As we exit yet another transformative year for many businesses, families, and individuals worldwide, I would like to take a moment, on behalf of everyone here at Meniga, to thank our partners, clients, and friends for their continued support, and I wish you all nothing but success and good fortune for 2022.

2021 has been a truly pivotal year for Meniga. Not only did we welcome new partners, secure additional funding, and launch innovative digital banking tools, this year we also significantly expanded our core product offering into the green banking space as more and more banks see the huge business opportunity in the green industrial revolution.

It has been a remarkable and eventful year for us and we are incredibly excited for 2022 to continue to help banks drive engagement, loyalty and revenue by promoting financial wellness. We have many exciting partnerships and new innovations in the pipeline, which we can’t wait to unveil and show you in the new year.

Before we embark on the next chapter of our journey, we would like to take you through some of the highlights and milestones of 2021, and what we have in store for the year ahead.

Digital engagement is more important than ever

At Meniga, our mission has always been to help people lead better and more sustainable financial lives - a mission that has never been more important and relevant given the sheer economic impact caused by the pandemic.

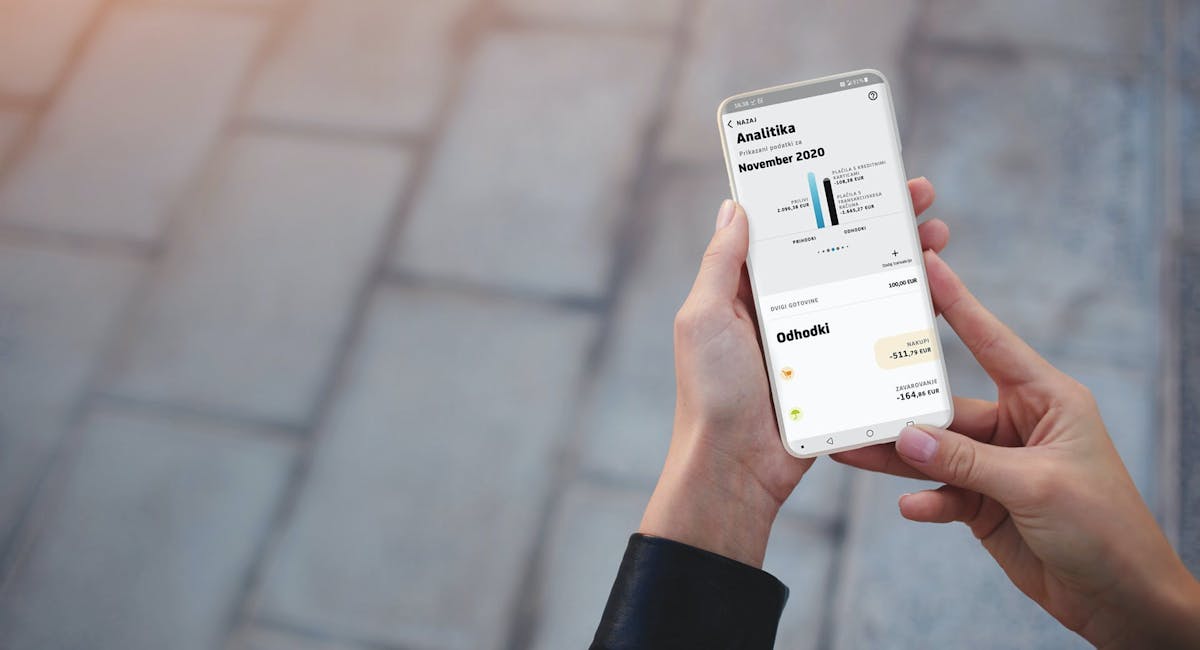

In 2021, we launched new digital banking solutions with two of our most trusted partner banks, UniCredit and Länsförsäkringar. We also introduced new innovations, such as our “Smart Money Rules'', a playful way to save and designed to motivate people to save more, and “Cashflow Assistant'', which helps users understand and manage their short-term cash flow. These new “smart assistants” have greatly enhanced our product suite, in providing our bank customers with more ways of creating long-lasting engagement with their digital banking users, while enhancing users’ financial wellness.

Meniga’s drive into the green banking space

Sustainability has always been a core part of Meniga’s culture and something we are extremely passionate about. We have an increasing responsibility to ensure that we are not only environmentally sound as a business, but that our products and services actively encourage banks and individuals worldwide to unite in the fight against climate change.

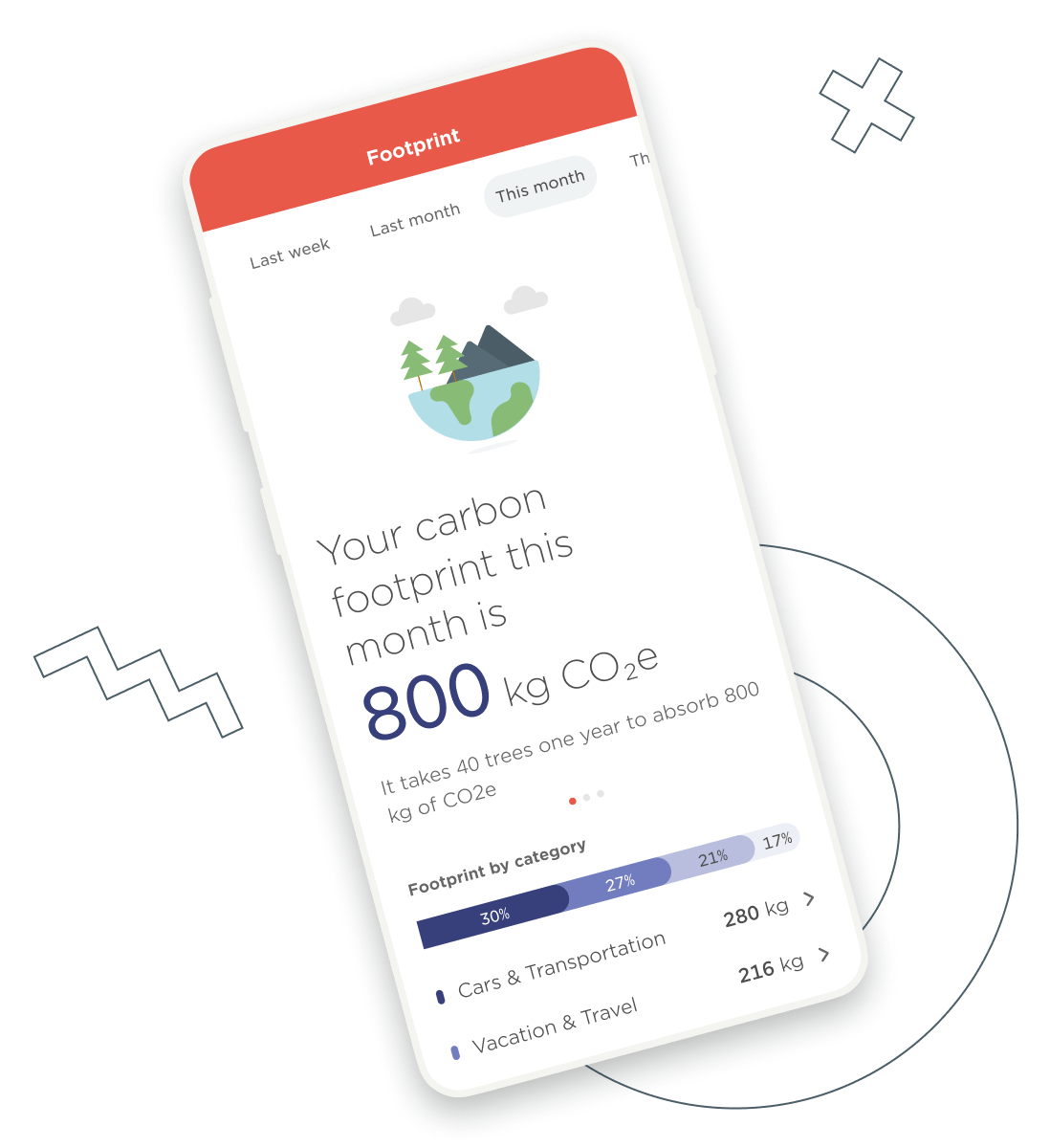

That is why Meniga has expanded its product portfolio to include green solutions for banks, namely our Carbon Insight product. Carbon Insight provides a user-friendly and engaging way for users to automatically estimate and track the carbon footprint that stems from their spending. The solution empowers users to reduce their carbon footprint by changing their lifestyle and/or offset their emissions.

We are really proud of the success Carbon Insight has achieved so far, having already launched the solution with Íslandsbanki in Iceland, and Crédito Agrícola in Portugal, and we are in the process of launching this product with many more banks in several other countries in the coming months. Earlier this year, we closed a €10m investment round, which allowed us to accelerate the development of our Carbon Insight solution and be at the forefront of a new generation of green banking products. We can’t be thankful enough to our investors, both existing and new. Their support and encouragement have been instrumental in the success and growth of our Carbon Insight solution.

As a testament to the reliability, transparency, and suitability of the solution for estimating the carbon value of banking transactions, we are also proud to share that Ernst & Young recently provided an assurance of the methodology underlying the Meniga Carbon Index, thus enhancing the credibility of our market-leading solution.

The future of green banking: A unique opportunity for banks

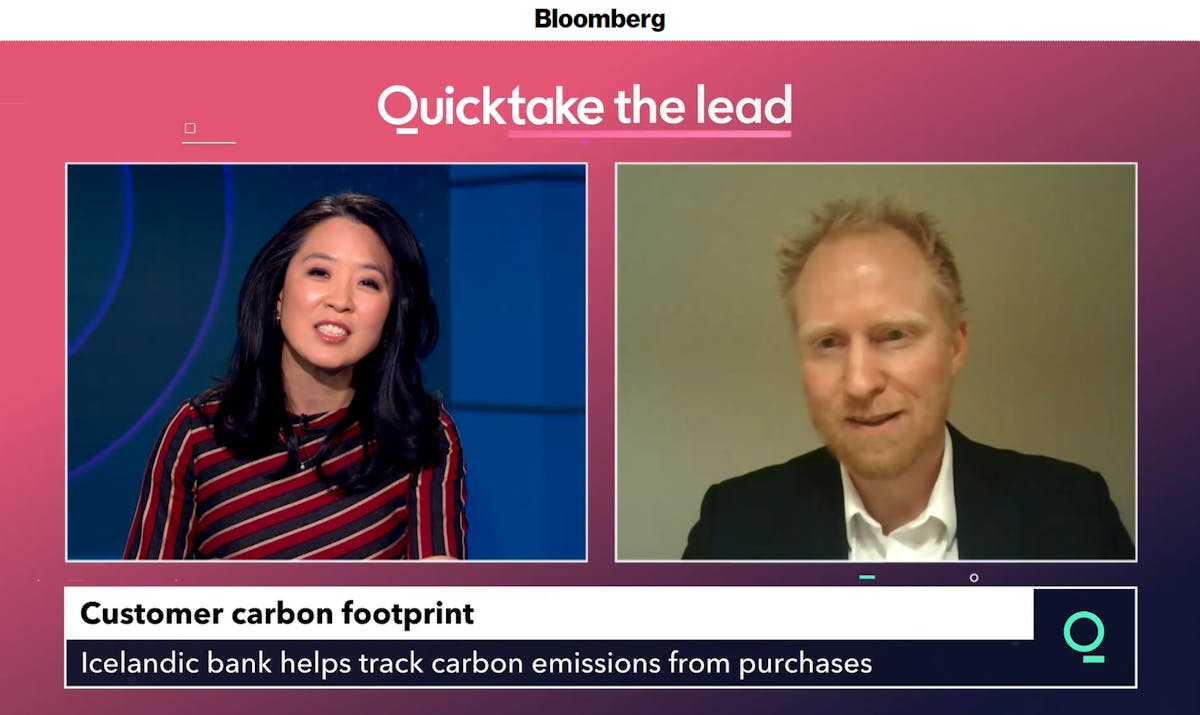

I had the pleasure of appearing on Bloomberg TV a few weeks ago while the world leaders met in Scotland for COP26, to discuss the role banks should play in the fight against climate change, our Carbon Insight product, and the unique opportunity such green banking solutions present to banks.

As people’s concern about climate change grows, more and more consumers are expecting the products and brands they consume to be green and eco-friendly, and rightly demand more of their banks on climate change. In fact, we recently commissioned a survey that revealed that 80% of consumers want to use their banking apps to help them estimate their carbon footprint.

Serving the needs of this rapidly growing consumer segment is not just the right thing to do - it is a business opportunity not to be missed. There is still a fundamental gap in the market in terms of tools that allow us to understand the impact that our consumption has on the environment. It’s not just a matter of bolstering your ESG strategy either. Filling this gap will prove pivotal in helping banks diversify their digital banking offering, drive user engagement and customer loyalty.

Next steps

Our priorities for next year will remain largely the same as this year, in continuing to support our customers, both existing and new, and provide the best possible tools and services for people to manage their finances.

We will continue to work hard to strengthen our position as the leading digital innovation partner for banks and continue to lead the way in engagement banking. We will continue to evolve our leading personal finance product suite with a major emphasis on green banking solutions. With the global appetite for sustainable products getting stronger every day, I believe we can achieve this on a much greater scale with our portfolio of green products.

Green banking has only just taken off, and we’re delighted that our Carbon Insight solution is already getting rave reviews. We recently won an award for Most Authentic ESG at the FF Awards, and with the strong interest from financial institutions worldwide that we’re currently seeing for the product, we’re confident that we and our partner banks can be at the forefront of the green banking movement in 2022 and beyond.

In the meantime, from everyone here at Meniga, we wish you and your families a very happy and relaxing time over the holidays.