Tink provides solutions to let you tap into financial data, but as the role of data continues to evolve, so do the opportunities to do more with it.

With rising customer expectations and evolving tech needs, you may want to rethink your data enrichment partners to get more value from every data point.

Whether you're after faster integration, better coverage, or smarter insights, our list of the best 9 Tink alternatives should help you find the solution that better matches your needs.

Let’s get started!

Top 9 Tink alternatives you should know about

Here’s a quick overview of our top picks.

| Alternative | Core focus | Best for/stellar feature | Ideal for |

| Meniga | Advanced Data Enrichment & categorisation, AI-powered insights, open banking with REST API, neobank-grade user experiences | Strong AI-driven personalised insights and categorisation | Banks and financial institutions that want to transform their online and mobile digital environments |

| Yapily | API for bank data access, and account ownership verification | Single API for Europe/UK, strong compliance focus | Businesses needing EU/UK reach |

| Bud | Financial data aggregation, income verification, categorisation | High UK bank coverage, real-time data, white-label API | Banks and fintech companies with a focus on data enrichment |

| Plaid | API access to a great number of US financial institutions, transaction data, account balances, and authentication | Broad US coverage and robust integrations | Fintechs needing US connectivity |

| TrueLayer | Transaction categorisation, data aggregation, real-time bank data access | Fast settlement, strong security, and compliance | eCommerce, fintechs, travel, digital wallets |

| Finexer | Data aggregation, KYC/KYB verification, API-first development, | Fully PSD2/PSD3 compliant, customisable | UK SMBs, payroll, invoicing, fintechs, enterprises |

| finAPI | Data enrichment/categorisation, account aggregation, digital identity/KYC, white-label APIs | Strong PSD2/BaFin compliance | Banks, fintechs, insurers, lenders, accounting, and eCommerce in DACH/EU |

| Finicity | Real-time account data aggregation, direct data access, pay-by-bank | Proven data quality, Mastercard backing | US banks, fintechs, lenders, wealth managers, and compliance-focused enterprises |

| Qwist | API management platform, Open Banking Suite, digital account/portfolio switch | Fast onboarding, API management platform | Banks, insurers, fintechs, eCommerce, and marketplaces in DACH/IBERIA/EU |

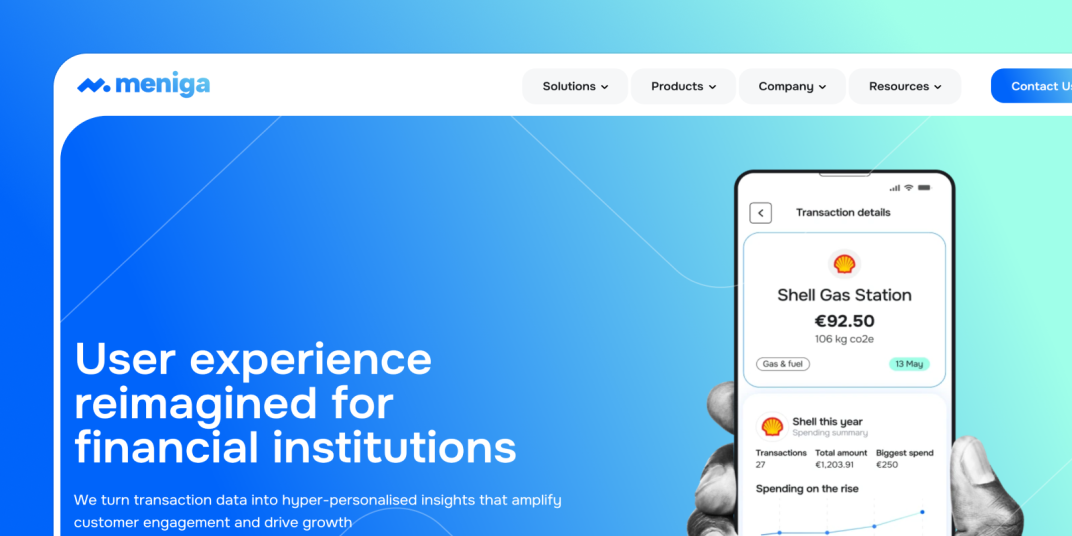

1. Meniga

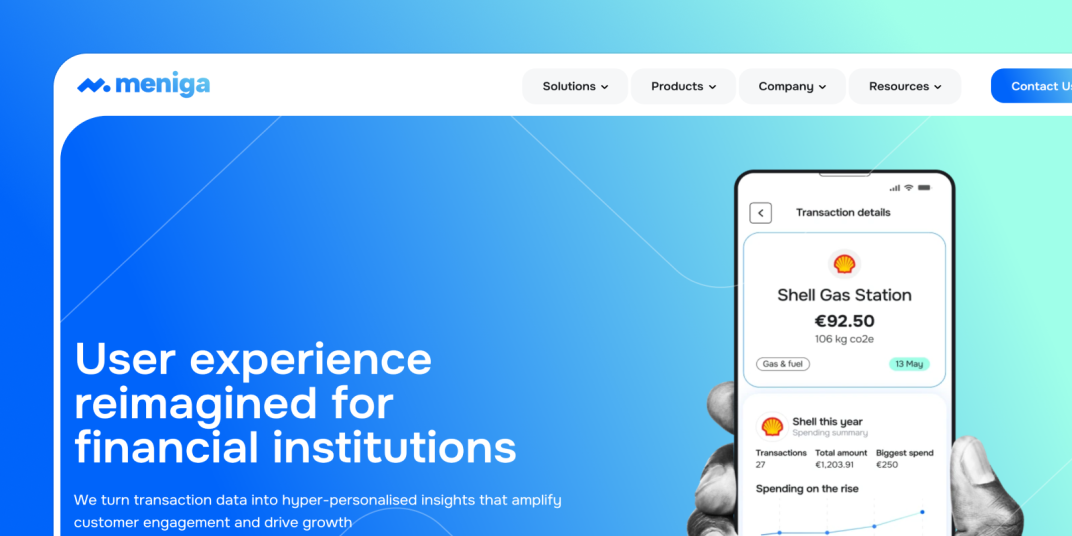

Meniga delivers powerful digital banking solutions that help large financial institutions modernise their online and mobile experiences with minimal upfront investment.

Our platform is flexible, scalable, and designed to integrate seamlessly with existing core systems, enabling you to upgrade your digital channels without overhauling your current infrastructure.

No matter the complexity of your tech stack, Meniga makes transformation fast, efficient, and future-ready.

Key features

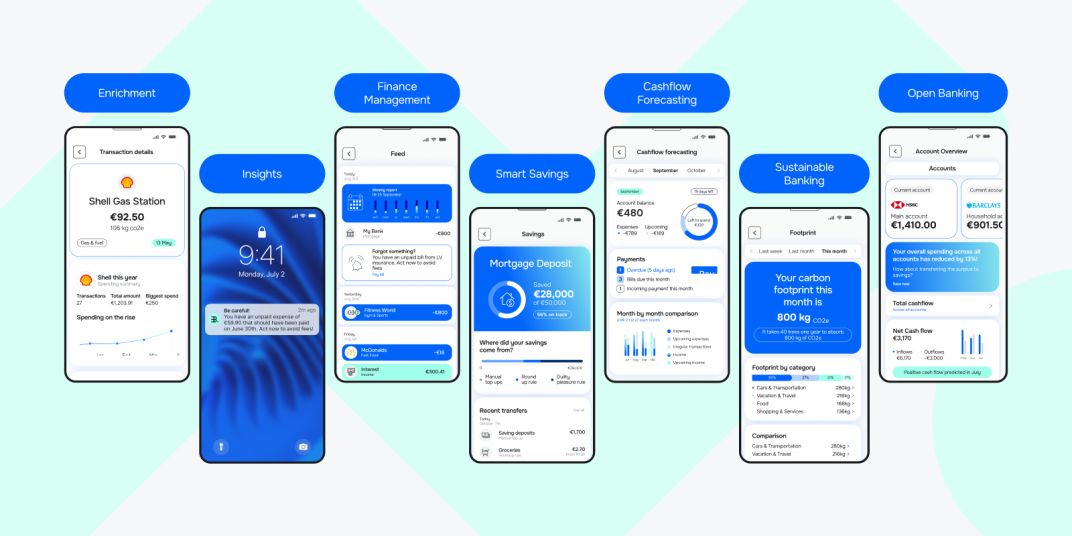

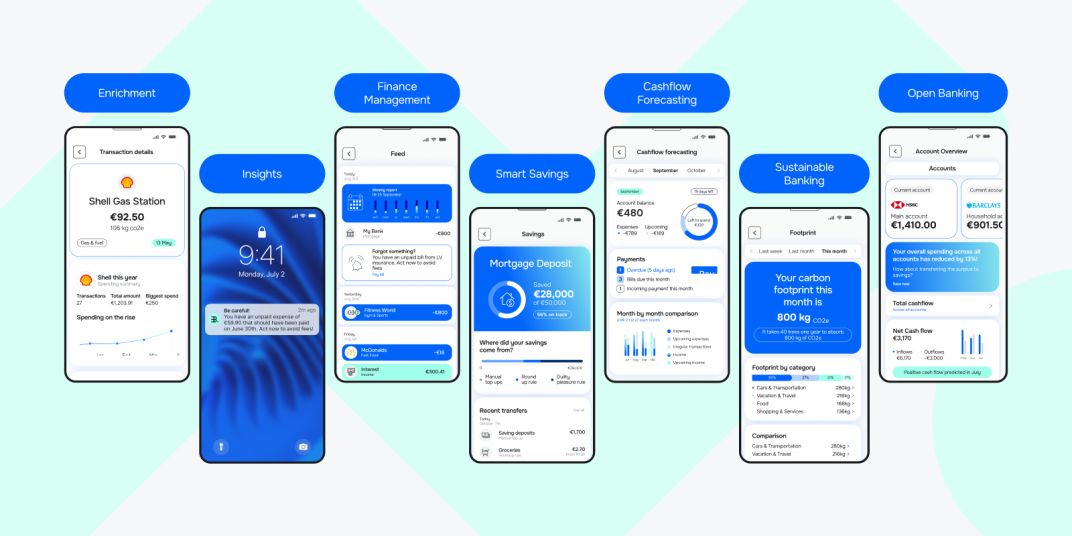

1. Data consolidation and enrichment

Our Enrichment Engine tackles the challenge of fragmented or delayed financial data by consolidating information from multiple sources, including open banking feeds, and enhancing it with contextual details like:

-

Merchant names,

-

Logos, and

-

Recurring payments.

It transforms raw transactions into structured, categorised data, giving banks a full view of customer spending behaviour.

This functionality enables more accurate insights, better segmentation, and the ability to deliver tailored financial products and experiences.

Moreover, Meniga helps you automatically categorise all income and expense transactions with high accuracy.

You can leverage your existing category structure or use Meniga’s own fully localised setup, depending on what works best for you.

And the best part? The system learns over time, from user behaviour and community input, so the more it’s used, the smarter and more accurate it gets.

2. Insights Platform

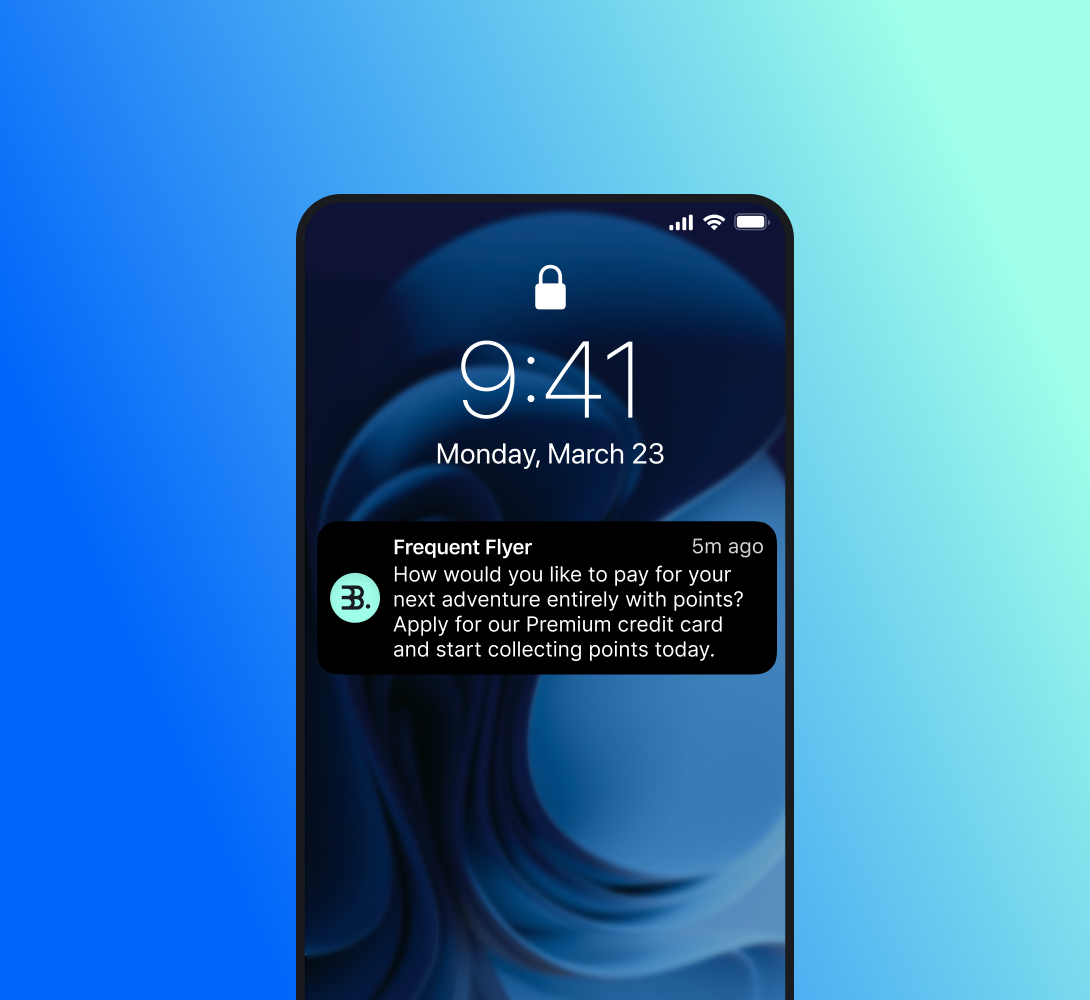

Our Insights platform helps you deliver real-time, hyper-personalised experiences that go beyond standard notifications.

Powered by AI, it enables contextual communication tailored to each individual, so customers get relevant messages instead of generic alerts.

With built-in micro-segmentation tools, you can analyse customer behaviour at a granular level and create targeted insights that drive:

3. Cashflow Forecasting module

The AI-powered Cashflow Forecasting gives your customers a clear view of their balance history and forecasts future cash flow, helping them manage their finances more effectively.

It highlights recurring income and expenses, providing valuable insights into spending patterns.

Plus, with proactive alerts, it helps customers avoid unnecessary overdraft fees and missed payments by sending timely warnings before issues arise.

Based on real-time liquidity and upcoming transactions, it also notifies your customers when their finances are at risk of running low, offering tailored advice on whether to save or spend to stay on track.

Meniga: key takeaways

Meniga offers solutions that:

-

Modernise legacy systems, driving digital transformation.

-

Bridge the gap between you and neobanks with out-of-the-box financial wellness modules for engaging digital experiences.

-

Deliver tailored, hyper-personalised products and solutions for your customers.

-

Support sustainable revenue growth through targeted digital sales, deposit growth, and more.

2. Yapily

Yapily is a European open banking platform that provides businesses with access to financial data and payment initiation services through a single API.

It operates in 19 countries and provides tools for digital banking so that you can offer personalised banking solutions.

Key features:

-

Data categorisation — Organise bank account transaction data derived from open banking in 20+ incoming and 70+ outgoing categories.

-

Data analysis — Automate the analysis of large volumes of valuable data to identify key trends and patterns.

-

Open banking data services — Use real-time transaction data to optimise your credit risk models, assess affordability and creditworthiness, personalise product offerings, etc.

-

Bank account validation — Allows you to confirm customer and account details instantly via KYC checks.

-

Recurrence detection — Identifies recurring transactions such as subscriptions, mortgages, or loan repayments.

3. Bud

Bud specialises in financial data enrichment and analytics, focusing on income verification and categorisation, primarily in the UK and US.

It also provides PMF tools and AI-powered transaction features.

Key features:

-

Data Enrichment — Transforms raw transaction data into accurate categories with merchant names, logos, and geolocations.

-

Intelligent Search feature — Enables your customers to ask questions about their spending, transaction locations, regularity, and habits. The system also provides proactive suggestions and smart keywords.

-

Cash flow underwriting — Helps you make informed lending decisions based on actual financial behaviours. It enables real-time employment and income verification.

-

Recurring payment analysis — Detects the frequency and variability of recurring payments and highlights missing or unusual transactions.

4. Plaid

Plaid is a data connectivity platform that powers the digital financial ecosystem for fintechs, banks, and enterprises.

Although it’s expanded its operations internationally, the platform primarily focuses on the US market and covers a vast majority of US banks.

Key features

-

The Plaid API — Allows fintech apps to access consumer-permissioned data, including account balances, transaction histories, and identity verification, all with user consent.

-

Transaction data capability— Enables you to retrieve up to two years of transaction data, including merchant and category information. It also informs you about new transactions via a webhook.

-

Assets feature — Provides a consolidated summary showing account balances, historical transactions, and account holder identity information for better credit assessment.

-

Modular link feature — Lets customers connect their financial accounts and customise elements of account connection flow by selecting from the prebuilt modules and SDKs.

5. TrueLayer

TrueLayer offers broad data services and combines enriched financial data and flexible recurring billing.

It provides businesses with access to financial data and payment initiation services across the UK and Europe.

Key features:

-

Data API add-on — Connects you to verified bank customer data, enabling you to provide personalised offers and recommendations, such as smart budgeting analysis, rewards for healthy spending habits, account aggregation, etc.

-

Verification add-on — Combines KYC and AML checks with cross-checking your customer’s name with the account holder to confirm the details are correct.

-

Verification add-on — Combines KYC and AML checks with cross-checking your customer’s name with the account holder to confirm the details are correct.

-

Pay by Bank — Enables customers to pay directly and instantly from their bank account via their bank app, reducing transaction fees.

-

Recurring payments — Based on Direct Debit and Variable Recurring Payment (VRP), the functionality allows customers to spread their payment into multiple instalments, fixed or variable.

6. Finexer

Finexer is a UK-based, FCA-authorised platform that simplifies and accelerates financial processes for SMBs.

It offers API-driven infrastructure that enables seamless access to real-time bank account data.

Key features:

-

Data aggregation — Enables access to accounts across multiple banks with a single access point through API for real-time data about customers, balance and transactions. It also allows you to categorise transactions and improve product suggestions and offers.

-

Dashboard — Helps you keep track of connected bank accounts, created consents, customers, payments, analytics, and reports.

-

Sign in via Bank — Allows you to verify customer identity online with information from banks and facial recognition tools, and extract data from documents or received from financial institutions to improve your credit scoring model.

-

Affordability checking — Via an authentication process, you gain access to relevant bank records to judge the customer’s affordability before offering credit.

7. finAPI

finAPI is a German open banking platform that provides API-driven solutions for account information, data enrichment, and digital identity services.

It caters to banks, fintechs, insurance companies, and enterprises across Europe.

Key features

-

Data Enrichment and categorisation — Provides automated categorisation of transactions, analytics-ready data for PFM, credit scoring, and risk assessment.

-

Open banking — Allows you to access financial data from multiple banks, accounts and deposits in real time to analyse payments and optimise transactions.

-

Digital identity and KYC — Enables digital identity verification and account ownership checks to streamline onboarding and compliance for banks, insurers, and fintechs.

-

Bank transfer API — Allows standard and scheduled bank transfers, instant payments, standing orders, collective transfers, or payments via payment link or QR code.

8. Finicity

Finicity is a Mastercard company that provides direct data access and payment solutions for financial institutions, fintechs, lenders, and enterprises.

It’s known for its commitment to compliance with evolving US open banking regulations, including CFPB Section 1033.

Key features:

-

Direct data access — Provides real-time access to account balances, transaction histories, and account details.

-

Data aggregation — The platform aggregates consumer-permissioned data from various financial institutions, supporting personal finance, lending, and wealth management applications.

-

PMF capability — Help customers improve their finances through monitoring, budgeting, analytics, etc.

-

Open banking — Enables seamless pay-by-bank and account-to-account payment services via Mastercard for US businesses and consumers, as an alternative to card-based payments.

-

Cash flow analytics — Provides insights into a borrower’s liquidity and revenue streams, credits, debits, and balances up to 24 months.

9. Qwist

Qwist is a European finance platform that operates in the DACH and Iberia regions.

It focuses on secure API management and regulatory compliance, embedded finance, digital lending, and advanced financial data analytics.

Key features:

-

Financial Transaction Data solution — Connects, harmonises and aggregates data for retail and business accounts from more financial sources in Germany, Austria, Portugal, and Spain.

-

Data Categorisation engine — Converts raw transaction data into actionable insights. It sorts data into around 21 main categories with multiple subcategories for retail use cases.

-

Risk Insights — Uses up-to-date information about applicants’ risk behaviour, income, and spending habits to improve risk decision-making.

-

API Management platform — Centralised, API gateway for exposing, managing, and securing financial APIs. It supports the full API lifecycle, including provisioning, publishing, access control, and monitoring.

-

dgtal SwitchKit Suite — A Digital account and portfolio transfer solution that enables end-users to switch accounts or portfolios between institutions.

Why should Meniga be your optimal Tink alternative?

While Tink is widely recognised for its extensive bank connectivity and data categorisation across Europe, Meniga’s strength lies in its deep focus on customer engagement and financial wellness tools.

As a result, our solution is particularly attractive for banks and fintechs looking to differentiate their digital banking apps with personalised experiences and value-added services.

Thus, with Meniga, you can:

-

Increase customer satisfaction and retention through highly personalised, value-added services.

-

Differentiate your digital offering by prioritising financial wellness and personalised engagement over generic features.

-

Comply without compromise and without sacrificing innovation or agility in your digital strategy.

-

Empower your customers and drive real engagement and loyalty.

-

Work with a trusted, experienced partner capable of handling large-scale deployments and integrations.

Ready to explore more?

Contact us today to discover how to turn financial data into a strategic asset.