Each swipe, tap, or click creates a transaction that tells a story. But without structure, it’s just noise.

That’s where transaction categorisation steps in — to make sense out of the noise.

It underpins everything from fraud prevention to personalised financial insights.

When you manage millions of data points daily, the ability to accurately and intelligently sort transactions isn't just an operational task — it's a strategic advantage.

But how to implement it to really see the benefits?

Read on to learn all about transaction categorisation to drive retention and reshape customer experience.

What is transaction categorisation?

Transaction categorisation labels financial transactions into predefined or dynamic groups based on their attributes, such as:

-

Merchant name,

-

Transaction amount,

-

Payment type, or

-

Purchase context.

This way, it systematically groups transactions for easier financial management, reporting, and analysis.

Transactions are typically grouped into categories such as:

-

Income — Money received, such as salaries, sales, and dividends.

-

Expenses — Outflows for goods or services like rent, utilities, and marketing.

-

Transfers — Movement of funds between accounts.

-

Investments — Purchase or sale of assets like stocks or property.

-

Loans — Borrowed funds or repayments.

Why transaction categorisation matters

Transaction categorisation is highly necessary since it transforms raw financial data into actionable insights.

It reveals patterns, preferences, and priorities that help you truly understand your customers.

1. Know your customers better than ever before

Imagine understanding your customers' financial lives so deeply that you can anticipate their needs.

Transaction categorisation makes it possible.

By analysing spending patterns, you can uncover valuable information about customer preferences, such as frequent dining, travel habits, healthcare expenses, and use this knowledge to offer:

-

Personalised loans,

-

Savings plans, and

-

Investment advice.

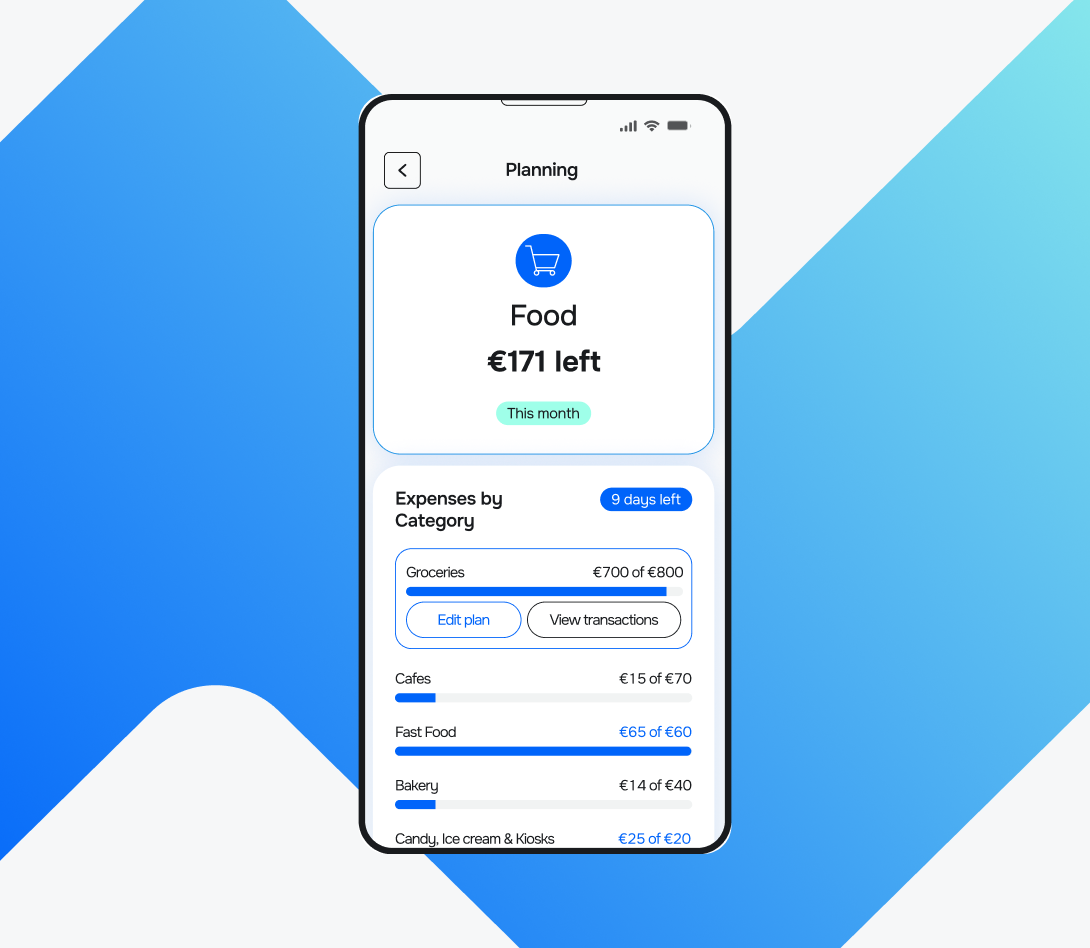

Granular categorisation allows you to group customers by lifestyle or business needs, enabling laser-targeted marketing and loyalty programs that actually resonate.

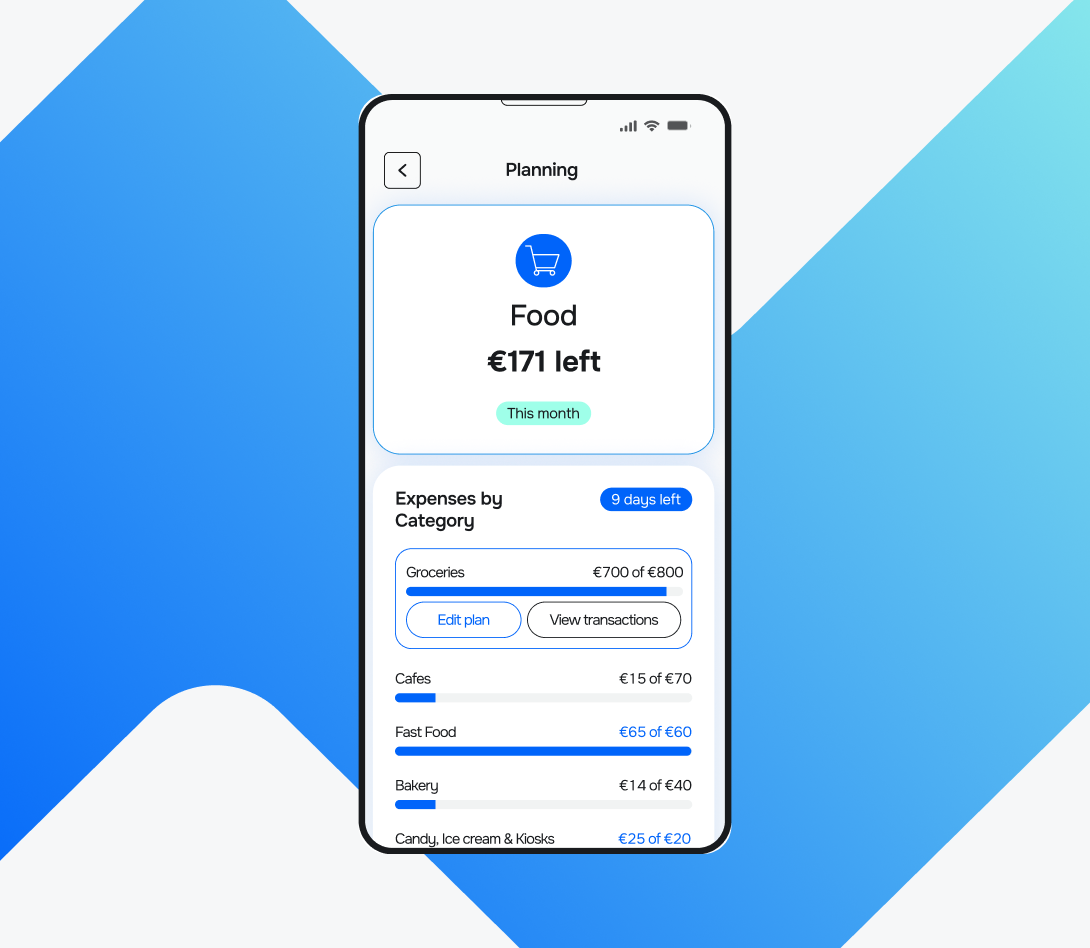

Moreover, it empowers your app to provide budgeting tools, spending alerts, and predictive insights that foster customer engagement and keep them coming back.

2. Mitigate fraud and risk

Stay one step ahead of fraudsters with smart transaction categorisation.

Unusual transactions that don't fit the norm trigger instant alerts, helping you detect fraud early and minimise losses.

Accurate categorisation is also essential for loan underwriting, providing lenders with the insights they need to assess:

3. Supercharge your operations with automation

You can free up your team from tedious manual tasks and supercharge your operational efficiency with AI-driven categorisation that helps with:

1. Automated processing

Advanced technologies like machine learning, natural language processing, and deep learning can process millions of transactions daily, reducing manual errors and significantly speeding up data handling.

2. Cashflow forecasting

In addition, hierarchical categorisation systems are invaluable to help you effectively identify and analyse trends within cash inflows and outflows.

This granular approach allows for a deeper understanding of cash flow patterns than a simple overview would provide.

For example, you may categorise inflows by source (sales, investments, loans), while categorising outflows by department, vendor, or type of expense.

As a result, you can more easily identify potential bottlenecks, seasonal fluctuations, and other critical trends.

Worth knowing

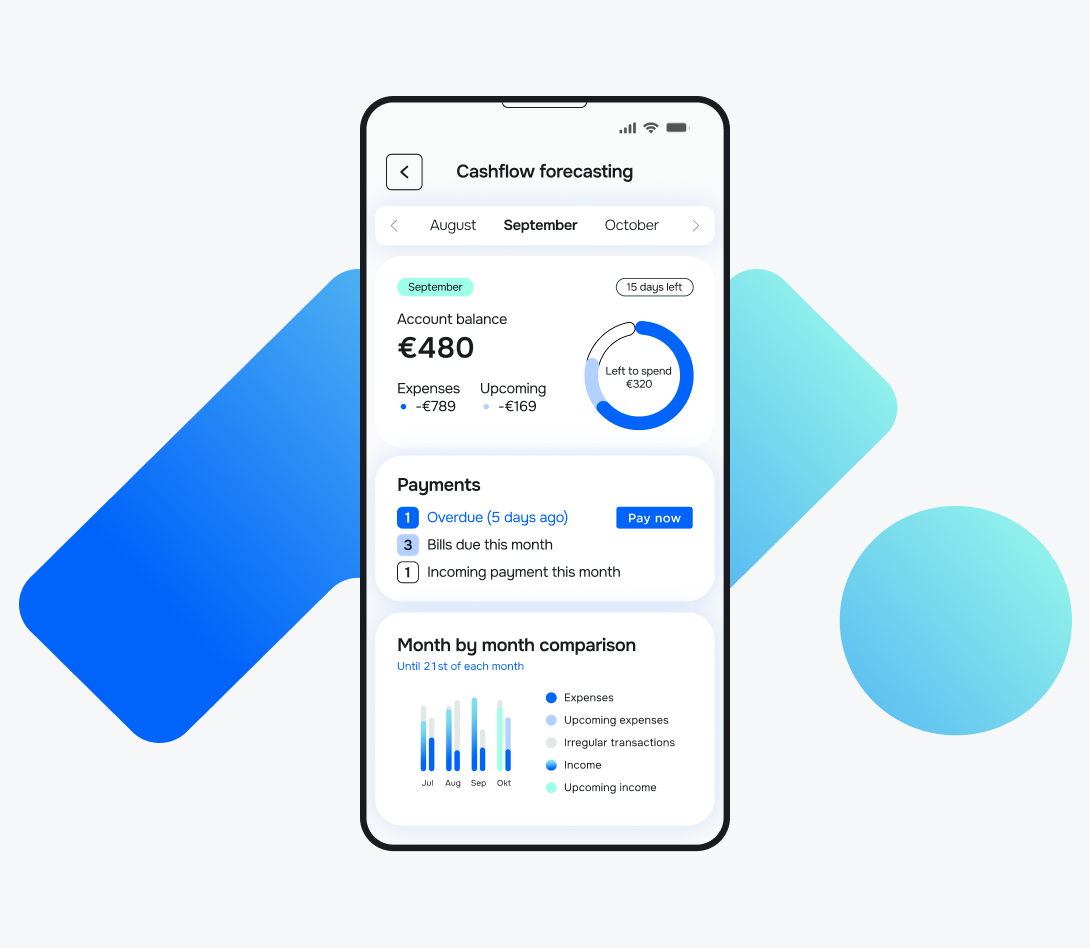

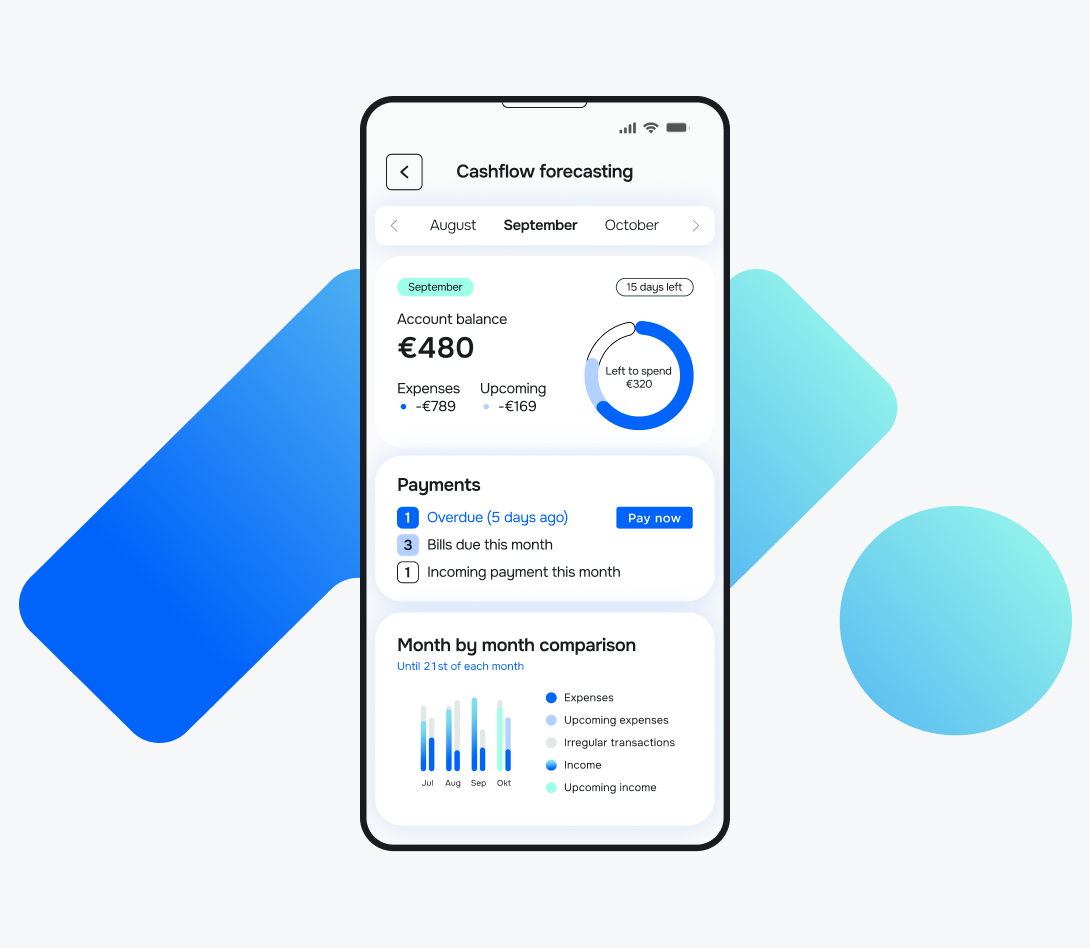

With Meniga’s Cashflow Forecasting, your banking customers can understand their balance history and anticipate their future cash flow.

The tool provides valuable insights into your customers’ recurring income and expenses, helping them avoid overdraft fees and make informed decisions about their spending and saving.

What’s more, it allows you to warn customers about potential low finances and advises on saving or spending based on their liquidity and upcoming transactions.

4. Empower your banking customers

By analysing categorised business transactions, you can help lenders evaluate profitability, operational efficiency, and creditworthiness.

You can provide your business customers with bank-provided categorisation tools to identify wasteful spending and reallocate budgets effectively, helping them optimise their cash flow and improve their bottom line.

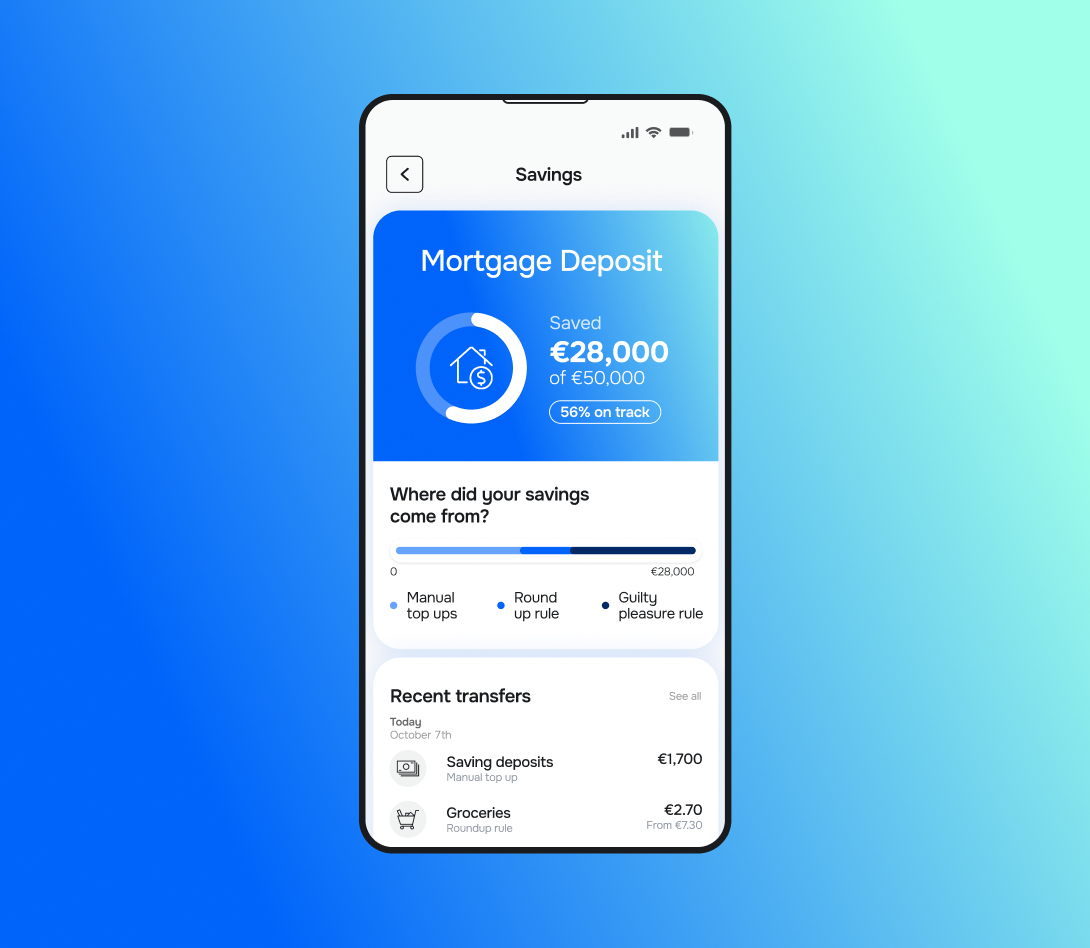

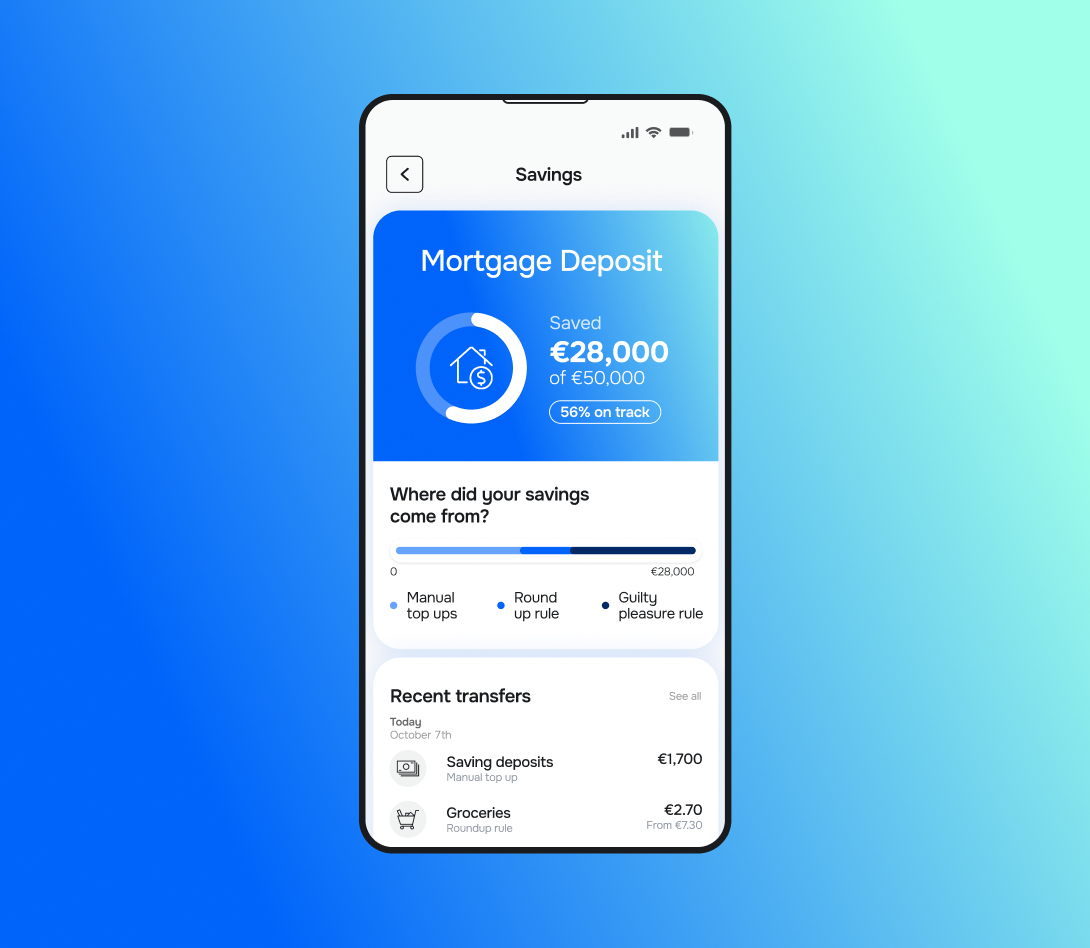

Did you know that with Meniga’s Smart Savings functionality, you can help customers effortlessly manage their savings through a variety of fun savings modules?

This way, you can help them increase deposits and encourage healthy habits. Customers can create pots of savings where they work towards a specific target, such as saving for:

They can choose pre-existing or build their own savings rules, which automatically transfer money into savings at certain amounts or intervals, or are tied to IFTTT events.

How transaction categorisation works

Modern categorisation typically follows a multi-step process:

-

Data ingestion — Collect transaction data from sources like bank feeds, direct integrations, or APIs.

-

Feature extraction —Identify useful data points such as: Merchant name, Merchant Category Code (MCC), Transaction amount, Geolocation, Timestamp

-

Normalisation — Clean up merchant names and standardise transaction descriptions. For example, translating "AMZN Mktp US*1234" to "Amazon Marketplace".

-

Categorisation — Apply categorisation using: Rules (hard-coded mappings), Machine learning models (trained on millions of labelled transactions), Hybrid logic. More about this shortly.

Feedback loop — Capture user corrections to retrain and improve the model.

How do banks use algorithms to categorise transactions?

We’ve promised to shed more light on the methods of transaction categorisation. The 3 main methods dominate the field.

1. Rule-based method

Rule-based systems are the original backbone of transaction categorisation.

They operate on explicit logic, such as keyword matching, hard-coded merchant lists, or mappings based on Merchant Category Codes (MCCs).

The system uses these pre-defined rules and criteria aligned with industry standards, regulatory requirements, and internal policies.

For example, if the transaction description contains “Spotify,” it will be assigned to the Entertainment category.

Strengths:

-

Simplicity — Easy to understand and implement.

-

Speed — Fast processing with low computational requirements.

-

Auditability — Decisions are transparent and easy to trace, a plus for compliance teams.

Limitations:

-

Complex transactions — Some transactions involve multiple products or services, making it hard to assign a single category. For example, a single Amazon purchase may include books, electronics, and clothing.

-

Evolving business models — New types of businesses and revenue streams may not fit neatly into existing categories, especially when relying on traditional MCC codes.

-

Regional variations — The same merchant may be categorised differently in various countries due to local classification standards, leading to inconsistencies.

-

Customer intent — Generic categories may not capture the user's intent. For example, buying organic food at a grocery store might be better categorised under "Healthy Living" rather than "Groceries."

-

Scalability issues — Managing and updating thousands of rules becomes complex over time.

While rule-based systems are still used in many legacy systems or for first-pass categorisation, they’re rarely enough on their own in today’s high-volume, high-variance transaction environments.

However, the solution lies in the following method.

2. Machine Learning Models (ML) and AI

Increasingly, banks are using machine learning (ML) and AI to improve categorisation accuracy and adapt to new types of transactions.

ML models analyse large volumes of historical transaction data, learning to recognise subtle patterns and variations in transaction descriptions, merchant names, and amounts.

ML transforms how financial institutions process, analyse, and understand transaction data with its key functions:

2.1. Pattern recognition

ML models analyse vast amounts of historical transaction data to identify patterns in spending behaviour, transaction types, and merchant trends.

This enables the system to learn how to accurately assign categories to new transactions, even as user behaviour and merchant offerings evolve.

2.2. Data processing and enrichment

Machine learning algorithms preprocess transaction data by cleaning, normalising, and enriching it, filling in missing details, and converting textual descriptions into structured formats.

Data enrichment improves raw transaction data by adding details like merchant names and logos, clarifying ambiguous descriptors.

Thus, it helps AI models accurately classify transactions, even with broad, ambiguous or inaccurate MCC codes, making it crucial for improving categorisation accuracy.

For example, Meniga consolidates and enriches transactional data from any internal or external source, including open banking.

Our Enrichment Engine categorises and enhances transaction data, providing details that improve data quality and usability for both you and your customers.

The intelligent categorisation learns from user and community contributions to continuously improve accuracy over time and brings the data to life with:

2.3. Automated classification

ML allows for the automatic categorisation of millions of transactions in seconds, which would be impossible to achieve manually.

Supervised learning models are commonly trained on labelled transaction datasets, learning to associate features like merchant name, amount, and description with specific categories.

2.4. Natural Language Processing (NLP)

ML models use NLP to interpret and extract meaning from unstructured transaction descriptions, which often contain valuable clues for accurate categorisation.

Therefore, it can interpret unstructured text in transaction descriptions, enabling models to differentiate between similar transactions, such as "Amazon - Books" vs "Amazon - Electronics".

2.5. Continuous learning and adaptation

ML systems can be retrained and improved over time as new labelled data becomes available, allowing them to adapt to changing consumer habits, new merchants, and evolving transaction types.

As a result, these models can learn user-specific preferences, further refining categorisation accuracy.

3. Hybrid approach

This system combines the strengths of both rule-based and ML models. Hybrid categorisation frameworks typically follow a layered approach:

-

Rules first — Use determined rules for well-known, high-confidence merchants.

-

ML prediction next — Apply machine learning models to handle ambiguous or unknown transactions.

-

Manual review or user feedback — Flag edge cases for human oversight or use customer corrections to refine categorisation.

5 common mistakes to avoid in transaction categorisation

If you're going to rely on transaction categorisation, accuracy is key. Check our list below so you can avoid common errors.

-

Vague or generic descriptions — Using broad labels like "POS withdrawal" or "Retail" without specifics leads to misclassification.

-

Inconsistent labelling — Mixing terms like "Utilities" and "Bills" for the same expense type.

-

Manual errors and oversights — Mislabeling transactions due to high volumes or human fatigue.

-

Failing to split transactions — Categorising a single transaction with multiple expenses) under one label.

-

Ignoring small transactions — Overlooking minor expenses, which cumulatively distort budgets.

Luckily, there is a solution that can help you avoid the above mistakes by transforming raw transaction data into meaningful categories for your customers.

Enter, Meniga.

How can you improve transaction categorisation with Meniga?

Meniga specialises in digital banking solutions, helping banks and financial institutions manage their financial data more effectively.

Due to our global expertise and markets, our category tree is fully localised and customisable for clients worldwide.

What else is in store for you?

-

Turn transaction data into real value for you and your customer, and provide a 360-degree view of your customers’ spending habits and finances.

-

Display clean and accurate merchant names for a clear overview and improved search results.

-

Assign current logos for easy identification and visualisation.

-

Build and deliver hyper-personalised insights through our AI-powered platform to increase digital sales by promoting relevant products to the right customers, at the right time.

-

Micro-segment your customers to understand them on a granular level.

Ready to explore Meniga more in detail?

Contact us today to discover how Meniga can help you clean up transaction feeds and provide a superior customer experience for your customers.