What are the best savings strategies your customers should know about?

Banks can leverage emerging technologies, personalised solutions, and behavioural insights to enhance savings outcomes for their customers.

Here are our top savings strategies to help your customers save better.

1. Personalised savings goals and insights

Banks can launch intelligent features that help customers break down large, often intimidating savings plans, such as emergency funds, home purchases, or retirement, into manageable, time-bound steps.

AI algorithms analyse historical income, spending patterns, and cash flow to set realistic monthly saving targets, ensuring customers save what they can comfortably afford without risking financial stress.

Banks’ mobile apps and online platforms provide customers with real-time savings progress updates alongside dynamic advice.

If a customer deviates from their savings plan due to unexpected expenses or changes in income, the AI adjusts recommendations automatically.

As a result, your customer can get back on track without delay. This flexibility boosts a proactive savings culture and continuous engagement.

How can you deliver relevant and timely insights with Meniga?

Leveraging the full power of transaction data, our AI-powered Insights enables your customers to receive personalised insights and recommendations that help them:

-

Save more effectively,

-

Optimise spending, and

-

Reduce unnecessary fees.

2. Automated and smart savings programmes

AI integrations allow banks to add automated savings to their banks such as:

The savings tools help customers save more effortlessly and consistently by reducing the friction involved in manual saving processes.

What are the key features of automated savings solutions?

1. Round-up transactions and micro-savings

Many banks offer round-up programs where everyday purchases are rounded up to the nearest dollar, and the spare change is automatically transferred to savings accounts.

This painless micro-saving strategy accumulates meaningful savings over time without impacting customers’ day-to-day cash flow.

Thus, it encourages habitual saving more naturally.

A quick tip:

Pair this with scheduled micro-deposits, such as $5 every time they buy coffee, and you create a seamless, habit-forming experience that keeps funds within your institution.

With Meniga’s Smart Savings feature, you can turn transactional data into actionable insights and automate savings with flexible, gamified rules:

-

Every purchase a customer makes is rounded up to the nearest euro (or other currency), and the spare change is automatically transferred to their savings.

-

Our Savings engine can automatically allocate a user-defined percentage of incoming income, such as salary or refunds, transferring those amounts into savings accounts.

-

Customers can choose to "tax" specific spending categories automatically. For instance, a small percentage can be set aside from ‘guilty pleasure’ spending categories, such as dining out or entertainment, converting impulse spending into savings.

2. Scheduled and flexible transfers

Customers can schedule fixed-amount transfers from checking to savings accounts on a recurring basis, for example, weekly or monthly.

Let’s say a customer sets up a recurring transfer of $300 from their checking to their savings account each month.

One month, an unexpected expense arises, leaving them short on cash.

Thanks to your bank’s flexible transfer feature, customers can adjust the transfer amount or pause it entirely, and then resume the regular amount the following month.

This approach allows the customer to maintain consistent savings without risking overdrafts, effectively turning saving into an automated, manageable habit.

Meniga’s solutions enable customers to set automated savings transfers on a regular schedule, weekly, monthly, or any chosen interval, making saving habitual and predictable.

3. Integration with high-yield savings products

Banks package automated savings programs with high-yield savings accounts (HYSA), with some banks even offering Annual Percentage Yields (APYs) of 5.00%.

It is in sharp contrast to regular savings accounts that may offer APYs around 0.1% to 1%.

As a result, HYSA significantly improves the return on saved funds compared to standard accounts.

For example, saving $1,000 in an account with a 0.5% APY yields only $5 in interest after one year, but in an account with a 5.0% APY, it would yield $50.

In addition, if you encourage customers to save regularly by automating transfers or rounding up purchases and directing those funds into these high-yield accounts, your customers can gain more returns passively without changing their spending or saving habits.

Also, automating the saving process, combined with attractive interest rates, makes saving more rewarding and less of a chore, motivating customers to keep building their savings.

Naturally, there are benefits for banks, too. Offering automated savings linked with high rates helps you attract and retain customers seeking better growth on their savings.

4. Enhanced customer experience and trust

Your banking app should combine simplicity, transparency, and intelligent safeguards to make saving effortless, engaging, and secure for customers.

What does that actually imply?

-

User-friendly interfaces that allow customers to easily set up, customise, and manage automated savings plans. Clear menus, step-by-step prompts, and visual progress enable customers to quickly see how much they’ve saved, how close they are to their goals, and adjust saving preferences with minimal effort.

-

Overdraft alerts and overdraft prevention algorithms analyse customers’ account balances and spending patterns in real time to prevent automated savings from causing overdrafts or fees. These safeguards pause or reduce scheduled transfers when the system detects low funds, protecting customers from unintended financial harm.

-

Clear notifications and reports provide timely, personalised notifications that keep customers informed and motivated. For example, customers receive instant alerts when a savings transfer occurs, monthly reports of total savings and earned interest, and reminders to review or boost savings goals. These communications build confidence and reinforce positive habits by showing tangible results.

Banks that prioritise seamless user experiences and transparent communication in automated savings apps see:

-

Higher customer retention,

-

Increased savings rates, and

-

Stronger brand loyalty.

The reason is simple.

Customers feel empowered to save more, knowing the system protects their financial well-being and provides ongoing motivation through accessible insights.

3. Gamification and behavioural nudges for increased motivation

Even in the traditionally structured banking environment, people are drawn to play.

And banks are leveraging this instinct.

By incorporating gamification and behavioural nudges into digital platforms, they make saving more engaging and rewarding.

As a result, it encourages positive financial habits while turning routine financial management into an experience customers actually enjoy.

What was once a purely transactional task has evolved into an engaging experience, fostering lasting savings habits and strengthening customer loyalty.

Here are some suggestions that can make saving and managing money more enjoyable and motivating:

-

Progress bars and visual goal trackers: Interactive progress bars visually represent how close customers are to reaching savings targets. For example, you can enable customers to watch their savings ‘fill up’ a virtual pot or a jar.

-

Leaderboards and points: Some banks use points and leaderboard systems where users earn points through transactions or savings and compete with friends or others. Competitive elements can drive increased app usage and encourage smarter money management.

-

Financial challenges and missions: You can create missions or challenges, such as saving a certain amount within a period, with rewards like cashback or discounts. You can also introduce Duolingo-style streaks, which keep customers motivated to add to their savings consistently each month.

-

Rewards and cashback programmes: Customers can unlock rewards or cashback incentives by engaging regularly with banking products, reinforcing positive financial behaviours with tangible benefits.

How can behavioural nudges moderate spending?

Small, strategic nudges can subtly guide customers to make smarter spending decisions, helping them stay on track with their financial goals.

For example, your banking app can:

-

Prompt customers to pause and reconsider before making discretionary purchases, reducing impulsive spending. This ‘cooldown’ builds thoughtful money management habits over time.

-

Use timely nudges to remind customers about savings goals, upcoming bills, or opportunities to save more.

Real-world impact: How Meniga helped UOB create an engaging customer experience through gamification

UOB recognised that gamification is particularly effective in appealing to younger demographics, creating an app experience that promotes engagement and financial literacy. Customers could level up and build a virtual city that grows as their savings increase. The app includes payment reminders and alerts, and notifications, among other useful features.

4. Integration of budgeting and expense tracking tools

Integrating advanced budgeting and expense tracking tools into banks' online and mobile platforms helps customers better manage their finances and save more effectively.

You can provide tools that automatically categorise transactions into various spending categories such as groceries, utilities, entertainment, and dining out.

Visual dashboards help customers understand where their money goes through clear charts and graphs, making it easier to spot overspending or identify savings opportunities.

Meniga’s Enrichment categorises all expense and income transactions and displays clean and accurate merchant names and logos for an accurate overview and improved search and visibility.

What are the additional benefits of budgeting and tracking tools?

Banking apps now act like proactive financial assistants, alerting customers in real time about upcoming bills, low balances, and subscription renewals.

These automated reminders prompt customers to review and cancel unused subscriptions, which is a common drain on finances, and encourage timely payments that protect credit scores.

Modern budgeting features leverage AI to create dynamic budgets that adjust based on actual spending, income variability, and upcoming financial obligations, such as holidays or large purchases.

As a result, budgets stay realistic, personalised, and help customers avoid overspending while maximising savings potential.

Since many customers have multiple bank accounts, credit cards, and investment accounts, it’s great to consolidate this data, offering a holistic financial overview.

Not only does this enable smarter expense tracking and realistic budgeting, but it also reflects the full financial picture, all within a single platform.

Worth knowing:

Meniga consolidates data from multiple sources, including Open Banking data and any kind of cards and accounts, providing your customers with a 360-degree overview of their finances.

As a result, they can better understand and manage their finances.

Also, customers can automate savings from external accounts, making it easy to transfer and grow their money no matter where they bank.

For banks, use of external data means that they can spot when customers earn lower interest rates or hold competing products elsewhere and can proactively offer better rates or incentives to switch.

5. Allow emergency fund builder

Emergency fund builder features help customers build financial resilience and security against unexpected life events.

At the same time, they make saving for emergencies simpler, more structured, and more motivating.

Enable your customers to create separate ‘pots’ or sub-accounts specifically for emergency savings.

This separation makes the fund less accessible for everyday spending, reducing temptation to use it prematurely.

It also provides clear visibility, and customers can monitor their emergency savings balance distinct from other savings or checking accounts.

Did you know that with Meniga’s solutions, customers can create specific savings goals and dedicated “pots” to save toward particular targets such as an emergency fund, vacation, or big purchase?

When customers can track progress visually, it makes it easier for them to stay committed.

What are other helpful emergency fund builder strategies?

1. Banks can enable emergency fund accounts with restricted withdrawal capabilities, ensuring the money is reserved strictly for true emergencies.

This feature acts as a subtle form of self-discipline, helping customers resist the temptation to use the funds for everyday expenses and safeguarding the integrity of their emergency savings.

2. Remember personalised goals and dynamic tracking we mentioned earlier?

Your customers can apply those for the emergency fund builder.

They can set personalised targets based on their individual expenses and income stability and have access to dynamic progress tracking tools to visually display how close they are to reaching their emergency fund goals.

3. Also, the already-mentioned round-up systems can work great for emergency funds. Instead of transferring spare money to a high-yield account, customers can transfer spare change into the emergency fund.

Worth knowing:

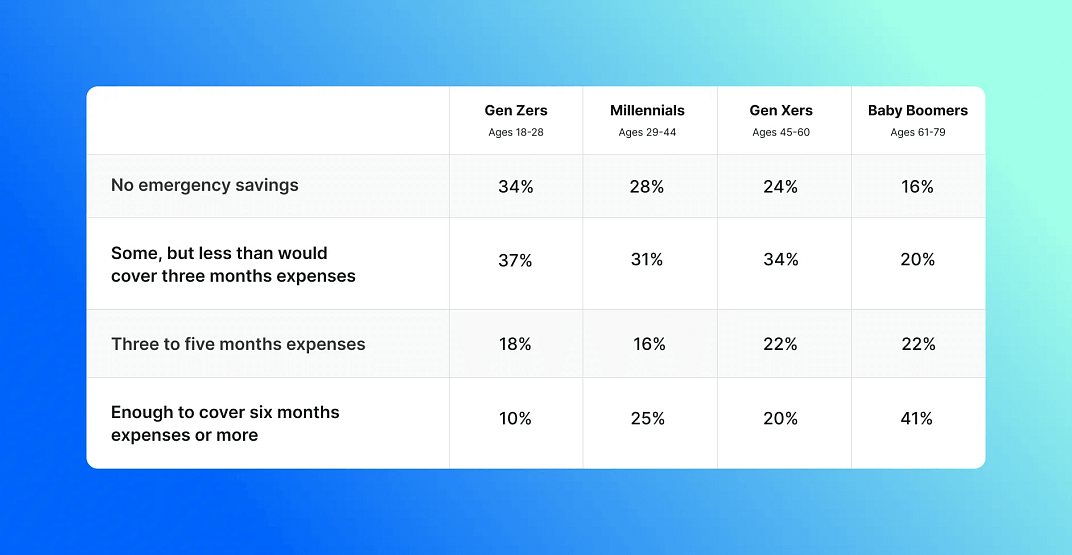

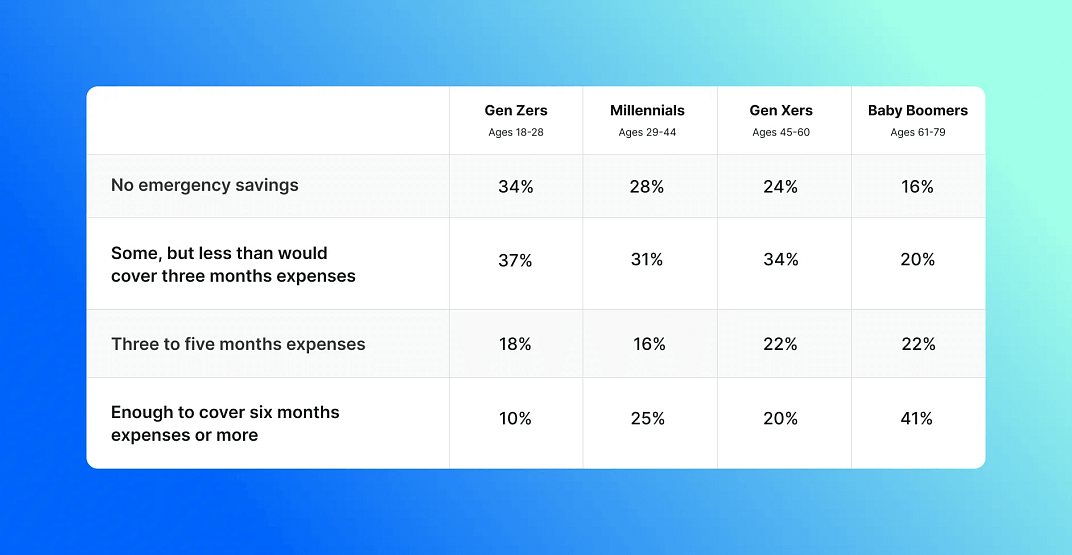

If you look at the following statistics regarding emergency savings levels in the USA, it is obvious that providing customers with structured financial tools can give your bank a great competitive edge.

Source: Bankrate Emergency Savings Survey, May 16-19, 2025

6. Offer cross-product incentives and bundling

By offering holistic financial solutions that combine savings, loans, credit cards, and investment accounts, banks can tailor their products more and deepen customer relationships.

How does bundling work in banks?

Banks create tailored product packages centred around a core account, often a checking or current account, alongside complementary products such as:

-

Savings accounts,

-

Credit cards,

-

Personal loans,

-

Mortgages, and

-

Investment options.

What are incentives that work?

Banks often offer bundles at discounted fees, reduced interest rates, or with exclusive benefits to incentivise customers to adopt multiple products within the same bank.

-

Reduced fees and better rates: Customers bundling a savings account with a credit card or mortgage often receive reduced fees, preferential interest rates on loans, or higher APYs on deposits. For example, a mortgage bundled with a savings account may include a discounted mortgage rate or cashback rewards.

-

Single application process: Bundling streamlines the onboarding experience, allowing customers to apply for several products simultaneously with minimal paperwork, encouraging higher adoption rates.

-

Personalised bundles: Banks leverage customer data and behaviour analytics to offer personalised bundles that address individual needs, increasing relevance. For instance, an employed customer might be offered a package including a salary deposit account, a credit card, and a small emergency loan.

-

Exclusive product access: Some bundles unlock premium services or loyalty programmes, such as priority customer service, waived ATM fees, and similar offers.

Besides obvious perks for customers, banks also benefit greatly from cross-selling and bundling.

-

Customers engaged with multiple products tend to remain loyal and are less likely to switch banks.

-

Bundling encourages cross-selling and upselling, boosting fees and interest income while building a comprehensive financial profile for targeted marketing.

-

Handling bundled services together reduces operational costs and simplifies relationship management.

7. Financially educate and support your customers

Banks should and must be a place of ultimate trust. And that trust goes beyond transparent money handling.

You should be a trusted advisor, providing your customers with resources to improve their financial habits and access tailored, relevant products, guides or checklists that can be used for their invoices or transfers.

You could deliver content in bite-sized, multimedia formats, such as videos, infographics, or articles embedded within banking apps or websites.

Focus on key financial topics:

-

Saving techniques, including automated savings, emergency fund building, and optimised budgeting.

-

Debt management strategies, such as prioritising repayments, understanding credit scores, and avoiding high-interest loans.

-

Investment basics covering diversification, risk tolerance, and retirement planning.

Meniga’s Cashflow Forecasting module helps customers understand their disposable income at any time and advises on whether they are safe-to-save or free-to-spend. Customers also have an easy-to-understand overview of upcoming transactions and current balance.

In what practical ways can you boost financial literacy?

Here are some practical ways that can help your customers manage their finances better, and thereby boost savings.

-

Leverage AI-driven virtual advisors that analyse each customer’s financial data to provide tailored advice aligned with their unique goals and situations.

-

These virtual coaches answer questions, suggest personalised action plans, and adapt guidance as circumstances evolve.

-

Incorporate gamification, quizzes, and simulation tests to make financial learning more engaging. For example, customers can test and simulate investment choices or budgeting plans and see how they affect future savings or debt without any real-world risk.

-

Apply multi-channel strategies combining digital platforms with live webinars, chat support, and text messaging. As a result, this broad approach ensures financial education is accessible regardless of customer tech proficiency, age, or location.

For example, one of our clients, Crédito Agrícola, used our solutions to boost engagement and better financial planning through personalised messages, such as insights, advice, fun facts, targeted rewards and product recommendations.

Backed with budget and financial planning tools, Crédito Agrícola’s app moey! provided a more relevant and immersive experience for their clients.