Banks are facing increasing pressure to become not just service providers but also trusted partners in their customers’ financial journeys.

Enter hyper-personalisation — a transformative approach reshaping banking by delivering real-time, context-aware, and deeply personalised customer experiences.

But why are banks racing to invest in hyper-personalisation, and what benefits does it bring?

Read on to learn more about hyper-personalisation in banking to help you gain a competitive advantage.

Let’s dive in!

What is hyper-personalisation in banking?

Hyper-personalisation leverages real-time data, advanced analytics, AI, and machine learning to deliver highly tailored products, services, and experiences to individual customers.

It goes beyond basic demographic data to include behaviour, preferences, financial goals, location, and even emotional cues.

Instead of asking, “What product can we sell this customer?”, banks now ask, “How can we genuinely serve this customer based on their current needs and future goals?”

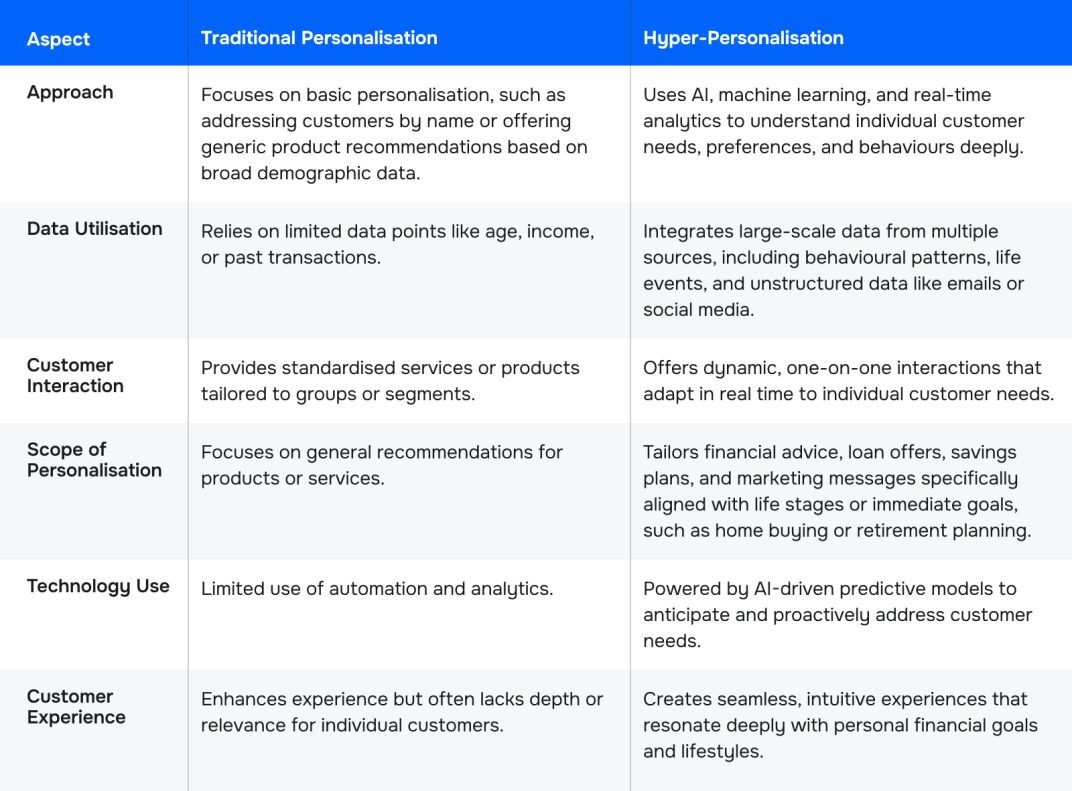

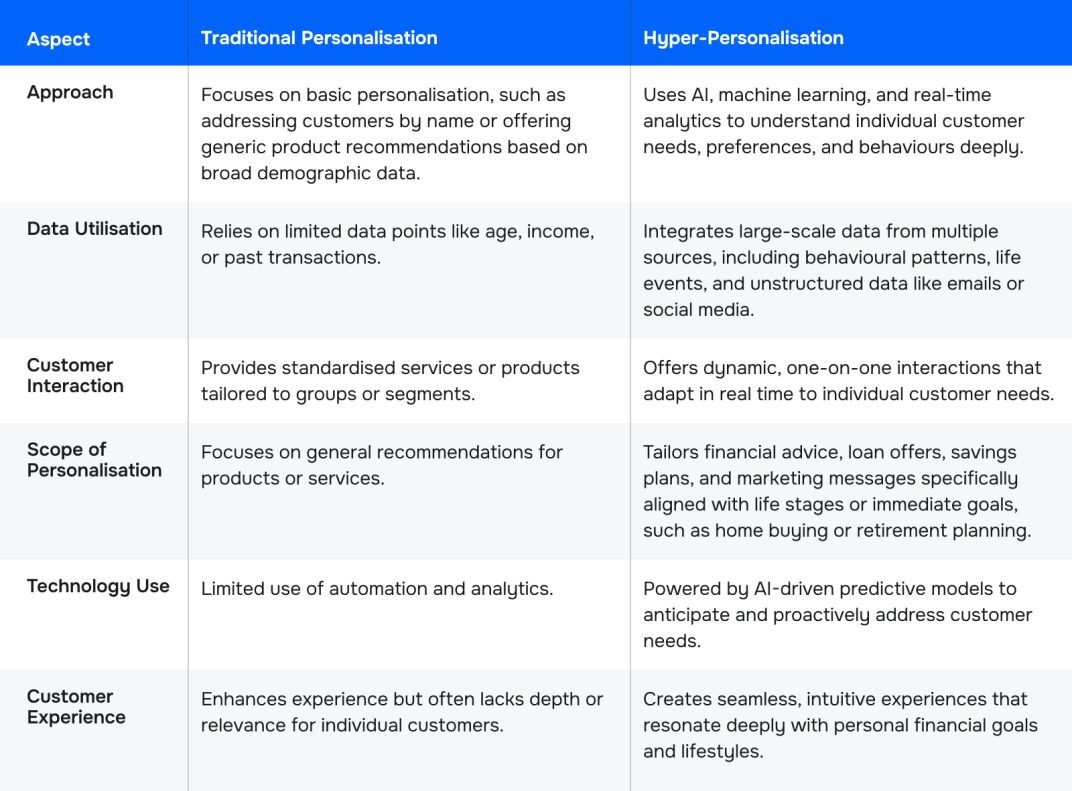

How does hyper-personalisation differ from traditional personalisation in banking?

While traditional personalisation provides a foundation for tailored banking experiences, hyper-personalisation takes it further by leveraging technology to create unique, dynamic interactions that meet individual needs in real time.

Why hyper-personalisation matters?

1. Keeping up with evolving customer expectations

The modern customer is no longer comparing their banking app to other banks. They’re comparing it to their favourite digital experiences.

Whether it’s the personalisation of Spotify’s weekly music recommendations or Amazon’s accurate product suggestions, customers expect their bank to “know them” just as well.

Previously, a bank sending a birthday message or addressing a customer by name was considered thoughtful. Today, that’s the bare minimum.

Customers now expect banks to understand their goals, challenges, and life moments and to respond proactively with tailored solutions.

For example, a customer who receives a generic credit card promotion might ignore it, but one who gets a notification offering a travel rewards card right after booking a vacation?

That’s relevant, timely, and appreciated.

2. Creating personalised financial solutions

Banks are in a unique position when it comes to customer data.

Few other industries can match the breadth and depth of insights available:

However, simply having data isn’t enough. The competitive advantage lies in how well you can analyse and act on it.

For example:

-

Real-time transaction monitoring can help you detect patterns that show what your customers may need soon. For example, if someone books a trip, you might offer travel insurance or a foreign currency card.

-

Historical spending data can inform budgeting tools that provide monthly insights and personalised saving goals.

-

Geolocation data can deliver local offers or branch suggestions when a customer is in a new city.

With the right AI models, you can anticipate needs before the customer even realises them.

This is the true power of hyper-personalisation: proactive, data-driven financial support.

Worth knowing

Did you know that with Meniga, you can analyse behavioural data to create ultra-specific customer segments, such as Likely to Invest or Starting a Family, and leverage real-time events from any external or internal banking tool to ensure timely delivery?

3. Increasing engagement and customer loyalty

Trust and relevance are the cornerstones of customer loyalty in banking.

Hyper-personalisation deepens both by making the customer feel like the bank truly understands and supports them, not just as an account holder, but as a person with evolving needs and goals.

When done right, hyper-personalisation leads to:

-

Higher engagement rates — Customers are more likely to open emails, click notifications, and explore offers that feel directly relevant to them.

-

Greater product adoption — Personalised recommendations lead to higher conversion rates because the customer sees clear, immediate value.

-

Improved retention — Personalised interactions foster emotional loyalty. Customers are less likely to switch banks when they feel their current one “gets them.”

If you use AI to predict when a customer might face a cash shortfall and then offer a low-interest overdraft or budgeting advice in advance, you turn a potentially negative experience into a trust-building moment.

4. Gaining a competitive edge

The fintech “revolution” has shown that digital-first, customer-centric banking is possible and profitable.

Neobanks have been quick to adopt hyper-personalisation as a core differentiator. They’re agile, tech-savvy, and often built from the ground up to personalise everything.

On the other hand, traditional banks, weighed down by legacy systems and siloed data, face an uphill battle but also an opportunity.

Adopting hyper-personalisation offers competitive advantages such as:

-

Appealing to younger, tech-native demographics.

-

Attracting customers dissatisfied with impersonal or outdated services.

-

Building a brand that’s known for innovation and customer focus.

Get inspired

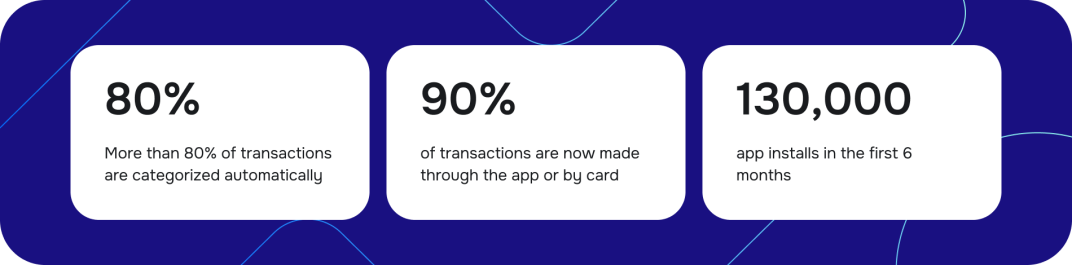

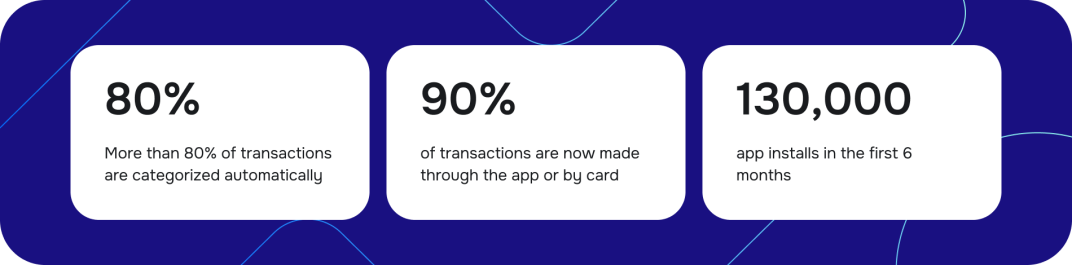

For example, we helped the Portuguese Crédito Agrícola bank respond to rapidly growing competition from agile neobanks and to retain and expand their customer base.

How? We helped them create their very own digital bank moey!, focusing on the digital banking experience.

Some of the features that we implemented include:

-

Automatic event categorisation system and intelligent analytics where expenses are segmented by category and sub-category and displayed in an organised way.

-

Activity feed that enables you to engage with customers to personalise messages such as insights, advice, fun facts, targeted rewards, and product recommendations.

-

Flexible expense reports with extensive filtering capabilities.

-

Automatic generation and management of financial budgets.

-

Savings goals, an easy-to-use tool for creating and managing savings goals, as well as a system of alerts and incentives to meet those goals.

And here’s the result.

5. Driving revenue growth and efficiency

Personalised banking isn’t just good for the customer, it’s great for your organisation, too. Embracing hyper-personalisation can lead to:

-

Improved ROI on marketing campaigns —Targeted offers cost less and convert more.

-

Higher product penetration — Customers who feel understood are more open to using multiple services.

-

Operational efficiency — AI-driven personalisation reduces reliance on mass marketing and manual processes while improving service quality.

Let’s say a bank uses AI to identify customers likely to need a car loan within the next 3 months. It can deliver tailored loan offers with pre-approved limits, competitive rates, and even partnerships with local dealerships.

Not only does this boost the chances of conversion, but it also shortens the sales cycle and reduces acquisition costs.

Worth knowing

With Meniga’s Insights, you can supercharge digital sales with micro-targeted campaigns and:

-

Promote the right products to the right people.

-

Offer products at the exact time the customer needs them.

-

Deliver across any channel for a holistic, omnichannel experience.

-

Identify significant milestones in a customer’s life and offer products that will support them in that journey.

As a result, you’ll be able to understand your customers on a granular level, and provide more tailored solutions.

We have a proven track record of customer metrics, including:

-

32% increase in monthly savings,

-

NPS scores of 40-60,

-

33% increase in registered users,

-

100% increase in time spent in the app,

-

104% increase in app logins, and so on.

A quick recap: Key drivers of hyper-personalisation and benefits for banks

So, let’s revise what’s pushing banks toward hyper-personalisation:

-

Advanced Technologies — AI, machine learning, cloud computing, and big data analytics are essential for capturing and analysing customer data to deliver real-time personalised experiences.

-

Behavioural Insights — Banks use predictive analytics to understand customer behaviour patterns, enabling them to offer relevant financial advice or products at the right moment.

-

Focus on Life Events — Hyper-personalised banking aligns services with major life milestones, such as marriage or purchasing a home, providing tailored solutions like mortgage options or insurance plans.

Benefits for Banks:

-

Improved Customer Loyalty — Personalised interactions deepen relationships and reduce attrition rates.

-

Cost-Efficiency in Marketing —Targeted messaging based on micro-segmentation minimises wasteful spending.

-

Higher Profitability — Loyal customers tend to have higher deposit rates and lower delinquency risks.

Bonus: How can banks build trust with customers when implementing hyper-personalisation?

Building customer trust is critical for banks implementing hyper-personalisation, as it involves handling sensitive personal data and delivering highly tailored services.

Nonetheless, there are practices you can implement to foster trust:

1. Transparent data practices

-

Clear communication — You should clearly explain how customer data is collected, stored, and used. Transparency about data usage builds confidence and reduces concerns about misuse.

-

Consent management — Ensure customers have control over their data by obtaining explicit consent for its use in hyper-personalisation efforts. Providing opt-in/opt-out options for specific personalisation features can enhance trust.

2. Robust data security measures

-

Advanced security protocols —Implement multi-layered security systems, including encryption, firewalls, and intrusion detection, to protect customer data from breaches.

-

Real-time fraud detection — Use AI-powered tools to monitor banking patterns and detect suspicious activity, ensuring customers feel secure sharing their information.

3. Ethical use of AI and data

-

Avoid over-personalisation — While hyper-personalisation offers value, overly intrusive experiences like recommendations based on private browsing habits can make customers uncomfortable. You should balance personalisation with respect for privacy.

-

Bias-free AI models — Ensure algorithms are free from bias to deliver fair and ethical outcomes for all customer segments.

4. Customer-centric approach

-

Value-driven personalisation — Focus on providing meaningful customer benefits, such as tailored financial advice or proactive solutions to their needs, rather than purely driving sales.

-

Empathy in design — Create experiences that align with customer preferences and life stages, showing an understanding of their unique financial goals.

5. Seamless customer experience

-

Consistency across channels — Deliver hyper-personalised services consistently across all touchpoints (e.g., apps, branches, websites) to build reliability and trust.

-

Proactive problem solving — Use predictive analytics to anticipate customer issues and offer timely solutions, reinforcing your role as a trusted advisor.

6. Education and empowerment

-

Customer education — Educate customers about the benefits of hyper-personalisation and how it can improve their financial well-being.

-

Control over personalisation —Allow customers to customise the level of personalisation they receive, empowering them to feel in control of their banking experience.

Meniga: your trusted partner to embrace hyper-personalisation

Meniga provides premium digital banking solutions, serving over 100 million customers across 165 financial institutions in 30 countries worldwide.

At the core of our mission is to enable large financial institutions to quickly transform their online and mobile digital environments with minimal investment.

Thus, with Meniga, you can:

-

Connect meaningfully with your customers and provide customised solutions thanks to our AI-powered and ML technology.

-

Seamlessly integrate our flexible and scalable solutions with existing systems, elevating and modernising the digital environment regardless of the underlying architecture.

-

Create and maintain sustainable revenue growth through targeted digital sales, deposit growth, etc.

Ready to see Meniga in action?

Contact us today and become a trusted financial advisor who truly gets to know the customer.