This is the first article in a series we call #RealWorldFintech. Please let us know via Twitter, Facebook, or Linkedin what fintech topics you would like to see us cover in the series. We kick things off by discussing SME banking but also expect articles about personal financial management.

How can banks help small businesses avoid a cash-crunch?

One of the most pressing issues banks servicing the SME market face is how to help small business owners and managers to avoid a cash crunch. SMEs always face many challenges, but ensuring that companies have sufficient operating capital to take them through hard times is a top priority during the current economic difficulties.

Improve the financial health of your SME customers

However, banks are hard-pressed to provide small businesses with guidance. During a pandemic, waiting times for consultation get longer, not shorter. So what can banks do now to ensure the financial health of small businesses?

Deliver financial self-help at scale

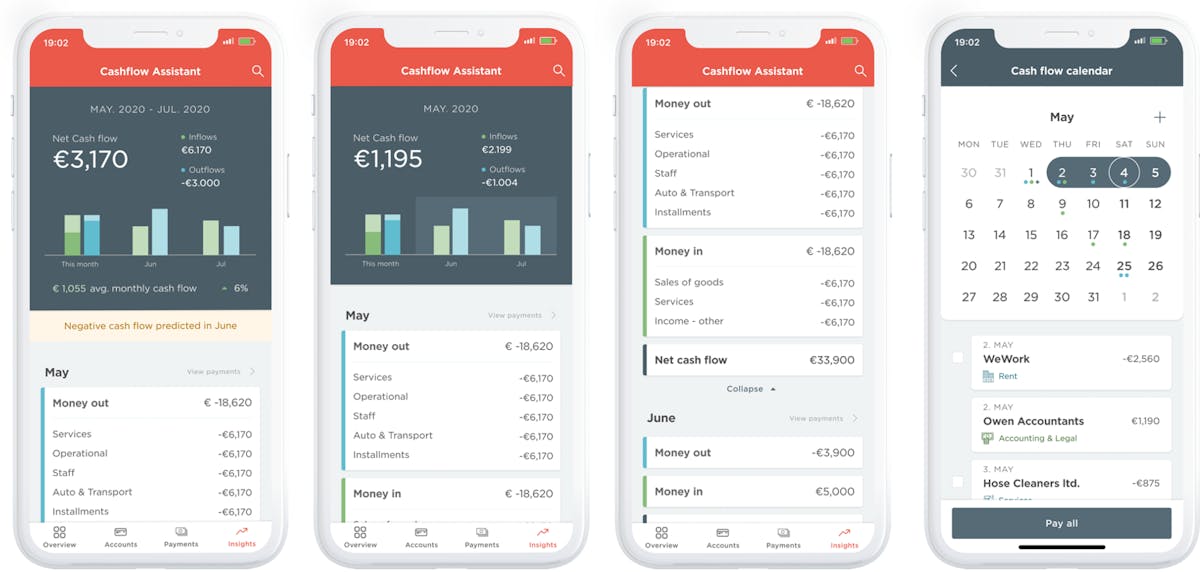

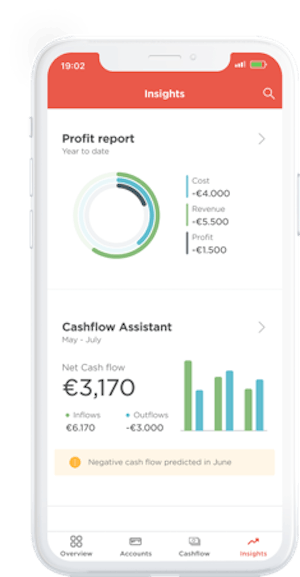

At Meniga, we know from experience that banks must deliver the tools for proactive financial self-help at scale during tough economic times. We also understand that people appreciate functionality, which automatically gives them crucial financial insights at the right time. This is as true for banking for small businesses as it is for personal financial management. This is why we have created the Cashflow Assistant.

A stitch in time saves nine

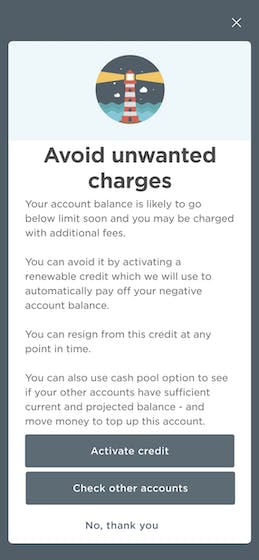

The Cashflow Assistant warns owners, or finance directors of small businesses, if a company is likely to run out of cash, or run a surplus, in a given period. We could write a lot about the innovative algorithms and transaction detection of recurring expenses that underpin The Cashflow Assistant. However, the most important thing is how this software reduces uncertainty for busy managers and enables them to take timely action to improve a company’s cash position when needed. Navigating the pandemic economy’s turbulent waters becomes a little easier.

Boon for banks

Banks can “automate” a part of their consulting and reduce the workload of their service centres. Their banking apps become engaging and more useful for SME customers. Banks gain a more financially healthier clientele and can engage their SME customers with products and services at the right time.

The steps to worry-free SME banking

Provide your SME customers with worry-free banking by deploying the Cashflow Assistant in your banking app. Meniga takes your bank through the implementation in a few easy steps.

- Standing orders & invoices in the bank are automatically linked to upcoming and recurring transactions. A baseline overview of what is left to spend is created based on known factors

- Cashflow Assistant automatically identifies and reconciles recurring transactions. It notifies users when a specific payment pattern stops and asks the user what should be done about it. This can help companies avoid missing payments on loans for example. Perhaps more importantly, it also notifies the user when an upcoming payment causes a company to deplete an account.

- When the Cashflow Assistant in place, your bank can build money management habits of your SME customers with an engaging user interface. If you need help with this, Meniga runs innovation workshops with banks which are designed to help them quickly implement the most effective user interfaces

- Offer the right products or services at the exact right time.

Try the Cashflow Assistant

Contact us if you want a demo of the Cashflow Assistant

More resources for banks from Meniga

Download Insight Papers or request a demo of our Business Financial Management platform.