What would you like us to write about in the field of fintech?

Welcome to the third article in a series we call #RealWorldFintech. Please let us know via Twitter, Facebook, or Linkedin what fintech topics you would like to see us cover in the series. Previously we have discussed SME banking and personal financial management. This time we focus on the open banking trend, which is a tremendous business opportunity for ambitious banks.

Simplify to win

The modern world is a complicated place, so companies that make things simpler for people are bound to succeed. Consider companies such as Uber, Netflix, Google, Airbnb, Fitbit, and my personal favourite, Spotify. Each company has successfully simplified its business area for people, be it transport, personal fitness, entertainment, travel, or finding information.

This principle is, of course, true for banks. We have already gone over how important it is for banking apps to show users easy-to-understand reports of their spending and invite them to engage with attractive looking transactions.

Create a joyous user experience

But banks can go even further in making life easier for their customers. I want to be so bold to say that banks can now aspire to be like the Spotify of banking. An essential function of Spotify is to consolidate music from numerous artists and music labels. It is made and easily accessible in one central repository. It results in a joyous user experience.

Open up; it is the law!

We live in a world where people are increasingly using more than one bank, although it is noteworthy how resilient incumbent banks have been in the face of increasing competition. In Europe and the UK, legislation has mandated banks to open up to competitors. This legislation means, amongst other things, that banks need to enable people to access their bank accounts in third-party apps and make payments from them. On the face of it, this does not bode well for banks. But there is a silver lining. You can now make your banking app the only banking app people ever want

Make your banking app the only banking app people need

Open banking allows ambitious bankers to compete on their banking apps’ usefulness rather than on rates. If customers get a better user interface and more engaging data in your bank’s app, your bank has created a reason for people to import their banking data into your app and it for all their digital banking. It will create an opportunity for you to deepen the customer relationship further.

How to win in the new open banking world

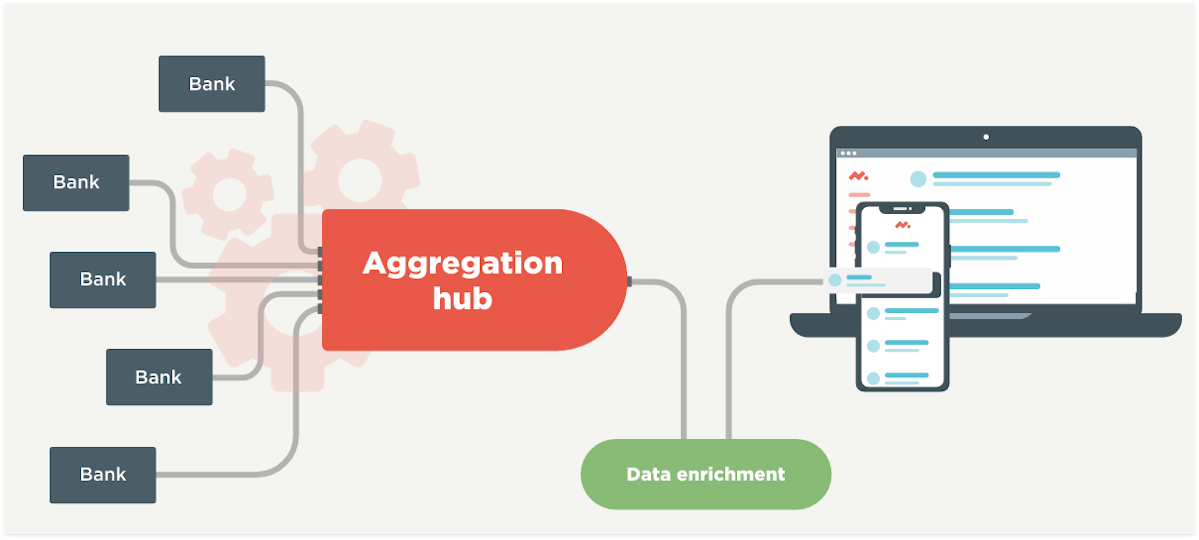

But how can this be done? The reality is that there are many banks and banking data aggregators to connect with if open banking is to work correctly. Luckily some brilliant colleagues of mine have solved this for you and your bank. They have spent a lot of time developing a brilliant bit of software known as the Aggregation Hub.

Simplifying banking data aggregation, and your life

The Aggregation hub gives your bank a single point of access to internal and external banking data providers. One of its primary purposes is to allow your customers to access all their credit card transactions and bank accounts in your banking app. It manages consents for viewing bank accounts and making payments. The aggregation hub is designed to help banks avoiding vendor lock-in. Banks will find it easy to change providers of financial information when needed.

More resources from Meniga about Open Banking

Download Insight Papers. I am sure you will be especially interested in the Insight Paper, which details the innovation opportunities of open banking.