2020 is finally (almost) over, and I daresay few people will miss it. We are all hopeful that vaccines will be available soon to people worldwide to alleviate the health crisis. It takes a long time to recover from a global emergency such as the Covid 19 pandemic, and banks will play an essential role in that recovery.

Planning digital banking development is not easy

If you are a digital leader in a financial institution, you are probably doing the difficult job of planning for 2021 and beyond. Uncertainties abound. How long will it take to manufacture, distribute, and deliver the vaccine to people? How long will it take for the economy to recover, and what shape will that recovery take?

Put the users first when planning banking app innovation

There is, however, a reasonable certainty in what people now need and want from their banks and banking apps. There are many more people using banking apps due to the pandemic. Many people also have to adjust to the challenging economic situation. The Covid 19 pandemic has not only upended our financial world, it also seems to have brought home the need for collective climate awareness and action.

User-friendly banking apps

The pandemic supercharged the adoption of banking apps, so banks have many new users. These unprecedented user numbers mean banks can gain more return on their investment in banking apps. However, consider that new users need their apps to be simple to use. Ensure that your banking apps are user-friendly, even for beginners. The reward is more loyal users and a better return on investment for your banking app development costs.

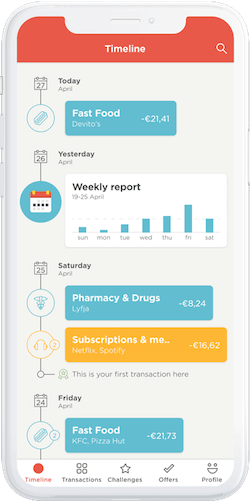

Easy to understand financial information

Financial illiteracy is common. Limited understanding of finances is a severe handicap for people in tough economic times. Therefore, make sure your banking app delivers financial information in a way that people with limited financial literacy will understand. Consider how you show the composition of spending. Deliver bite-sized reports. Test how you will inspire people to act upon the information to improve their finances. Your bank will gain a financially healthier user base.

Help people stay on top of their finances

It can be hard for people to keep up with bills and recurring payments. Help people to avoid overspending by automatically warning them when your bank detects that they are heading into overdraft. Your customers will thank you for it, and your customer loyalty KPIs will go up.

Show all finances in one place

In 2020, open banking has gone from being a compliance issue to being a business opportunity for innovative banks. Consider that your app can be the banking app of choice when it becomes a one-stop-shop for all things financial. I just logged on to a banking app that I rarely use, and it now has a view of all my bank accounts, credit cards, and pension funds. My regular bank's app now gives me less information than its rival. Should I perhaps switch to this new app?

New ways to save

Most of us need to save more. The challenging part is to get people started and inspire them to continue saving. Does your bank provide smart ways to get people going with saving? For example, does your bank offer your customers a way to round up their spending, so their savings account grows a little each time they purchase something?

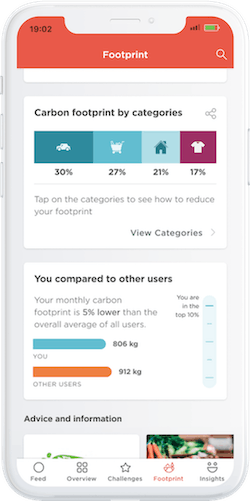

Empower people to act on climate change

Finally, climate change is the massive challenge that awaits us all when the Covid 19 pandemic has passed. In spite of the Covid 19 pandemic, climate anxiety around the world persists. Banks can show their banking app users an estimation of their carbon footprint based on their private consumption and enable them to act. Inspiring people to reduce their carbon footprint will not only reduce their climate anxiety, but it will also inspire them to save money on conspicuous consumption. It can position your bank as an environmental leader and engage your customers with your environmental or Corporate and Social Responsibility (CSR) initiatives in new ways.

Happy new year!

Thank you for reading. I hope that this article has been helpful in your planning for digital banking innovation at the start of a new year. Have a great 2021!

Get more inspiration for developing user-friendly banking apps

Download our free insight papers for banks or check out our digital banking products and services.