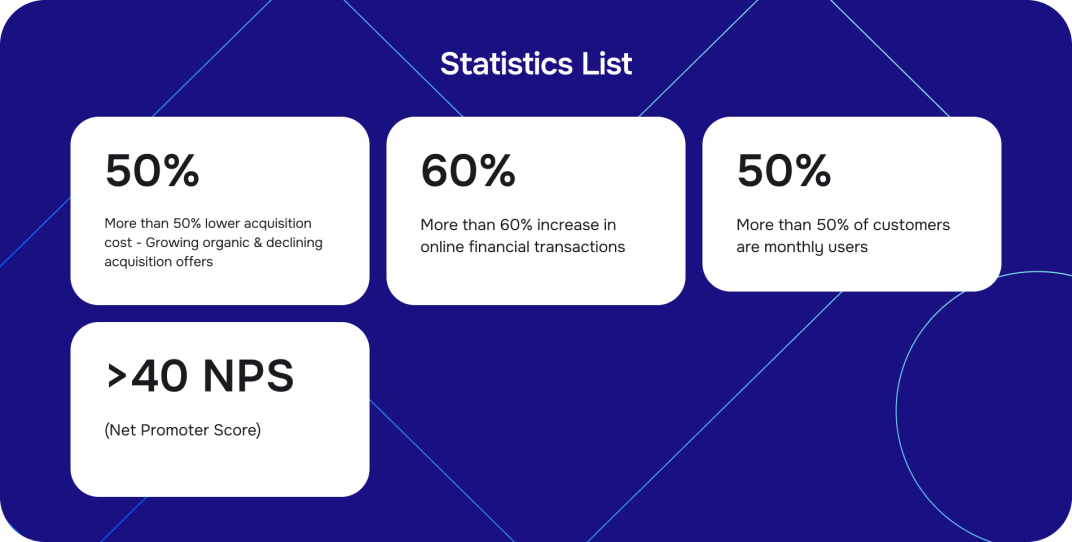

UOB (United Overseas Bank) is a leading bank in Asia, with over 500 offices across 19 countries in the Asia Pacific, Europe, and North America.

The bank launched the TMRW app, a digital banking platform designed specifically for ASEAN millennials.

With Meniga’s help, the bank cleaned, categorised, and processed complex transactional data to generate personalised financial insights.

The TMRW app incorporates gamification that makes banking as fun as a mobile game.

-

Customers can ‘level up’ and build a virtual city that expands as their savings grow, encouraging saving behaviour.

-

The app automatically generates notifications for upcoming payments and outstanding bills to help customers manage their finances better.

-

At the same time, instant alerts notify users of unusual or duplicate charges, increasing fraud awareness and account security.

2. Partner with schools and universities

The foundation of financial habits starts early, often before students even enter the workforce.

And this is exactly why educational partnerships are so important.

Banks can collaborate with schools, colleges, and universities to embed financial literacy into the academic ecosystem.

For example, you can:

-

Offer modules on budgeting, credit, and saving as part of economics or life skills courses.

-

Host interactive sessions on topics like ‘Building your credit score in college’ or ‘Smart student loan strategies.’

-

Pair educational resources with financial products such as low-fee student accounts, budgeting apps, and goal-based savings features.

Why it works: By engaging students before they form bad financial habits, you position yourself as a trusted guide during a crucial life stage.

As a result, you create brand familiarity and loyalty since these early relationships often mature into lifelong banking customers.

Research shows that 45% of youth account holders maintain their relationship for at least five years, and 24% remain customers indefinitely, contributing to prolonged customer lifetime value.

In other words, you create a pipeline of future clients who are already familiar and comfortable with your bank’s products and services.

| How youth accounts increase long-term customer lifetime value (CLV) for banks |

| Key area | Description |

| Early engagement and retention | Capture customers young, thus building loyalty and familiarity early. |

| Migration and account evolution | Smooth transition from youth to adult accounts encourages long-term engagement and new banking products as young customers mature. |

| Multi-generational banking | Family banking packages engage parents and siblings, expanding client base and revenue opportunities. |

| Behavioural impact and financial literacy | Early education fosters good habits, better creditworthiness, all leading to reduced risks for the bank and increased product usage and retention. |

| Lower acquisition costs | Lower costs compared to adult customers by leveraging family relationships and targeted youth programs. |

Additional considerations

Youth financial education programs typically also attract parents and school employees to open accounts with the bank.

This can expand your bank’s customer base not only among students but also into the broader community connected to the schools.

Additionally, consider offering incentives, such as cash bonuses, for student accounts.

-

By doing so, you’ll attract students to choose your bank over another and gain early access to potentially lifelong customers.

-

As a result, you’ll attract and secure students as long-term customers early in their financial journey.

-

This early engagement increases the likelihood that students will continue using the bank’s services post-graduation, eventually expanding their product usage with loans, credit cards, and mortgages.

And let’s not forget the educational aspect.

Bonuses often require students to meet specific conditions, such as maintaining a minimum deposit or completing certain transactions.

These actions encourage active use of the account and familiarise students with banking services.

Thus, it supports ongoing engagement and product cross-selling opportunities.

3. Personalised financial guidance

Banks sit on a wealth of customer data, yet most fail to use it meaningfully.

The future of financial education lies in turning data into actionable, personalised insights.

What does this mean practically?

Your bank can provide:

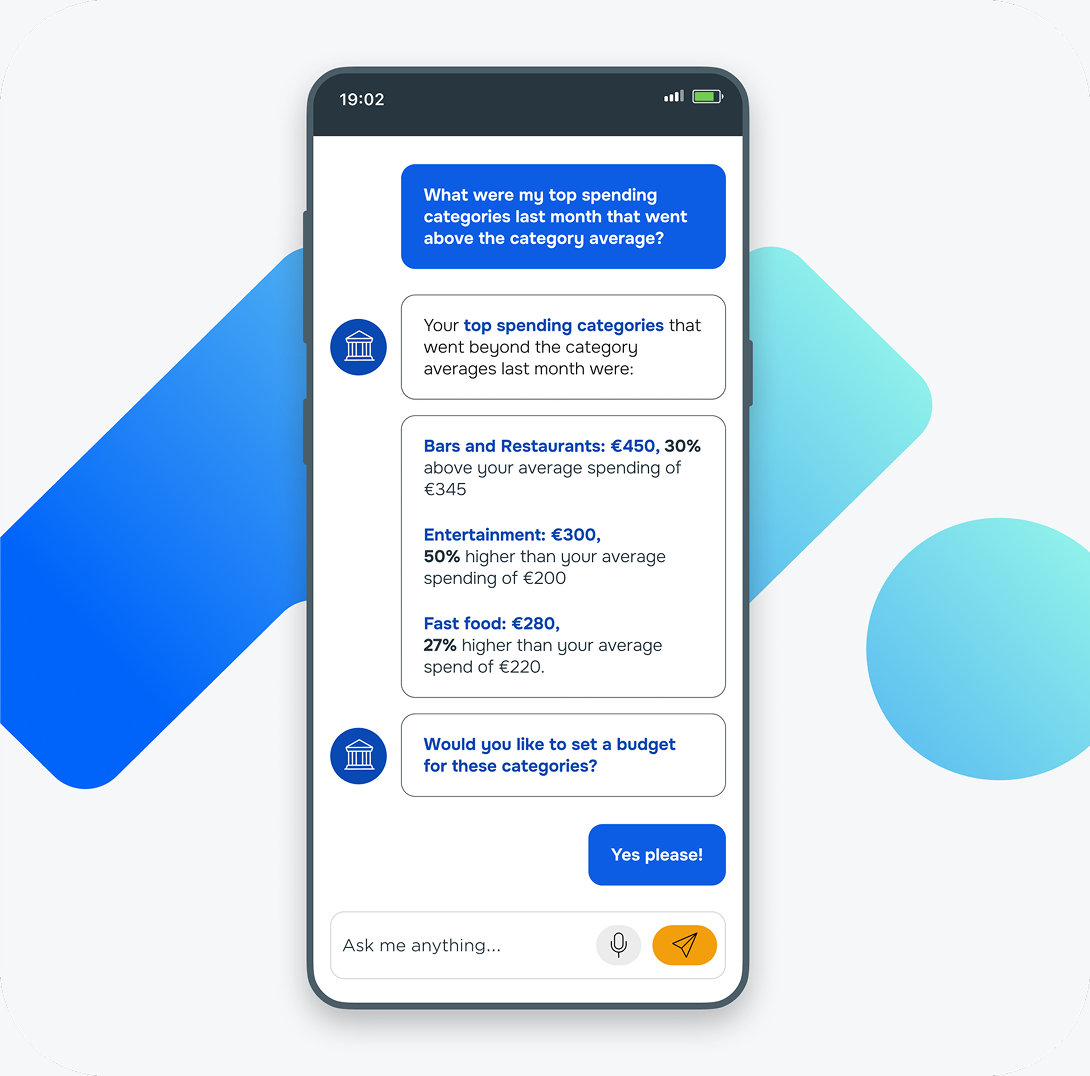

1. AI-driven financial coaches: Chatbots and tools that offer advice based on spending patterns, upcoming bills, or savings goals.

2. Life-stage recommendations: A student might receive guidance on building credit. A young professional on retirement contributions, and a new parent on college savings plans.

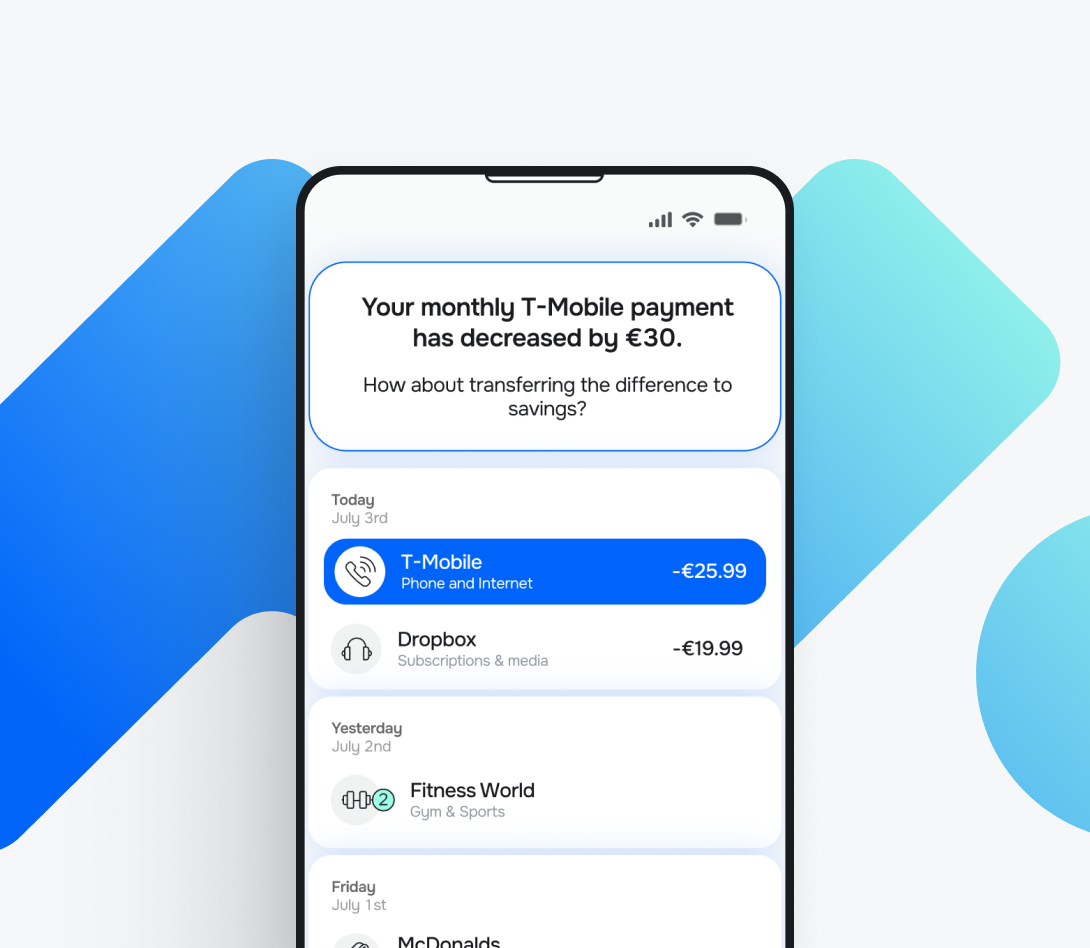

3. Proactive alerts: Instead of simply notifying a customer of a low balance, suggest solutions such as transferring funds from savings or enrolling in overdraft protection.

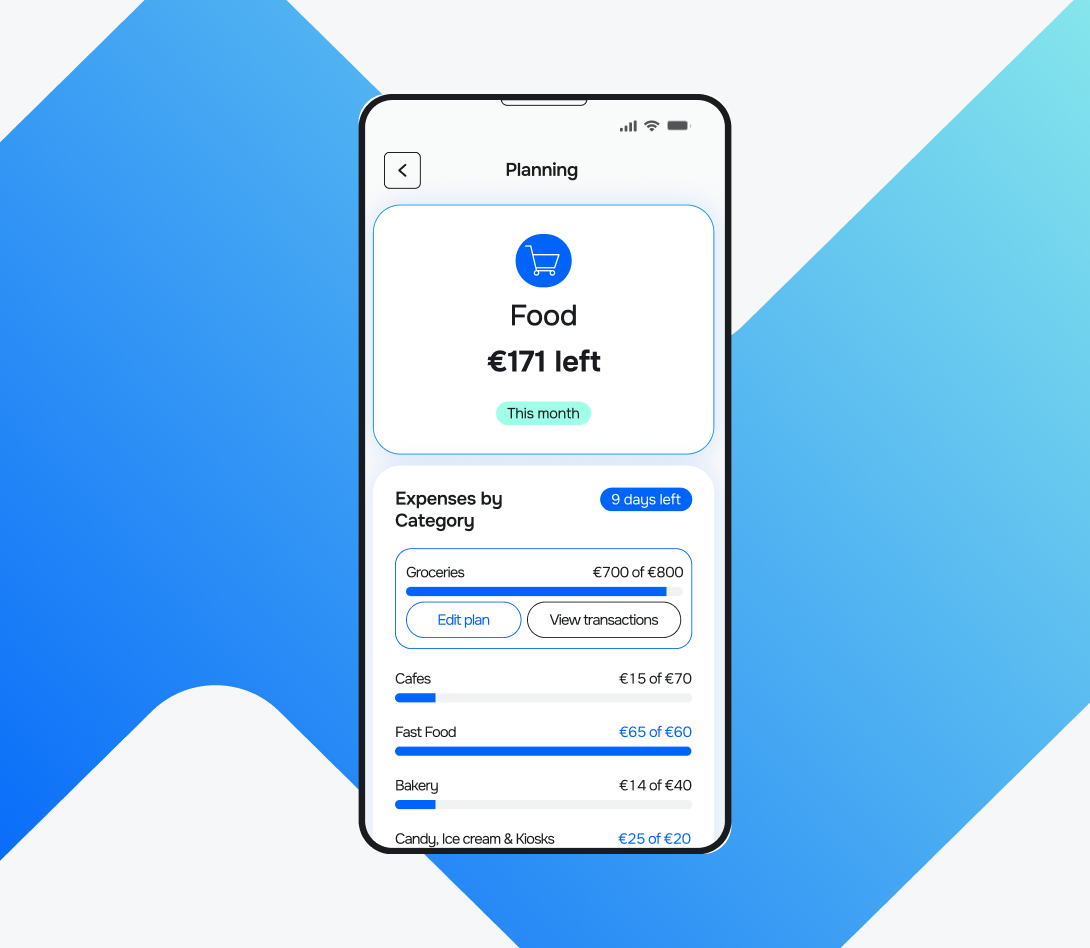

4. Goal-oriented tools: Personalised dashboards that help users visualise progress toward goals

Why it works: Tailored guidance transforms banking from a transactional relationship into an advisory partnership, deepening trust and increasing long-term engagement.

Worth knowing:

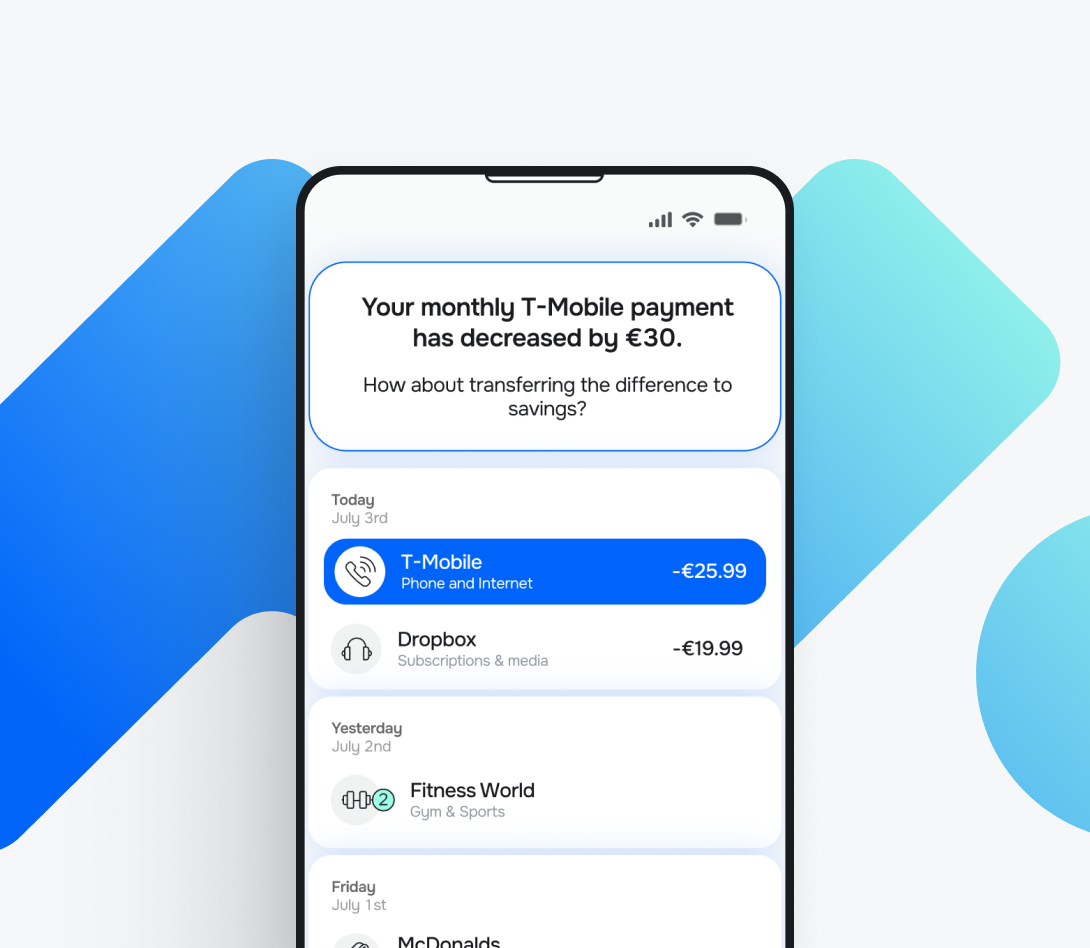

Meniga’s AI-powered Insights solution helps banks leverage data to anticipate customer needs and create proactive communication strategies.

We harness the full power of transaction data, combining advanced AI and machine learning to deliver finely segmented, contextually relevant insights to banking customers

Thus, you can promote relevant financial products to the right customers at the optimal time, driving product uptake and new revenue streams.

In addition, you can nudge customers towards banking solutions they are more likely to use, improving the ROI of existing digital features.

By demystifying financial habits, Meniga helps your customers:

-

Build awareness of their spending and cash flow

-

Develop actionable saving habits through challenges and rules

-

Receive tailored guidance that motivates real change

-

Learn in the moment, right where they manage money.

How to improve financial literacy with Meniga?

By turning complex financial data into personalised, actionable insights delivered seamlessly at scale, Meniga empowers banks to educate customers continuously.

We aggregate and enhance both internal and open banking data, providing banks with a comprehensive, 360-degree view of their customers’ spending patterns and overall financial health.

As a result, we deliver enriched merchant information to enhance financial literacy and streamline the customer experience. This includes:

-

Clear, accurate merchant names for better transaction clarity and easier search.

-

Informative merchant descriptions to help customers understand their spending.

-

Up-to-date logos for quick recognition and an improved visual experience.

How else can we help?

-

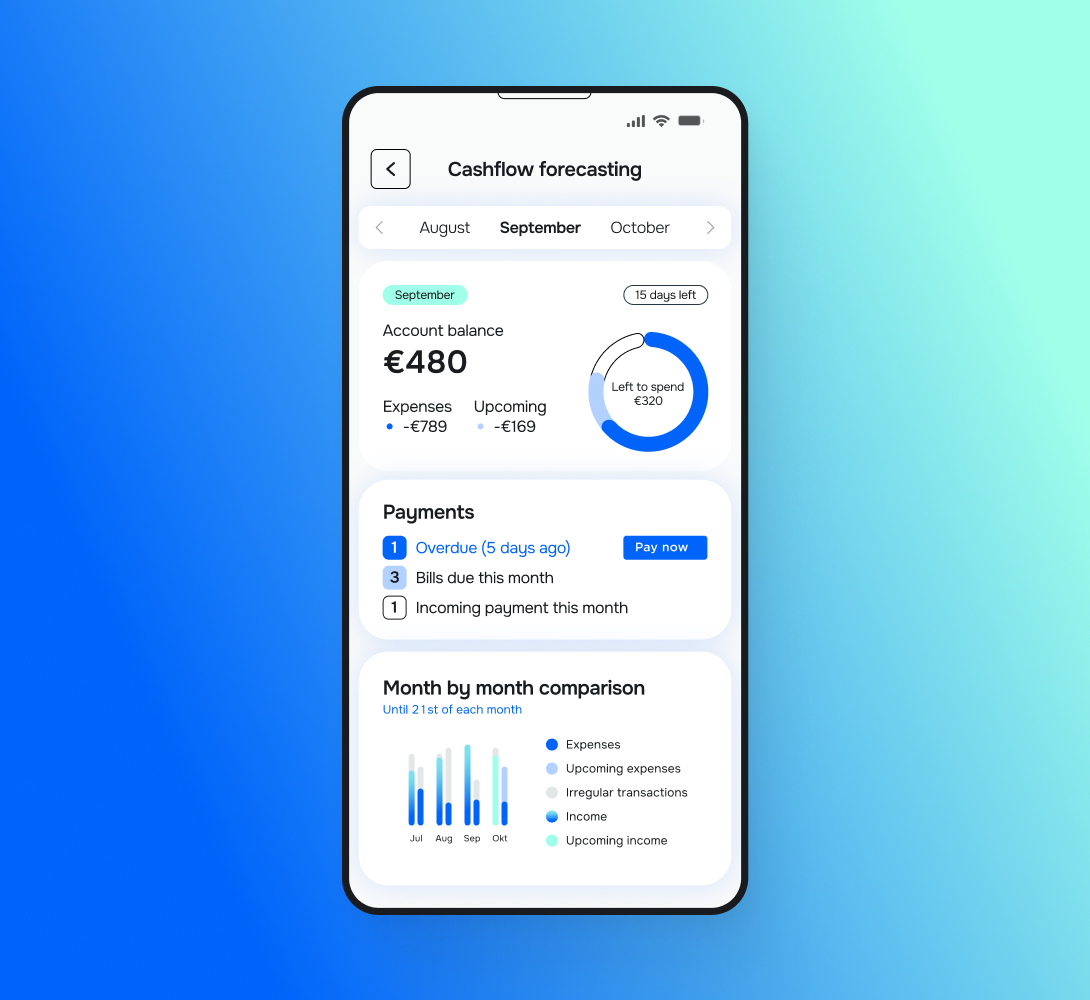

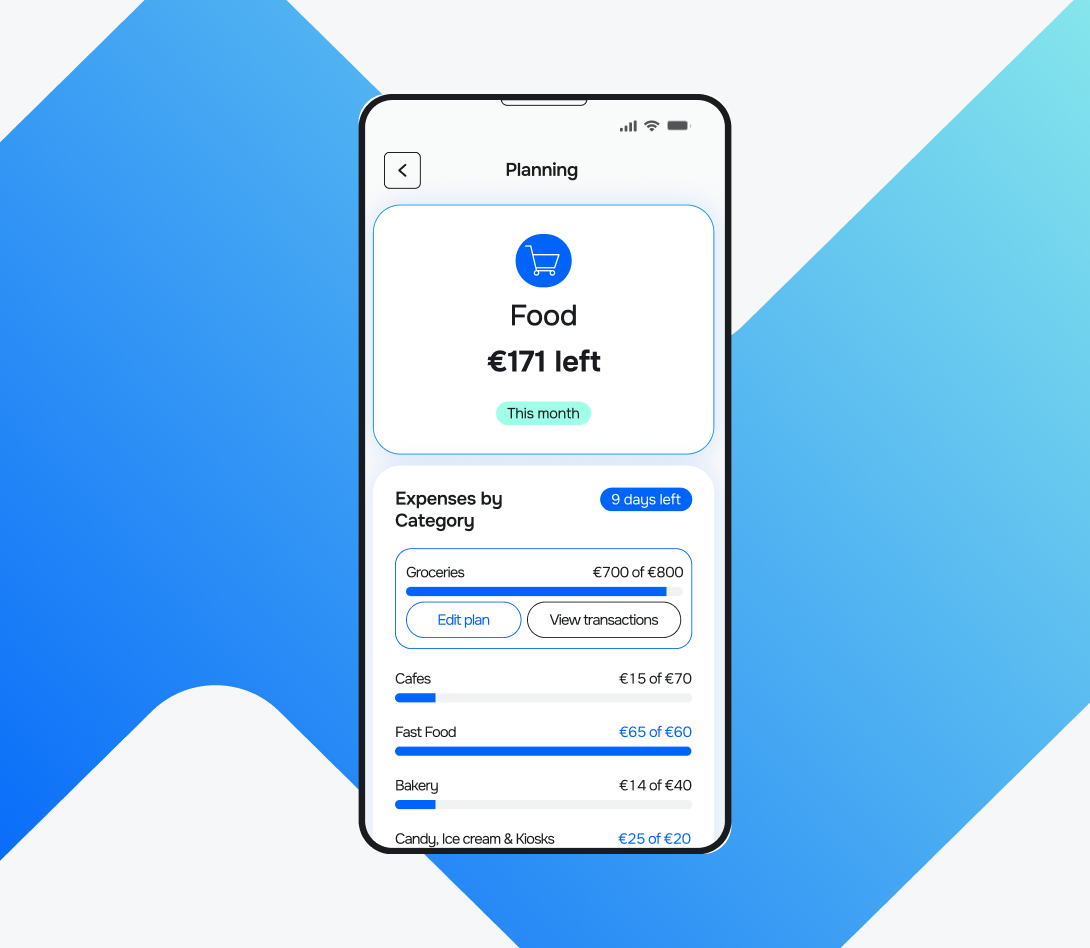

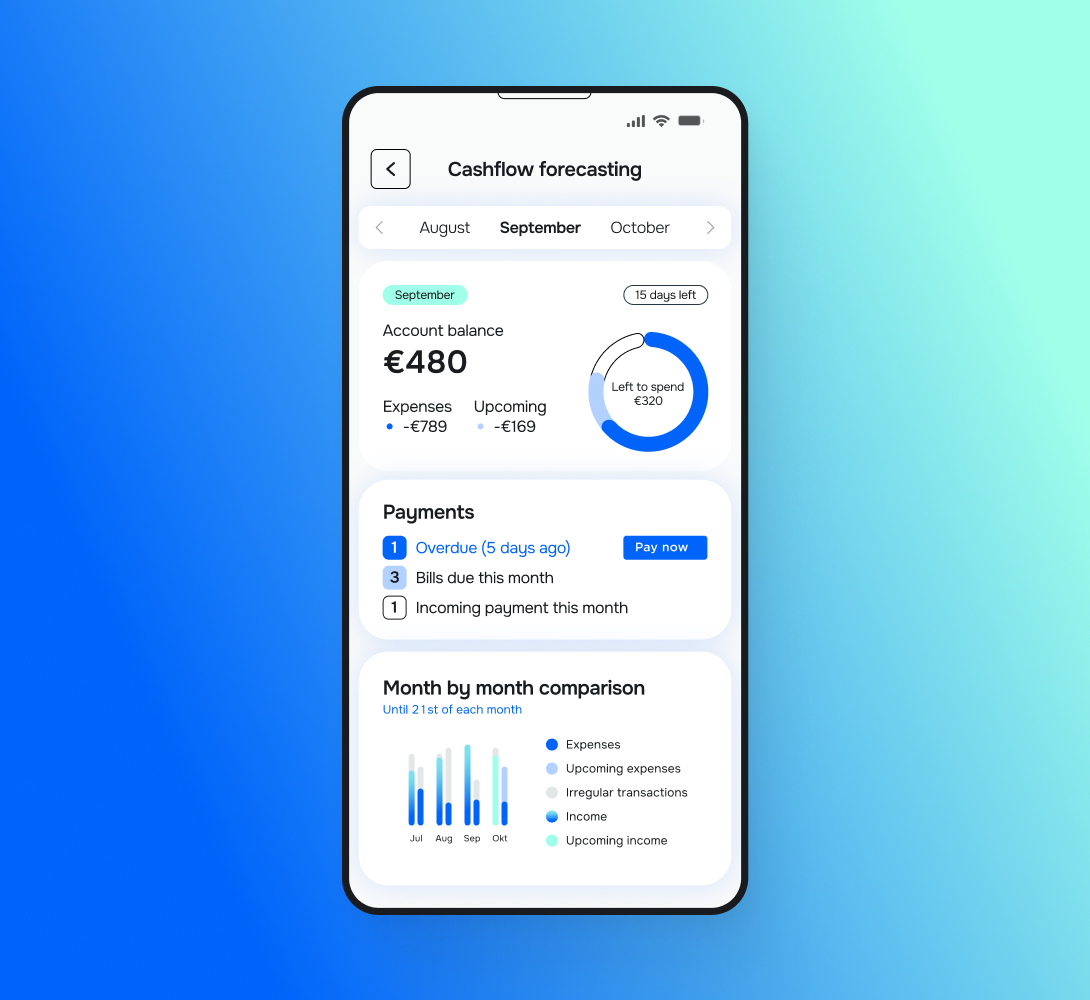

Our Cashflow Forecasting feature gives customers real-time insight into their disposable income. It provides actionable guidance on whether they’re in a safe position to save or have room to spend.

-

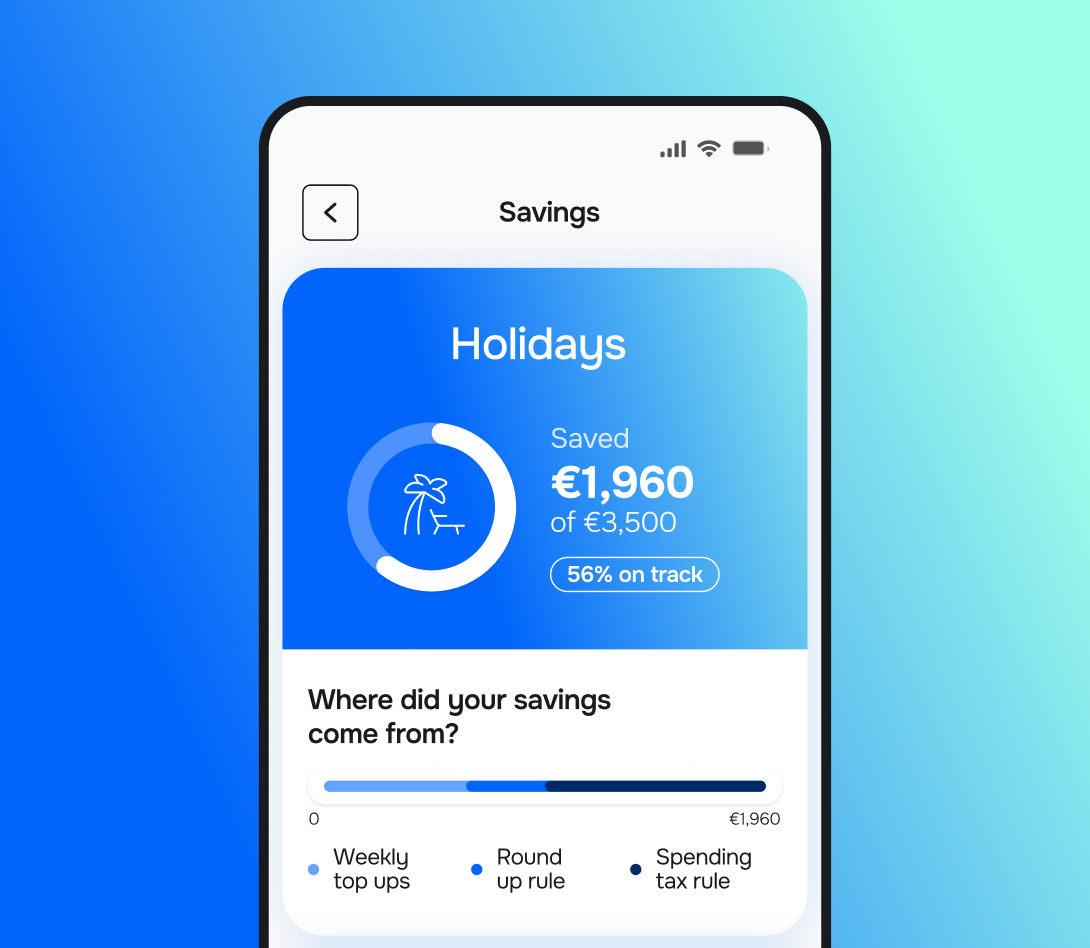

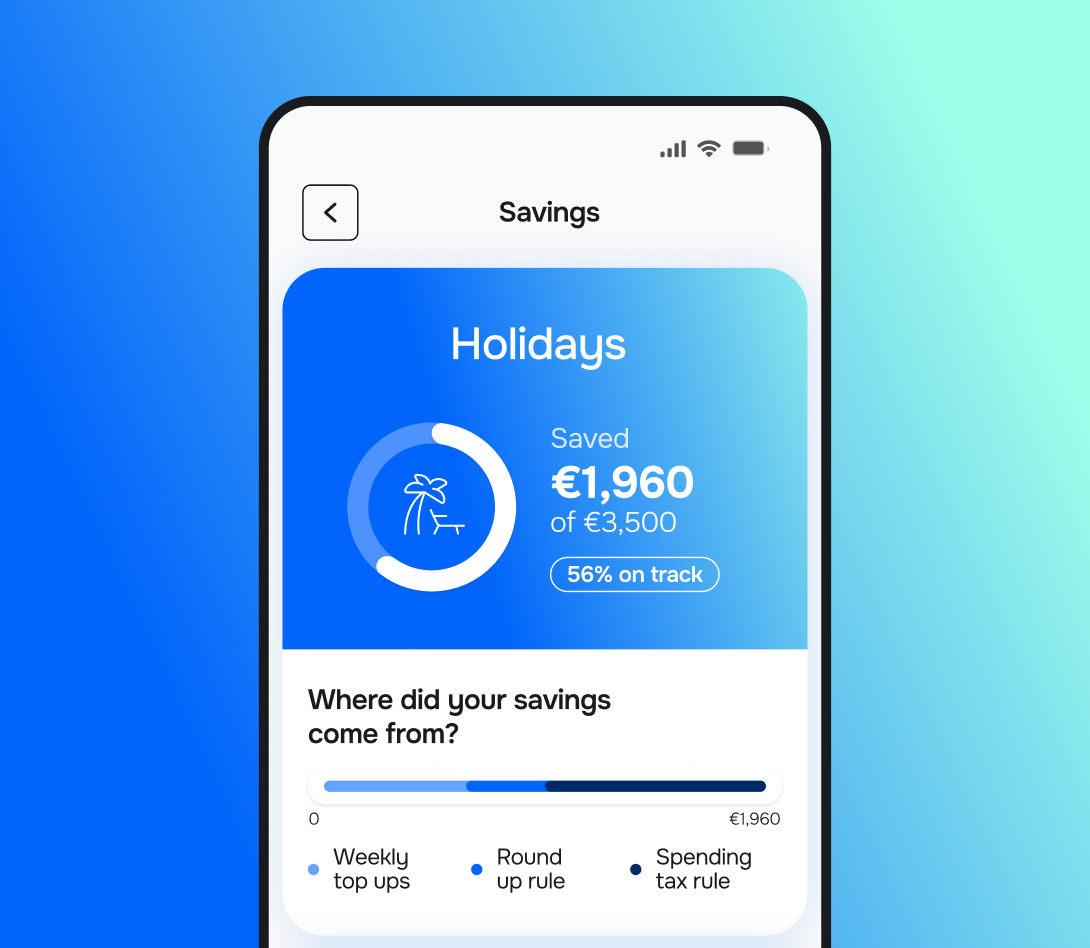

Smart Savings feature identifies opportunities to save and provides gamified and automated savings to help customers grow deposits. They can round up transactions to the nearest $, tax certain categories, such as guilty pleasures, create pots of savings where they can work towards a specific target, and more.

-

Our PMF Suite delivers clear transaction categorisation, intuitive search, budgeting tools, and actionable reports based on a customer’s spending history.

Our solutions enhance customers’ financial awareness, promote positive money habits, and cultivate confidence in financial decision-making, all key outcomes for effective financial literacy.

What’s new at Meniga?

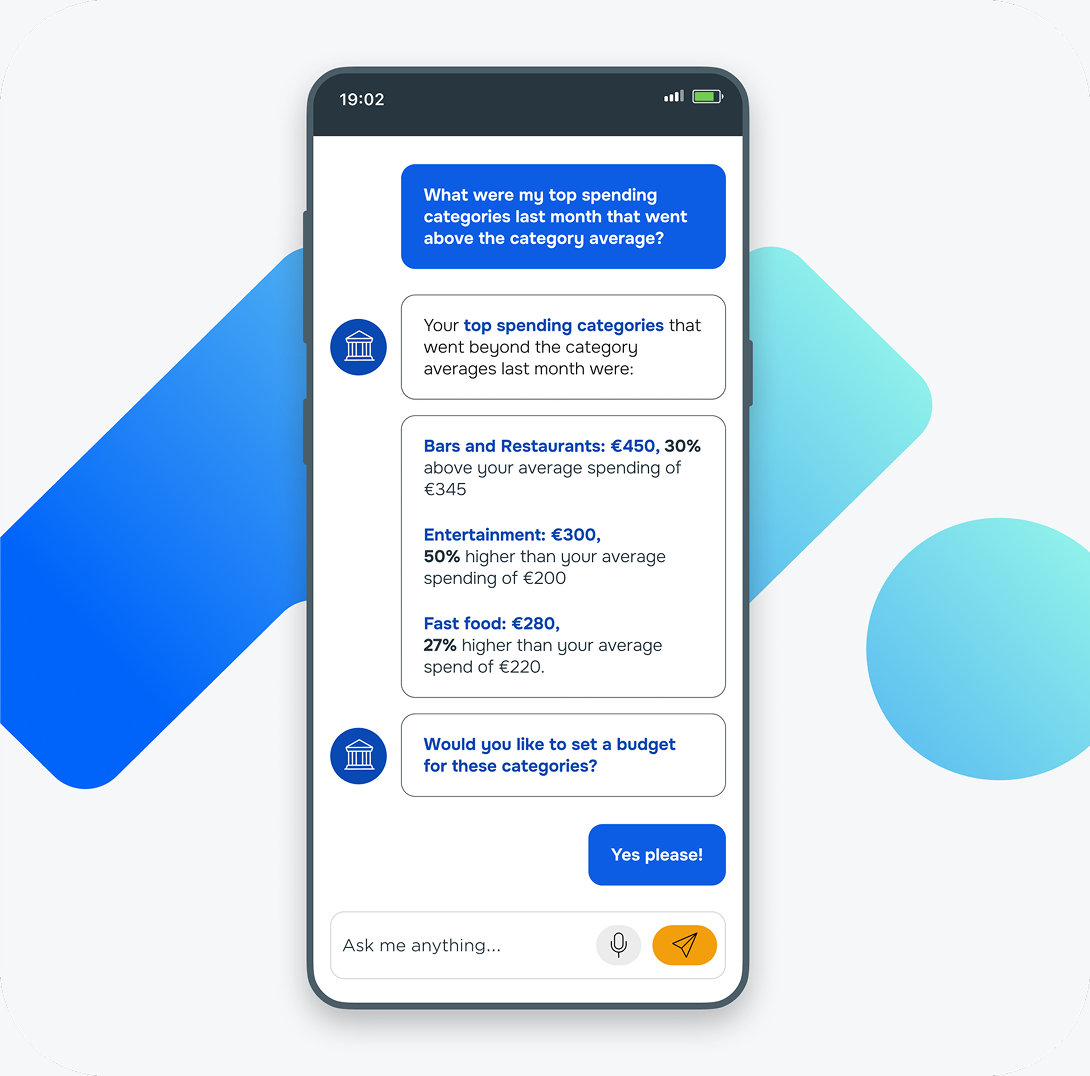

Meniga is introducing the Conversational Financial Assistant, a next-generation, LLM-powered solution created specifically for banks.

This intelligent tool enables customers to ask natural questions, such as ‘How much did I spend on groceries this month?’ or ‘Can I afford a weekend trip?’ and instantly receive accurate, real-time answers in a simple, conversational format.

Built on enriched financial data and reinforced with banking-grade security, the assistant provides hyper-personalised insights that help customers make smarter decisions.

Beyond enhancing the user experience, it reduces customer support costs and drives deeper digital engagement, positioning your bank as an innovative and trusted financial partner.

Enticed to find out more?

Contact us today to transform financial literacy from a passive concept into an engaging, personalised journey toward smarter financial habits and decisions.