Most digital banking experiences still revolve around static account views and basic transactions, leaving users disengaged.

However, customers look for interactive, rewarding experiences in every digital interaction.

That’s where gamification comes in.

Valued at $20.84 billion in 2025 and projected to reach $190.87 billion by 2034, it’s one of the fastest-growing engagement strategies.

By incorporating game mechanics into everyday banking, institutions can transform routine transactions into engaging experiences that drive real outcomes.

Read on to learn more about gamification in banking and how you can make it a competitive advantage.

What are the main gamification features currently used in digital banking?

There are numerous features and techniques you can use to incorporate gamification in an engaging and effective way.

Here are the most common ones:

-

Points: Customers earn points for completing tasks or achieving milestones. For example, receiving points for paying bills on time or setting up automated savings.

-

Badges: Visual tokens of achievement that recognise specific accomplishments. A “Savings Star” badge, for example, awarded after completing a month-long savings challenge.

-

Levels: A progression system that indicates user advancement and unlocks new features or rewards.

-

Challenges: Time-bound tasks to encourage specific behaviours or habits. For example, a 30-day “Spend Smart” challenge rewards customers for staying within budget.

-

Quests: Narrative-driven missions that guide customers through a series of related tasks. A “Debt-Free Journey” quest guides users through steps such as consolidating debt, setting goals, and tracking progress.

-

Feedback: Real-time responses that inform users of their progress or achievements, such as a pop-up that congratulates customers instantly when they hit a monthly savings target.

-

Progress bars: Visual indicators that track completion of goals, motivating users to finish tasks. They can show how close a customer is to completing a savings goal of, let’s say, $1,000.

-

Quizzes, simulations, and mini-games: Teach users about budgeting, investment, debt management, and banking products.

| Quiz format | Description | How it boosts retention | Example Features/Questions |

| Multiple-choice with immediate feedback | Questions with selectable answers and instant explanations | Reinforces correct understanding, corrects misconceptions promptly | What percentage of your income should go to savings? with feedback explaining why |

| Scenario-based questions/simulations | Real-world budgeting scenarios require applying concepts | Contextualises abstract knowledge, links learning to practical decisions | Allocating the monthly budget to expenses |

| Mix of question types | Combination of multiple-choice, open-ended, and image-based questions | Maintains engagement and addresses diverse learning styles | Identify the expense category from an image Explain the budgeting priority in own words |

| Gamified elements | Use of points, badges, etc., integrated within quizzes | Motivates customers to complete and repeat quizzes, and creates fun competition | Earn badges for completing budgeting sections |

| Personalised adaptive quizzes | Question difficulty adapts based on the customer's previous responses | Focuses practice on weak areas, improving mastery and retention | The quiz adjusts to ask more questions on saving if previous answers showed weakness |

| Repetitive spaced quizzes | Delivery of quizzes over spaced intervals (daily, weekly) | Leverages the spacing effect to strengthen long-term memory | Weekly budgeting check-in quizzes repeated over several weeks |

Why should banks incorporate gamification?

If incorporated properly, gamification can be a highly effective strategy for enhancing customer engagement, improving financial literacy, and driving sustainable business growth.

1. Boost customer engagement

Gamification elements, such as progress trackers, badges, challenges, and leaderboards, create interactive experiences that transform routine financial interactions into engaging activities.

Gamification elements, such as progress trackers, badges, challenges, and leaderboards, create interactive experiences that transform routine financial interactions into engaging activities.

Gamified banking platforms can boost user engagement by 48%, with some metrics indicating user actions soaring by over 200% when game mechanics are incorporated.

This heightened engagement drives stronger app stickiness, encouraging users to return regularly to complete challenges or unlock rewards.

A standout example is Extraco Bank in Texas, which saw a remarkable 700% increase in customer acquisition after introducing gamified financial education and product usage.

2. Make financial services more accessible and enjoyable

Financial concepts often intimidate users, but gamification breaks down those barriers by presenting information through:

-

Interactive quizzes,

-

Simulations, and

-

Mini-games.

These methods make learning about budgeting, investing, and debt management both accessible and fun.

Gamification changes that narrative by transforming education into an experience rather than a chore.

Through interactive quizzes, real-life simulations, and bite-sized mini-games, users can explore topics such as budgeting, investing, and debt management in a way that feels approachable and enjoyable.

3. Collect rich user behaviour data for personalisation

Gamification generates significant behavioural data, revealing users’ preferences, financial goals, and interaction patterns.

Banks and fintech companies leverage AI and advanced analytics to transform this data into highly personalised experiences, tailoring challenges, rewards, and financial advice to customer segments.

For example, a customer focused on saving might receive progressive savings quests, while someone working on debt reduction could see motivational milestones built into their repayment plan.

Did you know that institutions focused on data-driven gamification are 23 times more likely to acquire new customers and 19 times more likely to be profitable?

How can Meniga help you transform meaningless transaction data strings into personalisation insights?

The foundation of any financial institution is the transaction data. However, data is often fragmented, coming from various sources, and lacking categorisation and enrichment.

Meniga aggregates, consolidates, and enriches internal and open banking data to give financial institutions a 360-degree view of their customers’ spending habits and finances.

This way, your bank can create gamification elements that align perfectly with each customer’s financial needs and behaviour.

4. Balance entertainment with transparency and fairness

Successful gamification strategies balance fun with transparency and fairness, ensuring customers trust the program and remain engaged over the long term.

Customers need to feel confident that the program is transparent, with clear rules and achievable goals.

When customers understand how the system works and believe the rewards are meaningful, they are far more likely to stay engaged and view the experience as credible.

Fair play and thoughtful design create emotional connections, transforming routine banking interactions into moments of satisfaction and achievement.

Tiered reward systems, for example, recognise long-term commitment by offering progressively valuable incentives as users advance.

Besides deepening loyalty, gamification reduces churn, as customers feel acknowledged and rewarded for their continued engagement.

Beyond retention, well-designed gamification also encourages advocacy.

When customers feel proud of their progress, they are more likely to share those achievements socially, increasing the bank’s reach organically.

5. Grow business through engagement and loyalty

The cumulative impact of gamification extends beyond improved user experiences. It drives tangible business results.

When engagement rises, customers interact with the brand more frequently and meaningfully, creating opportunities to build trust and deepen relationships.

Enhanced financial literacy creates confidence, making customers more likely to explore new products and services.

Personalised experiences, powered by behavioural insights, ensure that each interaction feels relevant and valuable, while emotional connections transform routine transactions into rewarding milestones.

Increased engagement within the app promotes broader product adoption, thereby increasing cross-selling opportunities and boosting Customer Lifetime Value (CLV).

Gamification replaces passive interactions with active participation, leading to long-term, mutually beneficial relationships between financial institutions and their customers.

How can you drive impact by gamifying Financial Management features?

While almost any feature in a banking app can be gamified, not all areas deliver the same impact.

Some functions naturally lend themselves to game mechanics, making them better candidates for boosting engagement and customer satisfaction, such as PFM and financial engagement tools.

Financial management tools are among the most effective features to gamify. Activities such as budgeting, setting savings goals, and tracking expenses can seamlessly integrate elements such as:

-

Points,

-

Badges, and

-

Progress bars.

These mechanics make the experience more interactive and reinforce positive financial habits.

Equally important, adding gamification here doesn’t disrupt core operations such as account access or transaction processing.

Instead, it enhances usability and creates a sense of progress for the customer.

With Meniga’s Finance Management tools, you can guide customers toward their financial goals, assist them during challenging periods, and deliver a digital banking experience that acts in their best interest.

-

Offer concise weekly and monthly summaries to give users a clear, high-level view of their finances.

-

Enable deep dives into specific spending categories so customers can understand exactly where their money is going.

-

Visualise trends in income and expenses over time for better financial awareness.

-

Encourage positive financial habits by providing actionable insights, tailored advice, and progress tracking.

-

Allow users to set gamified challenges and goals for specific spending categories.

Three key trends impact how financial institutions engage, educate, and retain their customers.

1. Integration with AI

Artificial intelligence is transforming gamification from a generic engagement tool into a hyper-personalised experience.

AI analyses user behaviour, financial goals, and interaction patterns to deliver challenges, rewards, and guidance that are tailored to each individual.

This ensures that every mission feels relevant, timely, and motivating, increasing both engagement and the likelihood of positive financial behaviours.

Instead of generic savings prompts, users receive tailored missions such as ‘Save $200 this month to reach your vacation fund’ or ‘Reduce discretionary spending by 10% this week.’

For example, an AI-powered app can adjust a savings challenge based on a customer’s past performance or recommend targeted educational modules to improve financial literacy.

How can you create a hyper-personalised experience with Meniga?

Financial institutions often struggle to leverage data to anticipate customer needs and create proactive communication strategies and products.

Consequently, insufficient access to data inhibits banks from reacting in real-time to threats and opportunities.

Our AI-driven Insights platform enables you to:

-

Create and deliver highly personalised insights in just minutes.

-

Design personalised, context-aware messaging tailored to each individual.

-

Leverage advanced micro-segmentation that provides a deep, granular understanding of your customers.

-

Benefit from real-time analytics and processing to identify and act on opportunities the moment they arise.

As a result, you can become a trusted financial advisor by truly getting to know your customer and providing helpful advice.

Moreover, nudge customers towards banking solutions they will use and benefit from, increasing the ROI of existing features.

2. Cloud-based gamification solutions

Cloud technology is enabling scalable, flexible gamification frameworks that can be deployed quickly across multiple platforms.

Banks no longer need to build complex systems from scratch.

Instead, they can leverage cloud-based solutions to integrate gamified features seamlessly into mobile apps, web portals, and even third-party financial ecosystems.

As a result, this approach allows real-time updates, analytics, and rapid experimentation, ensuring that gamification programs remain dynamic and responsive to customer needs.

Meniga Insight: Meniga enables banks to modernise their digital experience without costly overhauls. Whether you operate on-premise, in the cloud, or through hybrid systems, our solutions adapt to your infrastructure. This flexibility lowers risk, accelerates innovation, and ensures your bank can scale seamlessly as customer expectations evolve.

3. Development of mega financial platforms

Gamification is moving beyond isolated features toward comprehensive, ecosystem-driven financial platforms.

One of the most powerful drivers of gamification in modern banking is the ability to deliver real-time rewards through open ecosystems.

Open banking APIs enable financial institutions to connect with a network of partners, from retailers and travel providers to wellness and lifestyle platforms.

As a result, customers can redeem points, unlock perks, or receive cashback immediately after completing gamified actions.

For example, a customer earns points for paying bills on time and then receives a bonus for booking eco-friendly travel through a partner service integrated into the banking app.

This way, they create a direct and tangible link between effort and reward.

The immediacy of these rewards enhances motivation, reinforcing positive financial behaviours and keeping customers engaged over time.

Beyond individual benefits, open ecosystems expand the bank’s value proposition by offering curated experiences that go beyond traditional banking services.

Customers no longer view the app as just a place to check balances but as a platform that rewards them for smart financial decisions while providing meaningful lifestyle benefits.

Thus, these ‘mega platforms’ integrate banking, investing, insurance, and lifestyle services into a single, gamified experience.

This holistic approach enhances stickiness, encourages cross-product adoption, and positions banks as central spots in customers’ financial lives.

How can Meniga help you transform your bank into a one-stop shop for all personal finances?

Meniga aggregates internal and external financial data from any bank, in any country, and across all currencies.

Designed for flexibility and scalability, you can tailor our solution to accommodate specific business logic, operational workflows, and regulatory requirements.

Data is processed in real time, then normalised and standardised to ensure consistency and reliability.

Through Meniga’s RESTful API, this information is instantly accessible to digital channels, enabling you to:

-

Deliver personalised experiences,

-

Power gamification features, and

-

Provide actionable insights securely and efficiently.

What is the technology behind gamification?

The technology underpinning gamification combines AI, cloud infrastructure, real-time analytics, and seamless integration with existing banking systems.

1. AI and data layer

At the core of modern gamification is artificial intelligence.

Banks leverage AI to analyse behavioural data, predict user preferences, and dynamically tailor challenges, rewards, and financial guidance.

Machine learning models identify patterns in spending, saving, and engagement, enabling the system to deliver hyper-personalised experiences that keep users motivated and invested.

2. Gamification engine

The gamification engine is the heart of the system.

It manages the rules, points, badges, progress tracking, challenges, and quests. Modern platforms support modular designs, allowing banks to experiment with new features, adjust difficulty levels, or launch seasonal campaigns without disrupting the core application.

3. Real-time engagement layer

Instant feedback is a necessity for maintaining engagement.

Real-time push notifications, in-app alerts, and contextual nudges provide immediate reinforcement for desired behaviours.

Whether celebrating a milestone, reminding users of an active challenge, or offering bonus rewards, this layer keeps interactions dynamic and compelling.

4. Cloud infrastructure

Cloud-based solutions allow scalability, flexibility, and speed.

Banks can ‘translate’ gamified experiences across multiple devices and platforms, test new features rapidly, and handle high volumes of user interactions without compromising performance.

Cloud architecture also enables secure storage of behavioural data while supporting analytics at scale.

5. Integration and APIs

Seamless integration with core banking systems, card networks, open banking platforms, and partner ecosystems is a must.

APIs facilitate cross-platform interactions, such as linking rewards to merchant offers, incorporating third-party educational content, or syncing with budgeting and investment tools.

As a result, you can create a unified experience for customers while maintaining data integrity and security.

6. Analytics and experimentation tools

Continuous improvement is a synonym of effective gamification.

Advanced analytics and experimentation frameworks allow banks to measure engagement, test variations of challenges, and refine reward structures.

Insights from these tools ensure that gamification strategies are evidence-based and optimised for customer satisfaction and business outcomes.

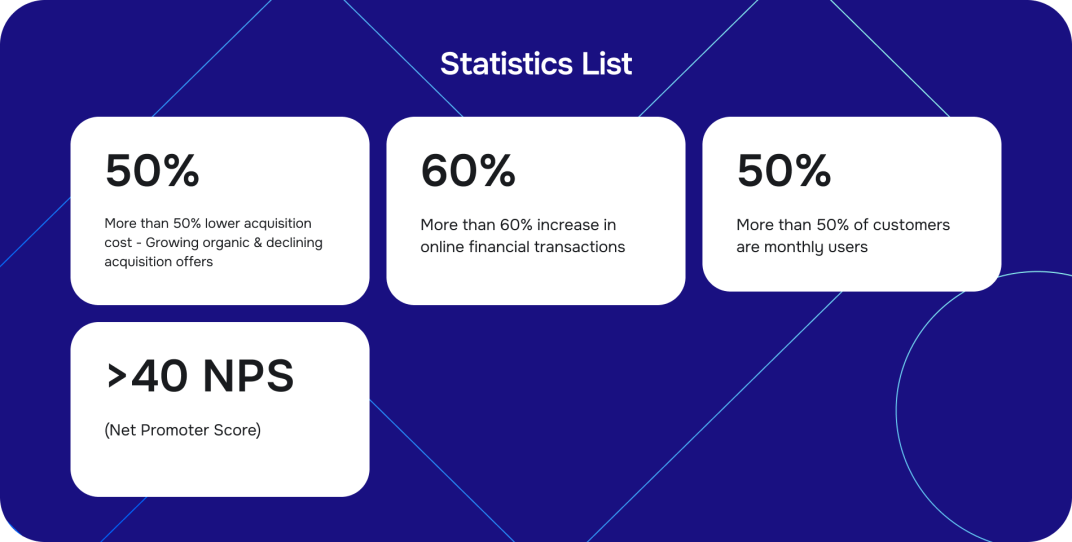

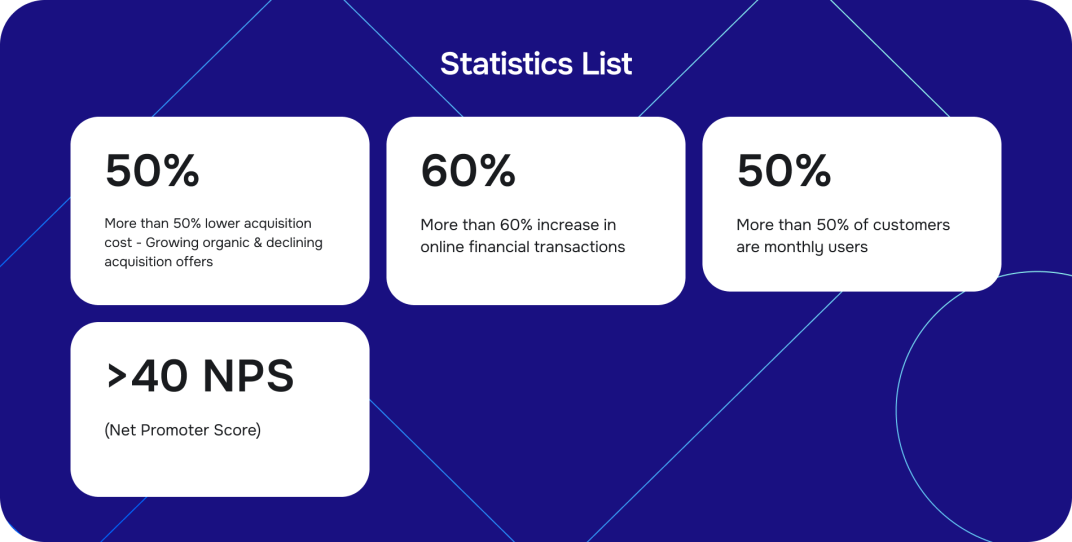

Real-world impact: How UOB bank lowered acquisition cost for more than 50% and grew organic offers through gamification?

UOB, a leading bank in the ASEAN region, partnered with Meniga, a leading global digital banking solutions provider specialising in data-driven personalisation.

The bank created TMRW, a mobile-first digital bank targeting ASEAN millennials, to educate them about better financial management and savings.

It incentivised saving behaviour by allowing customers to ‘level up’ and build a virtual city that grows as savings increase.

This visual and interactive reward system transforms saving money into an enjoyable and motivating game-like experience.

-

Customers receive personalised, automated challenges and reward notifications, encouraging them to meet financial goals such as budgeting, payments, or reducing spending.

-

The app has automated payment reminders, alerts for upcoming bills, and notifications of any unusual charges, helping customers avoid fees and fraud while reinforcing proactive money management.

What does the future of gamification in banking bring?

Gamification in digital banking isn’t only about making apps fun. It’s also a strategic approach to:

As a result, banks can turn routine tasks such as budgeting, tracking expenses, or saving into interactive and rewarding experiences.

With advances in AI, cloud infrastructure, and integrated financial platforms, gamified banking has the potential to redefine how customers interact with their finances.

But its success isn’t automatic. It works best when designed around the real needs, motivations, and goals of customers.

When thoughtfully implemented, gamification can create meaningful, long-term connections between customers and their bank.

On the other hand, poorly executed gamification risks feeling superficial, failing to engage customers, and offering little real value to either party.

How to create a meaningful gamified customer experience with Meniga?

Gamification in banking is set to become a cornerstone of customer engagement strategies, and Meniga is here to help banks lead the way.

With Meniga, you can:

-

Combine multiple data sources in real time, which you can use across digital channels.

-

Offer tailored advice based on a customer’s financial habits.

-

Create gamification elements to encourage positive financial behaviours.

-

Help customers track spending, set budgets, and manage savings.

Currently, Meniga is developing the Meniga Conversational Financial Assistant, an advanced LLM-powered solution designed specifically for banks.

Customers can interact naturally, asking questions like ‘How much did I spend on groceries this month?’ or ‘Can I afford a weekend getaway?’ and receive immediate, accurate responses in a conversational flow.

By leveraging enriched financial data secured with banking-grade protections, this intelligent assistant:

-

Delivers highly personalised guidance,

-

Eases the workload of customer support teams, and

-

Enhances digital engagement.

It positions your bank as a forward-thinking, trusted partner that empowers customers with actionable insights and a seamless banking experience.

Ready to discover more of what Meniga has to offer?

Contact us today to see how you can start transforming everyday banking into an interactive, personalised journey for your customers.