Open Banking and Embedded Finance are rewriting the rules of financial services by meeting customers where they already are: booking holidays online, browsing a shopping app, and more.

However, many banks still treat these trends as optional add-ons rather than strategic imperatives.

At the same time, fintechs and non-financial brands are already stepping in, building seamless financial experiences and stealing the spotlight, along with the customer relationships that come with it.

Nonetheless, banks can still hold the trust, infrastructure, and regulatory know-how that power the entire ecosystem if they understand how these two models differ, where they overlap, and how to use them to their advantage.

Read on to learn more about Open Banking vs. embedded finance so you can understand how to use them as complementary tools to expand your reach and reinvent customer experiences.

What is embedded finance: Overview and how it works

Embedded finance is the integration of financial services, such as payments, lending, insurance, and investments, directly into non-financial platforms and applications.

Instead of redirecting customers to a bank or separate financial institution, these services are built into the platforms customers already use.

As a result, they can complete transactions without ever leaving the platforms.

At the heart of this model are APIs, which connect non-financial companies to banks and licensed financial services.

These connections enable rapid data exchange and real-time service delivery, making financial transactions smoother, faster, and more intuitive.

What are the main benefits of embedded finance?

The rapid rise of embedded finance is being driven by companies’ desire to

By embedding financial products directly into customer journeys, businesses can offer more value and convenience, transforming everyday interactions into meaningful financial touchpoints.

Examples are already all around us:

-

Buy Now, Pay Later (BNPL) options that appear at checkout on eCommerce sites.

-

Ride-hailing apps that offer instant payments or microloans to their drivers.

-

Retail platforms that integrate digital wallets or branded payment cards for seamless transactions.

For banks, embedded finance can open new revenue streams through transaction fees, interest, and commissions, while also enabling richer data insights for personalised offerings.

Additionally, this approach is also crucial to expanding financial access, particularly for underserved users who may lack traditional banking relationships.

What is Open Banking: Overview and how it works

Open Banking allows consumers and businesses to securely share their financial data with 3rd-party providers through standardised APIs, all with their explicit consent.

As a result, this approach opens up banking systems to a broader ecosystem of fintechs, apps, and service providers.

It also enables the development of new products and experiences built around the customer rather than the bank.

Open Banking is actually about data portability and connectivity.

It empowers customers to control who has access to their financial information and how it’s used.

Through secure API connections, 3rd parties can:

-

Retrieve account data,

-

Initiate payments,

-

Analyse spending patterns, or

-

Offer tailored financial products without customers needing to log into their bank’s platform directly.

What are the main benefits of Open Banking?

Open Banking began as a regulatory initiative, primarily in regions such as the UK and EU, under PSD2, to increase competition, innovation, and transparency in financial services.

However, it has grown beyond compliance and enabled banks to build smarter, more customer-centric solutions.

Examples of Open Banking include:

-

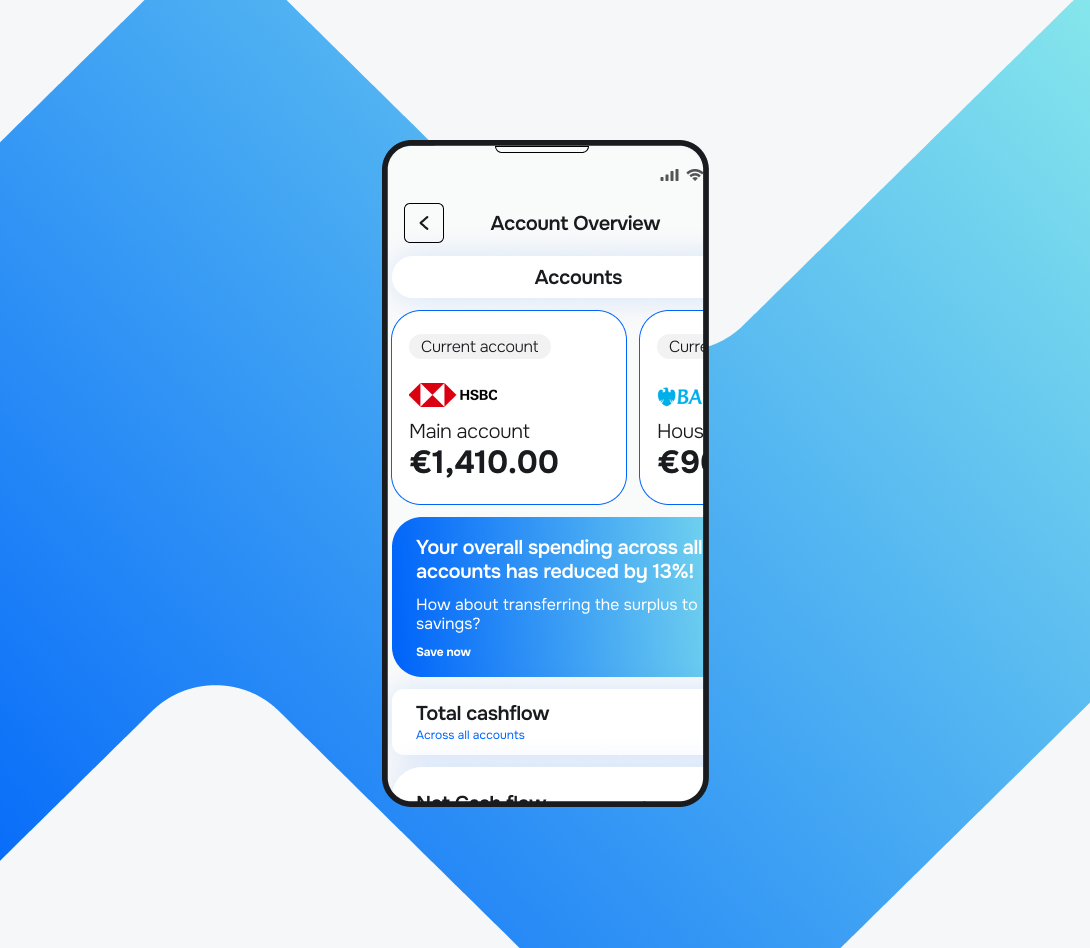

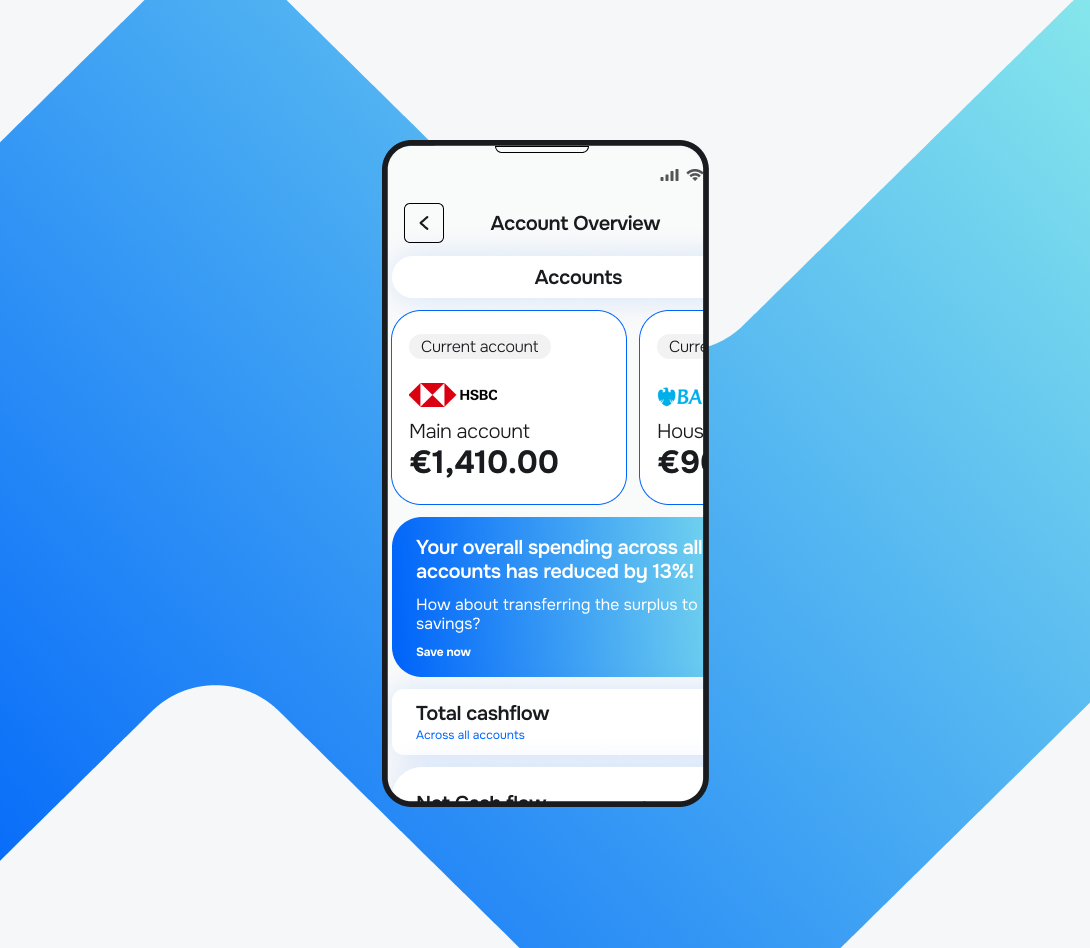

Account aggregation apps that give users a real-time view of multiple bank accounts in one place.

-

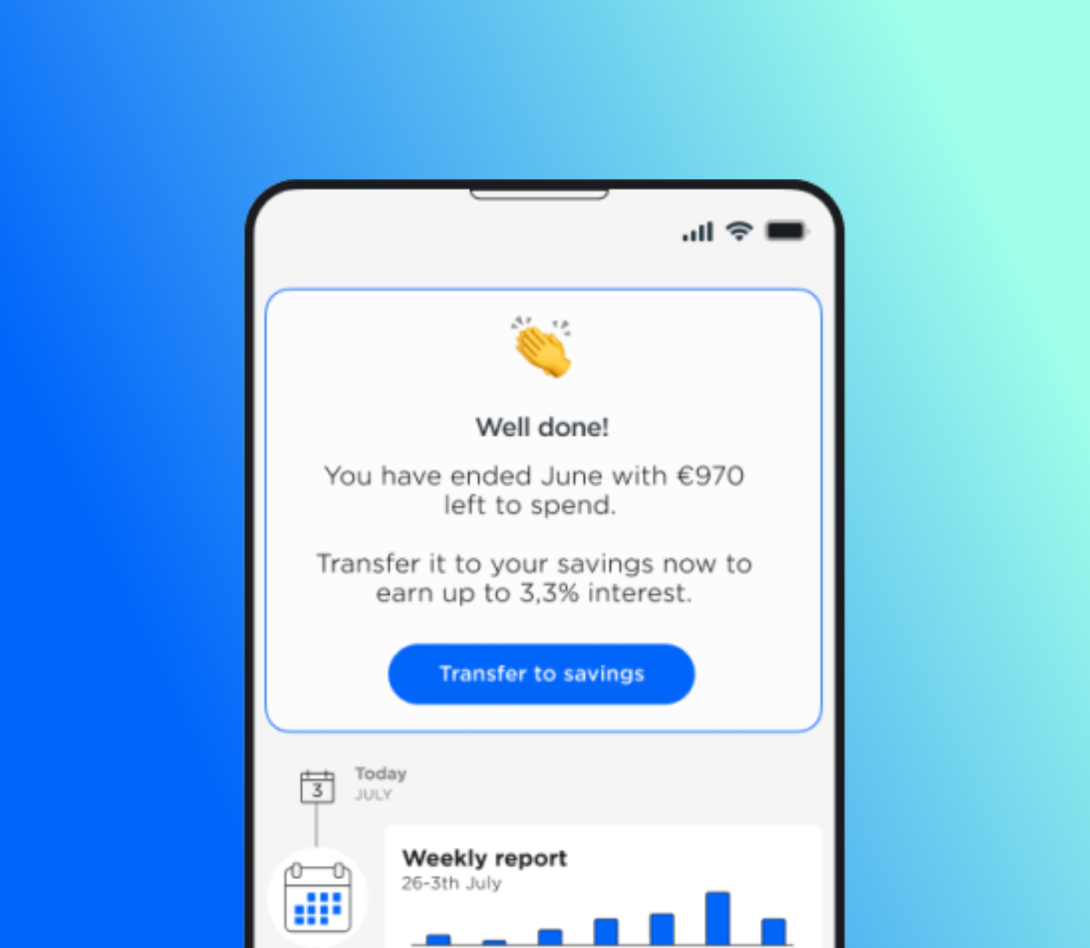

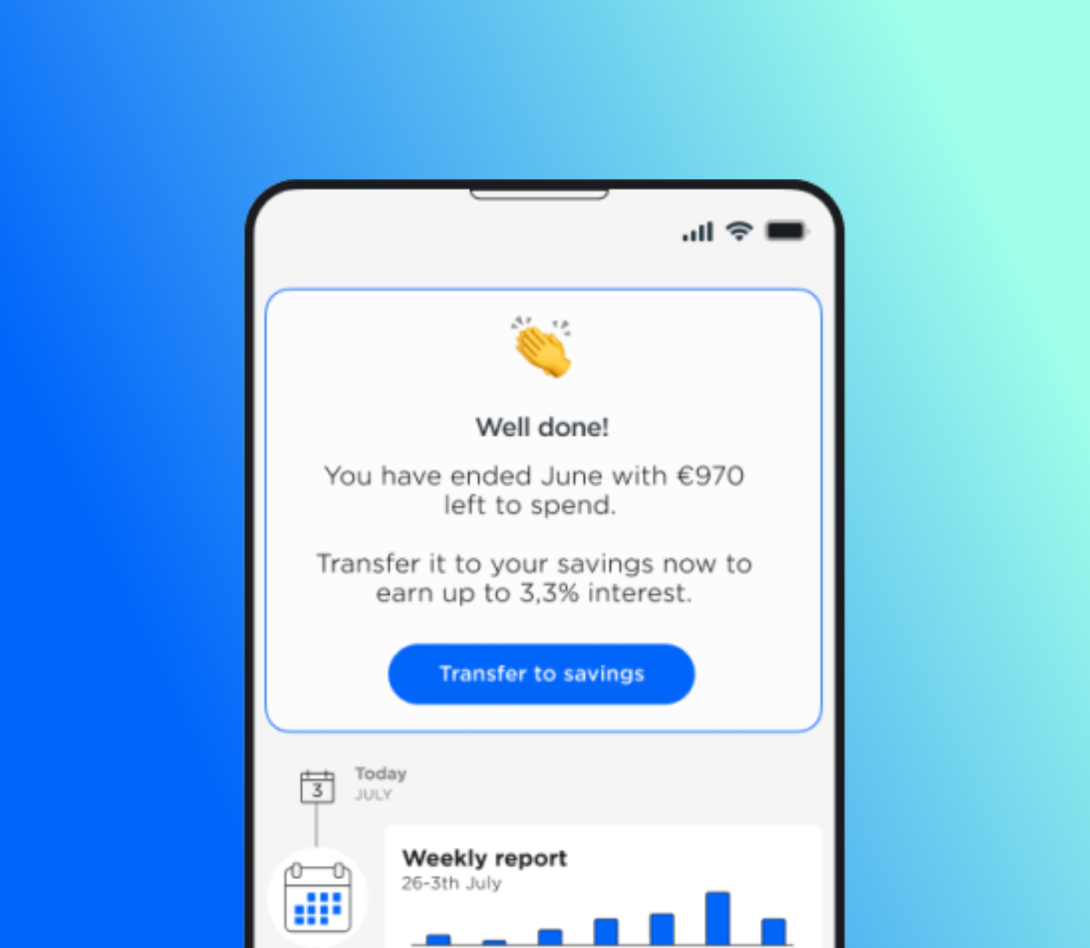

Budgeting and personal finance tools that analyse spending habits and offer personalised recommendations.

-

Payment initiation services that allow users to make secure, bank-to-bank payments directly from third-party platforms.

For banks, Open Banking represents both a challenge and an opportunity.

On one hand, it requires rethinking data sharing, security, and customer relationships.

On the other hand, it opens new revenue streams, partnership opportunities, and ways to deliver value beyond traditional banking channels.

Open Banking vs. embedded finance: How do they differ?

Although they may seem similar at first glance, Open Banking and Embedded Finance are distinct concepts.

They approach financial innovation from very different angles: one focused on data and connectivity, the other on experience and integration.

Understanding how they differ is a must if you want to benefit from their potential fully.

| Aspect | Open Banking | Embedded finance |

| Core function | Provides regulated access to customers' banking data via APIs for 3rd-party use with user consent. | Integrates full financial services (payments, lending, insurance) directly into non-financial platforms. |

| Business focus | Data sharing enables fintechs and banks to create personalised financial products and services. | Focuses on embedding financial services into everyday user journeys and platforms outside traditional finance. |

| Customer interaction | Customers know they’re using a bank-related service, even if it’s via a 3rd party. | Financial services operate in the background, often branded by the platform, not the bank. |

| Revenue model | Revenue mainly from API access fees, value-added data-driven services, and partnerships. | Earns revenue from transaction fees, interest, commissions, and licensing fees from embedded financial products. |

| Customer experience | Customers often switch between banking and third-party apps. Experience centred on data empowerment and control. | Provides seamless, in-app financial transactions without leaving the non-financial platform, reducing friction. |

| Regulation | Highly regulated under PSD2, for example, with strict data security, user consent, and privacy requirements. | The regulatory burden varies by service, including payments, lending, and insurance. Often partners with licensed financial institutions for compliance. |

| Technological integration | API gateway-centric, facilitating data interoperability and open ecosystems. | Deep integration into platform workflows. Financial features become part of the core service experience. |

| Market reach | Primarily targets existing banking customers looking for richer services and financial insights. | Retailers, SaaS platforms, marketplaces, and tech companies partnering with financial institutions. |

| Strategic use | Enables banks to innovate through expanded data use and participation in the fintech ecosystem. | Enables non-financial businesses to become financial service providers, driving new revenue and better customer retention. |

| Complementarity | Often complementary: Open Banking can provide the data foundation that embedded finance products use. | Enables embedding of comprehensive financial products, sometimes powered by Open Banking data and BaaS infrastructure. |

| Bank role | Data provider and regulated API gateway | Financial product provider and platform collaborator |

The two terms are complementary rather than competing.

Open Banking becomes far more impactful when combined with embedded finance strategies that extend its reach beyond the traditional banking ecosystem.

Open Banking vs. embedded finance: Risks and opportunities

Both Open Banking and embedded finance bring their own set of challenges that banks should be aware of to avoid risks while strategically benefiting from opportunities.

Risks: Navigating complexity and competition

Let’s take a look at the most common risks regarding open banking and embedded finance.

1. Disintermediation and loss of direct customer relationships

As financial services become embedded within 3rd-party platforms, customers increasingly engage with the platform’s brand rather than the bank’s.

Over time, this shift can weaken brand visibility and customer loyalty, reducing the bank’s role to that of a silent infrastructure provider operating in the background.

Without deliberate strategies to maintain relevance and visibility, banks risk becoming invisible utilities, necessary for the system but disconnected from the end user.

2. Regulatory and compliance challenges

Greater data sharing and integration lead to increased regulatory complexity.

Banks must ensure strict compliance with evolving standards, such as PSD3, data protection laws, and cross-border regulations, while maintaining robust cybersecurity and customer consent frameworks.

3. Intensifying competition from non-banks

Fintechs, big tech companies, and even retailers are increasingly offering financial services without banking licenses, often with greater agility and a more customer-centric design.

Meniga can help you create a neobank-grade customer experience with customer-centric products, based on data enrichment, AI-powered insights, and PMF tools.

In return, they enable you to create hyper-personalised and micro-targeted offers and products, at the exact time when customers need them most.

As a result, you can boost customer retention with engaging and habit-forming experiences.

4. Cultural and technological transformation

Successfully leveraging open banking and embedded finance requires more than new APIs.

It demands organisational change. Legacy systems, siloed structures, and traditional mindsets can all slow down transformation.

Therefore, you will need to invest in modern infrastructure and adopt new ways of working to capitalise on these opportunities.

Did you know that Meniga provides a flexible and scalable solution that enhances existing banking systems, enabling seamless integration with both legacy and modern infrastructures?

At the same time, our solution enables banks to deliver more efficient and adaptable financial services.

By adopting a modular, micro-services-based architecture, we facilitate the swift implementation of new features to meet evolving customer needs and market trends.

As a result, you can innovate rapidly, reduce operational costs, and deliver unique customer experiences through digital transformation.

Opportunities: Expanding reach and reinventing value

Banks that integrate flexible platforms and adopt embedded finance solutions can enhance operational efficiency while creating more value for their customers.

1. New revenue streams through APIs and partnerships

Open banking allows banks to monetise their infrastructure by exposing data and services through APIs.

By partnering with fintechs, retailers, and digital platforms, banks can generate new revenue from usage fees, revenue-sharing agreements, and value-added services that extend beyond traditional interest margins.

2. Reaching customers beyond the bank’s walls

Embedded finance opens doors to entirely new distribution channels.

Instead of waiting for customers to visit a branch or download a banking app, banks can meet them where they already spend their time: inside eCommerce platforms, SaaS tools, travel sites, and more.

As a result, it dramatically expands reach and relevance, even among demographics that traditional banking has struggled to serve.

3. Deeper customer insights and personalisation

By participating in an open and embedded ecosystem, banks gain access to richer, real-time data on customer behaviour and preferences.

This creates opportunities to deliver hyper-personalised products, smarter risk models, and predictive financial solutions that strengthen loyalty and increase lifetime value.

Meniga uses open banking APIs to deliver smooth, integrated embedded finance solutions, allowing banks to offer a wider range of financial services directly within 3rd-party applications.

Thus, you can create new opportunities for cross-selling and upselling.

Designed for flexibility, you can tailor our technology to match specific business rules and operational requirements.

Data is processed in real time, standardised, and made instantly available to the bank’s digital channels through Meniga’s RESTful API.

Open Banking vs. Embedded finance: Key takeaways and strategic recommendations for banks

To fully leverage the potential of open banking and embedded finance, banks must transition from theory to action, adopting clear strategies that position them for long-term growth and relevance.

1. Adopt a dual approach

Rather than choosing between open banking and embedded finance, banks should treat them as complementary tools.

Open banking provides the secure, regulated infrastructure for data and services, while embedded finance delivers seamless customer experiences across 3rd-party platforms.

Combining both allows you to extend your reach while maintaining trust and compliance.

2. Invest in APIs and developer ecosystems

Robust, well-documented APIs are the key to enabling 3rd-party integration and driving adoption.

Banks should create developer-friendly environments with clear guidelines, sandbox testing, and support to attract partners and fintech innovators.

A strong ecosystem increases both innovation potential and revenue opportunities.

3. Prioritise compliance and data governance

Expanding into 3rd-party ecosystems requires strict adherence to regulatory standards and strong data protection practices.

You should proactively manage risk, ensure real-time monitoring, and maintain transparency to build trust with both partners and end customers.

4. Focus on customer experience beyond the bank

Embedded finance succeeds when financial services feel natural and frictionless within the platforms customers already use.

Banks should invest in user-centred design, contextual offerings, and seamless journeys that integrate into everyday digital interactions, rather than expecting customers to come to them.

5. Collaborate strategically with partners

Partnerships with fintechs, marketplaces, and tech platforms can accelerate growth, extend reach, and improve service innovation.

Strategic collaboration, rather than seeing non-banks as competitors, allows you to tap into new audiences and co-create products that enhance loyalty and retention.

How can you open new revenue streams and prioritise customer experience with Meniga?

Meniga provides digital banking solutions that leverage data insights and engagement tools to enable banks and financial institutions to offer highly personalised, relevant products and services to their customers.

Here’s how we can help:

-

Get more value from existing products: Use behavioural and transaction data to increase engagement and usage of current banking products.

-

Accelerate digital conversions: Run micro-targeted campaigns that promote embedded financial solutions when customers are most receptive to them.

-

Increase loyalty through personalisation: Employ smart savings and data-driven insights to embed relevant banking products into customers’ everyday digital journeys.

-

Expand revenue potential: Hyper-personalise product offers to meet individual customer needs.

-

Drive savings engagement: Leverage gamification and personalised insights to increase deposits.

-

Outperform competitors: Provide all financial data in-app and create compelling offers that make your bank the primary choice.

Contact us today to learn how you can turn insights into hyper-personalised products that boost engagement.