Did you know that digital banking’s net interest income is projected to grow at a CAGR of 6.8% between 2025 and 2029, reaching $2.09 trillion by the end of the period?

Digital banking isn’t a side offering, it’s the core business. Customers expect speed, personalisation, and security by default.

Falling short on any of these is no longer just a UX issue, but a strategic liability, and for banks, keeping up isn’t about chasing trends but meeting a new baseline.

Let’s see which digital banking features matter this year, so your bank can build resilience, relevance, and long-term value.

Download our Insight Paper

Online banking vs. digital banking: What’s the real difference?

Online and digital banking are closely related, but they’re not exactly the same.

Online banking

Online banking refers specifically to accessing basic banking services through the internet, usually via a bank’s website or mobile app.

Core features:

-

Viewing account balances and transactions

-

Transferring money between accounts

-

Paying bills online

-

Downloading bank statements

-

Applying for basic banking products

You can think of it as a digital extension of a traditional bank.

Digital banking

On the other hand, digital banking is a broader, more comprehensive transformation.

It refers to fully digitised financial services, including the bank’s internal systems, customer interactions, and entire infrastructure.

Core features include everything in online banking, plus:

-

Opening accounts completely online

-

AI-powered financial insights and automation

-

Personalised financial planning tools

-

Virtual assistants and chatbots

-

Integrated fintech services like budgeting apps or investment tools

-

Paperless processes such as digital ID verification, e-signatures, etc.

It is an end-to-end digital experience, often powered by cloud computing, AI, and APIs.

Furthermore, digital banking can exist without any physical branches.

| Feature | Online Banking | Digital Banking |

| Access to basic services | Yes | Yes |

| Fully paperless processes | Often partially | Fully digital |

| AI and personalisation | Limited | Moderate to advanced insights |

| End-to-end account opening | May require in-person | 100% online |

| Use of mobile-first design | Sometimes | Always |

| Integration with other apps | Rare | Common with open banking |

So, all online banking is part of digital banking, but not all digital banking is limited to what online banking can do.

8 Digital banking features that you should know about in 2025

Let’s take a closer look at features you should pay attention to and why they matter so much.

1. AI-powered personal finance management

What used to be simple budgeting tools have evolved into intelligent financial ecosystems that learn from user behaviour and adapt in real time.

Today’s digital banking platforms use AI to do far more than track spending.

They analyse income patterns, transaction history, and even lifestyle choices to offer tailored financial advice.

Whether it’s forecasting customers’ cash flow for the month, spotting irregular spending, or recommending how to adjust their savings strategy, these systems help your customers make smarter decisions without needing to be financial experts.

Moreover, AI can scan recurring transactions to spot unused subscriptions, suggest lower-fee alternatives for services, or flag bank charges that might be avoidable.

For example, if the AI assistant notices that your customer’s:

-

Spending spikes in the last week of every month, it might proactively recommend shifting their bill payment schedule or increasing savings earlier in the month.

-

Income is variable, it can project lean periods and prompt them to set aside reserves during higher-earning weeks.

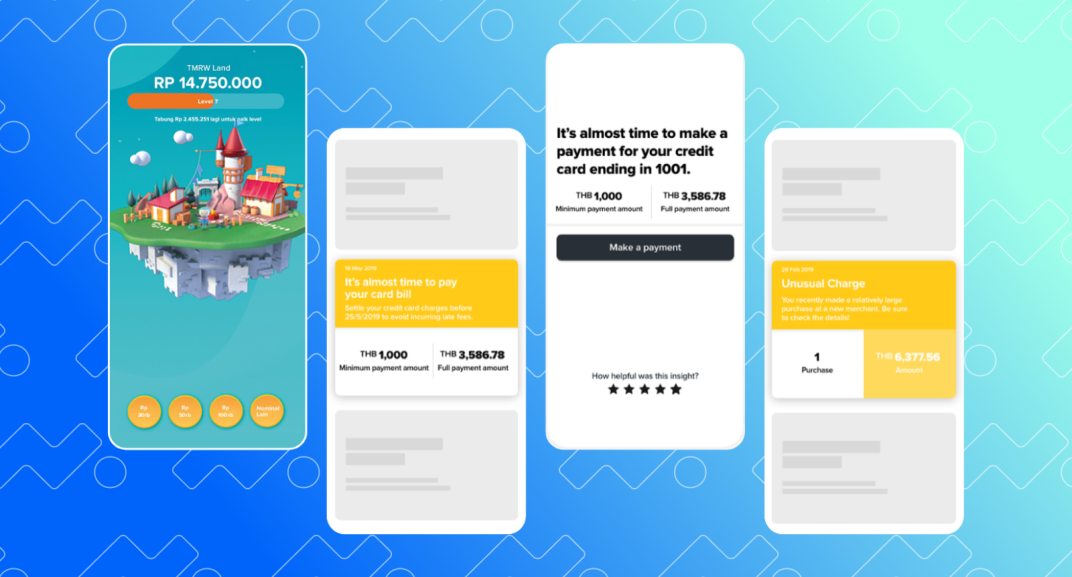

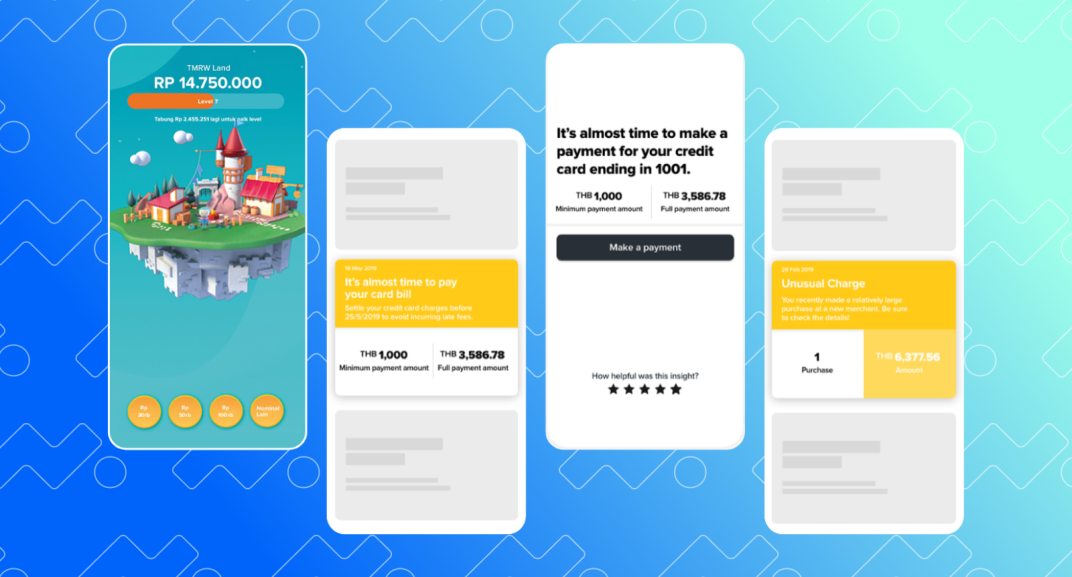

Did you know some banks even turn saving into a habit through gamification by rewarding users for hitting savings goals or staying within budget, helping change behaviour through small but consistent nudges?

That’s precisely what our client, UOB, a leading bank in ASEAN, did.

They enticed their millennial customers to save by enabling them to level up and build a virtual city that gets bigger as their savings increase.

It led to >40 NPS and a more than 60% increase in online financial transactions.

2. Hyper-personalisation through Big Data

Thanks to big data, banks can now deliver highly targeted, real-time experiences based on who you are, what you do, and when you do it.

But banks don’t just analyse transaction history. They are leveraging data from multiple sources:

-

Spending patterns,

-

Location data,

-

Search behaviour, even

-

Social signals.

This way, your bank can anticipate a customer’s needs and act at the right moment.

For example, suppose a customer is browsing real estate listings. Now imagine your app shows them pre-approved mortgage options or a calculator tailored to their budget range, without them even asking.

This level of hyper-personalisation may seem invasive at first glance, but it isn’t.

When done right, it feels useful. The difference is context.

It's not about pushing products, but rather about positioning yourself as a trusted financial advisor through timing and relevance.

For example:

-

A travel credit card offer appears when your customer books a flight.

-

An expense-tracking tool prompts customers when monthly bills spike.

-

A loan payoff suggestion pops up when your customer’s income trends upward.

Behind the scenes, this is all powered by advanced analytics and machine learning.

But for the customer, it feels intuitive, like their bank actually understands their goals and helps them reach them.

Worth knowing

Meniga’s micro-segmentation capability allows you to understand your customers on a granular level and tailor contextual communication to your customers’ needs.

Thus, you can nudge customers towards banking solutions they will use and benefit from, while increasing the ROI of existing features.

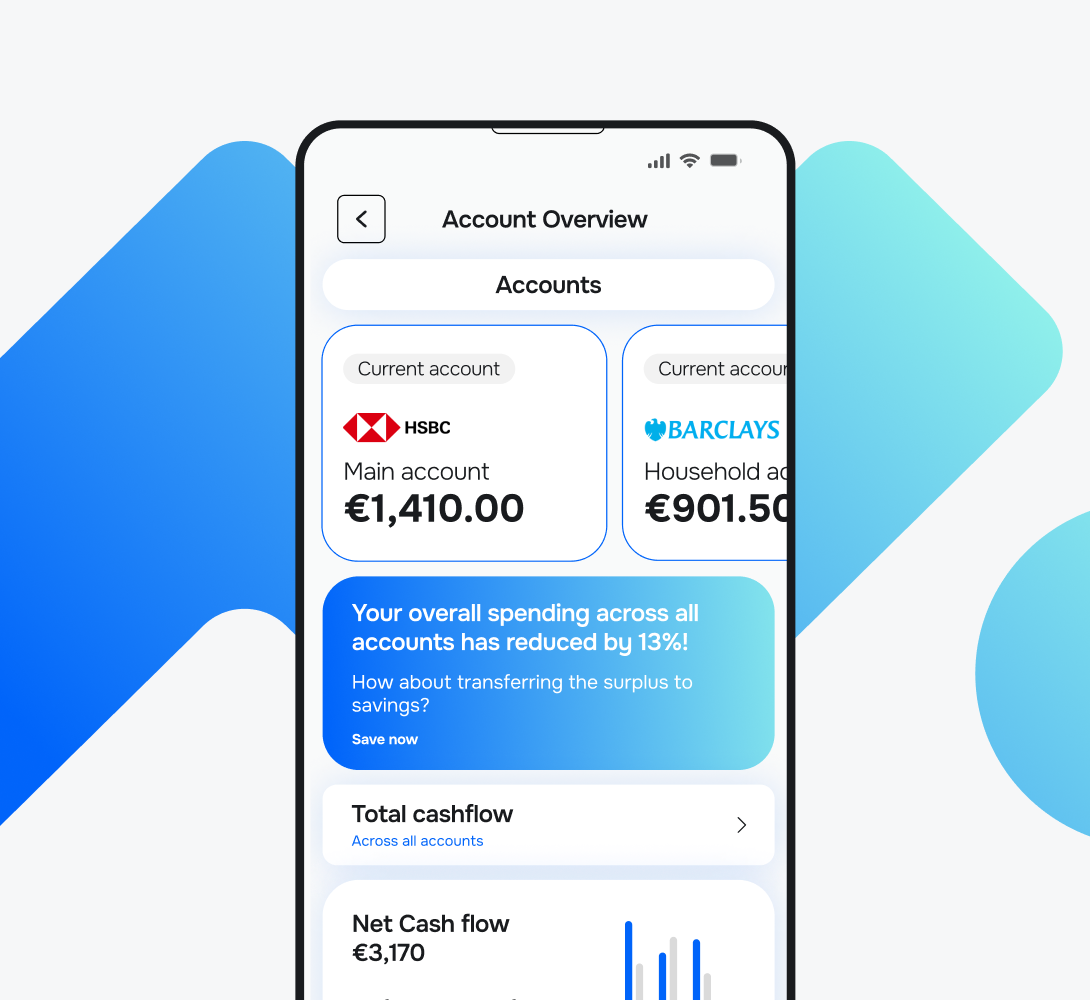

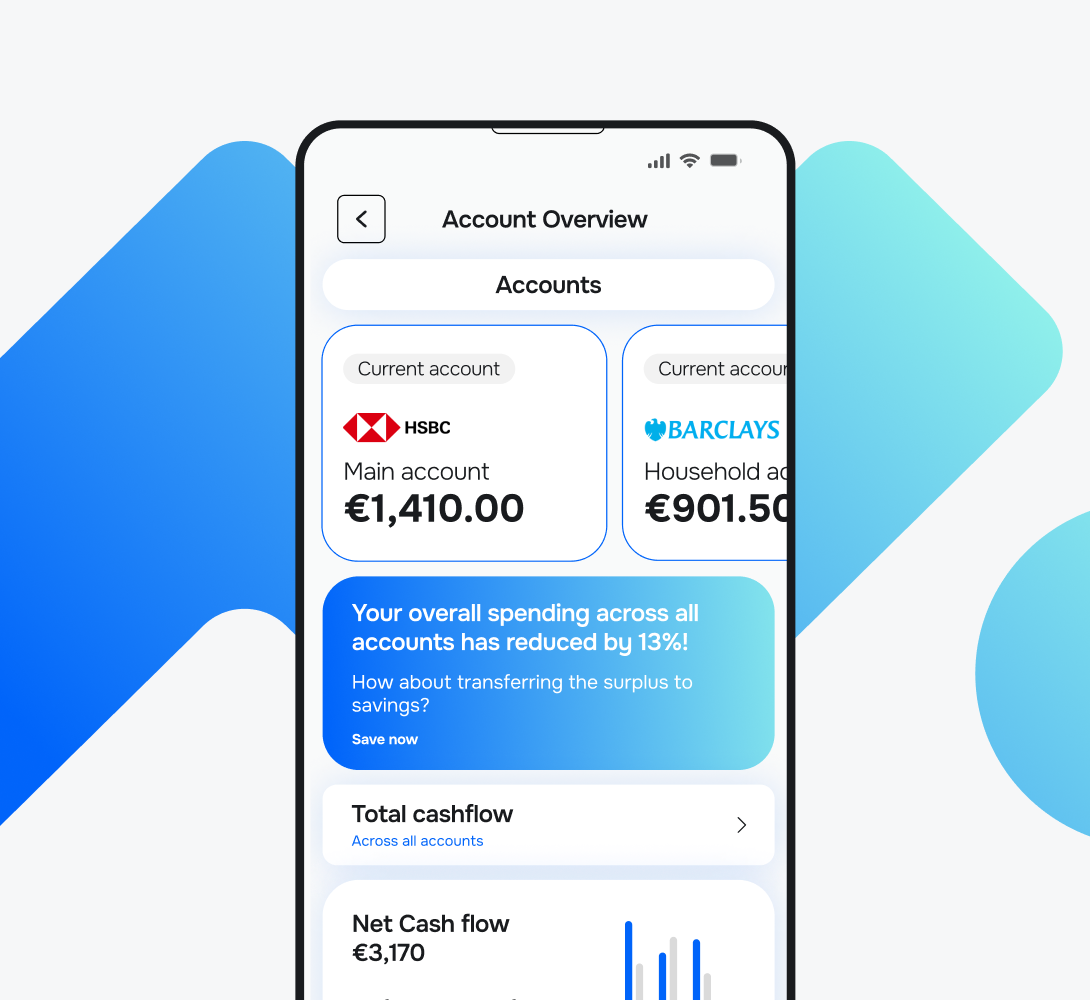

3. Open banking and aggregation

Managing finances across multiple banks, cards, and investment platforms doesn’t have to require logging into half a dozen apps.

Thanks to open banking, customers can see their entire financial life, from checking accounts to credit cards to crypto, all in one place.

The key enabler? APIs.

Open banking uses secure APIs to connect data across institutions.

That means a customer’s primary banking app can now pull in balances, transactions, and even loan information from other banks, credit unions, or fintech apps, providing a unified view of finances.

Nonetheless, it isn’t only about a cleaner interface but also about better decision-making.

When customers can see how much they owe, where they’re spending, and how their investments are performing, they’re more likely to:

-

Stay on top of payments,

-

Optimise savings, and

-

Notice issues early.

For example, customers could view their mortgage from Bank A, investment account from Platform B, and credit card from Bank C, right inside their main banking app.

Smart tools can then analyse this combined data to offer tailored advice, like paying off high-interest debt first.

If your bank is new to open banking, you may initially see it as a threat, but in reality, it’s a huge opportunity.

By supporting open banking, you become the go-to financial hub, even when customers hold accounts elsewhere.

Moreover, it builds trust, loyalty, and more opportunities to offer value-added services based on a complete financial picture.

Open banking also lays the groundwork for:

-

More advanced personalisation,

-

Smarter lending decisions, and

-

Cross-platform services.

It turns fragmented data into actionable insights, both for you and your customers.

Worth knowing

With Meniga, you can bring together financial data from any source, including open banking feeds, and turn it into a clear, unified picture.

Once that data is consolidated and enriched, you can leverage it to truly understand how your customers spend, save, and manage their money.

And here’s the thing: AI is only as smart as the data behind it.

Without clean, structured, and enriched information, even the best algorithms fall short.

That’s why strong data consolidation, enrichment, and standardisation aren’t just helpful, they’re critical if you want your AI tools to deliver real value and hyper-personalised experiences.

4. Embedded finances

Banking is no longer confined to bank apps or websites. Financial services now show up exactly where and when people need them: within non-financial platforms they use daily.

Picture this:

-

A customer is booking a flight and, right at checkout, is offered travel insurance or a currency exchange wallet: there is no need to leave the app or log in to their bank.

-

Or they’re shopping online, and instead of applying separately for a loan, they’re instantly approved for credit right at checkout, tailored to their profile.

That’s embedded finance in action.

For banks and financial institutions, this shift is strategic.

Partnering with non-financial platforms allows you to extend services, reach new audiences, and generate revenue without owning the full customer relationship.

And because these experiences are tightly integrated, they feel frictionless to the end user.

5. Predictive analytics for risk assessment

With vast amounts of customer data at their fingertips, banks now use machine learning models to anticipate risk before it becomes a problem.

Credit risk

When it comes to credit risk, predictive tools analyse a wide range of variables that go beyond just credit scores:

As a result, you can do more accurate risk profiling, especially for non-traditional or thin-file customers like freelancers, gig workers, or younger borrowers.

Fraud prevention

On the fraud prevention front, predictive analytics enables real-time detection of unusual patterns.

If a customer's behaviour suddenly deviates: an odd login location or a sudden high-value transfer, the system can flag it instantly or trigger automated security measures.

What makes predictive analytics so powerful is its proactive nature.

It allows you to step in early, offering a credit adjustment, verifying a suspicious transaction, or flagging financial distress before a missed payment or security breach occurs.

For you, this means:

6. Robo-advisors

Robo-advisors use algorithms to automate portfolio management, rebalancing, and tax strategies for everyday users.

Whether someone is investing $500 or $50,000, they can now receive tailored advice based on their goals, risk profile, and time horizon, without ever speaking to a traditional advisor.

The platforms typically rely on low-cost ETFs and Modern Portfolio Theory to optimise returns while managing risk.

They also support a wide range of account types, from taxable brokerage to IRAs, making them a one-stop shop for long-term financial planning.

And thanks to real-time monitoring, robo-advisors can adjust strategies as markets shift or the customer’s goals evolve.

However, the most effective are hybrid models that combine automated intelligence with human advisors for more complex needs.

7. Mobile banking features

It’s safe to say that mobile banking has become the primary gateway for the majority of customers to manage their finances.

This widespread use is driven by technological advances, changing user expectations, and the rise of AI-powered personalisation.

Key features defining mobile banking include:

-

Biometric authentication — Face ID, fingerprint scans, and behavioural biometrics offer secure, seamless logins without passwords.

-

Real-time notifications — Instant alerts for transactions, unusual activity, and account changes keep users informed and in control.

-

Smart budgeting tools — Integrated AI helps users track spending, set goals, and receive personalised savings insights, right from the app.

-

Card controls — Users can instantly freeze, unfreeze, or set limits on cards, reducing fraud risk and improving security.

-

Mobile wallet integration — Tap-to-pay functionality and integration with Apple Pay, Google Pay, and other wallets make payments frictionless.

-

Loan and investment access — Apply for loans, monitor investments, or speak with a virtual advisor without switching platforms.

-

Chatbots and virtual assistants — AI-powered chat tools help users resolve issues, manage accounts, and get personalised advice 24/7.

8. Cloud-based banking features

By shifting to the cloud, you can reduce overhead, launch products faster, and tap into powerful AI and analytics tools, all while improving security and compliance.

Cloud platforms also support smarter fraud detection, seamless team collaboration, and blockchain integration for more secure transactions.

The main use cases include:

-

Core banking modernisation — Cloud-native core banking systems replace legacy platforms, offering modular, API-driven architectures that support rapid innovation and integration with fintech ecosystems.

-

Payments and card management — Powers real-time payment processing, AI-based fraud detection, instant digital card issuance, and seamless cross-border transactions.

-

Personal finance and wealth management — Enables personalised financial advice, budgeting tools, and robo-advisory services accessible via mobile apps.

-

Customer onboarding — Streamlined digital onboarding workflows, identity verification, and compliance checks with scalable, automated processes.

Cloud banking capability implies more than just a tech upgrade. It’s how you stay competitive, agile, and customer-first.

Meniga is a digital banking technology provider that helps banks and large financial institutions make the most of their customer transaction data.

By turning raw financial information into actionable insights and personalised services, we empower banks to deliver more value to their customers.

What do you get with Meniga?

1. Clean, categorised data

Meniga solves messy and inconsistent banking data by enriching and standardising transaction data. It means that:

-

Descriptions are cleaned up for readability (no more cryptic merchant codes).

-

Transactions are automatically categorised using advanced machine learning.

-

They are enriched with merchant information such as clean merchant names, logos, and geolocations.

-

The system adds context, like identifying recurring payments or major life events, to help you better understand user behaviour.

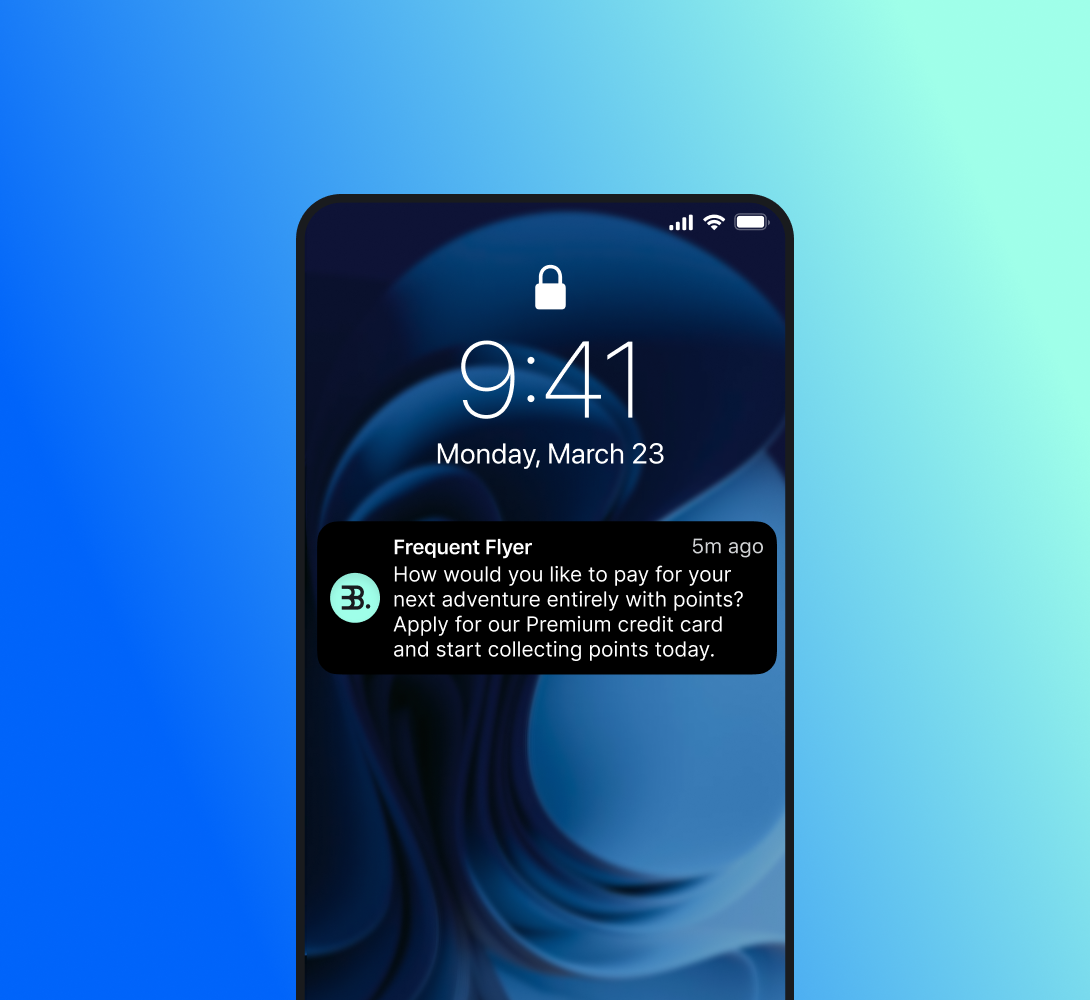

2. Apply Hyper-Personalisation

When banks start emphasising digital channels rather than physical branches, it is important to be able to provide the same level of personalised service.

Meniga’s AI-Powered Hyper-Personalisation Platform allows banks to position themselves as trusted financial advisors, enabling them to:

Care: Increase trust and loyalty by giving helpful advice about finances, such as warning customers about an outstanding payment that they have not paid yet.

Inspire: Boost ROI of existing digital features by nudging customers towards them, such as offering customers to sign up for Cashflow Forecasting to see all upcoming transactions for the next month.

Promote: Boost product uptake and digital sales by sharing ultra-relevant and hyper-personalised product recommendations at the exact time the customer needs it, such as offering a short-term loan to cover an unpaid expense.

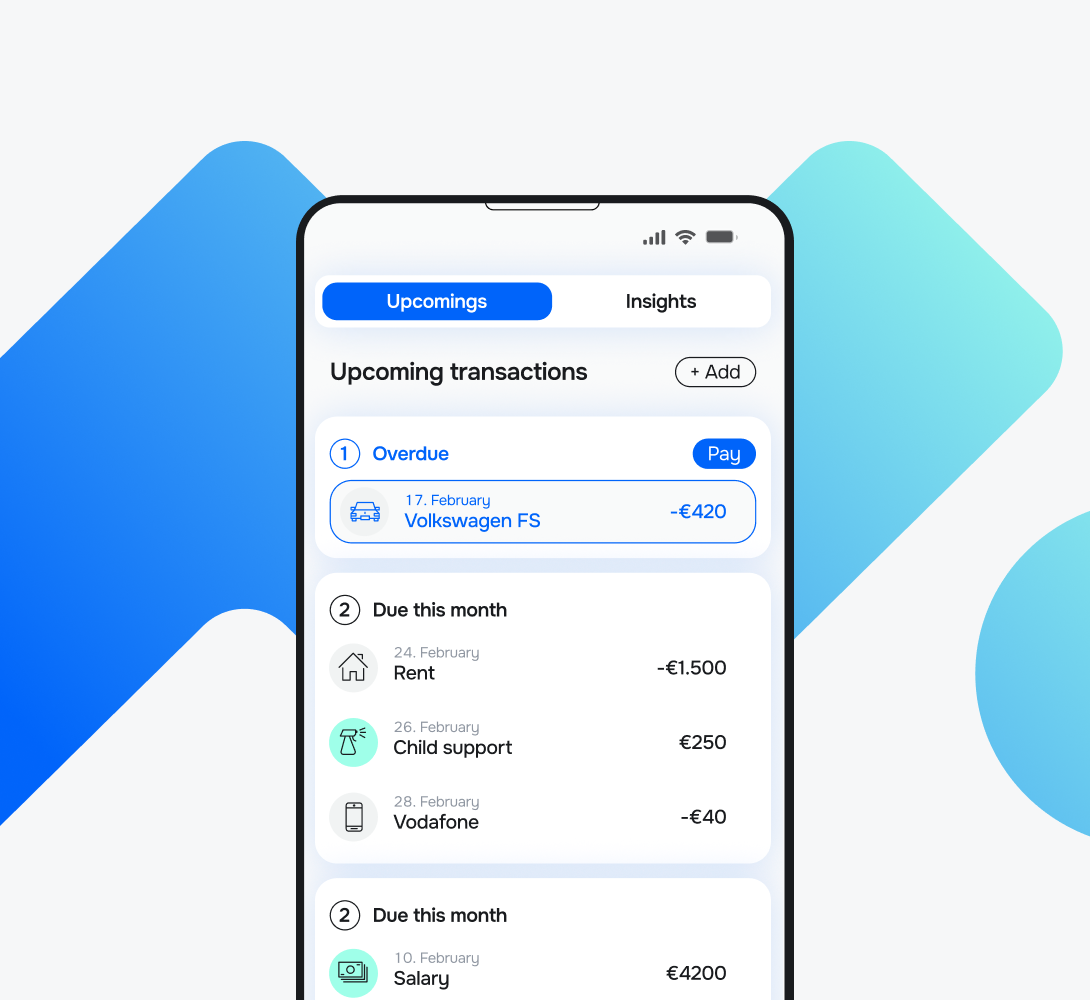

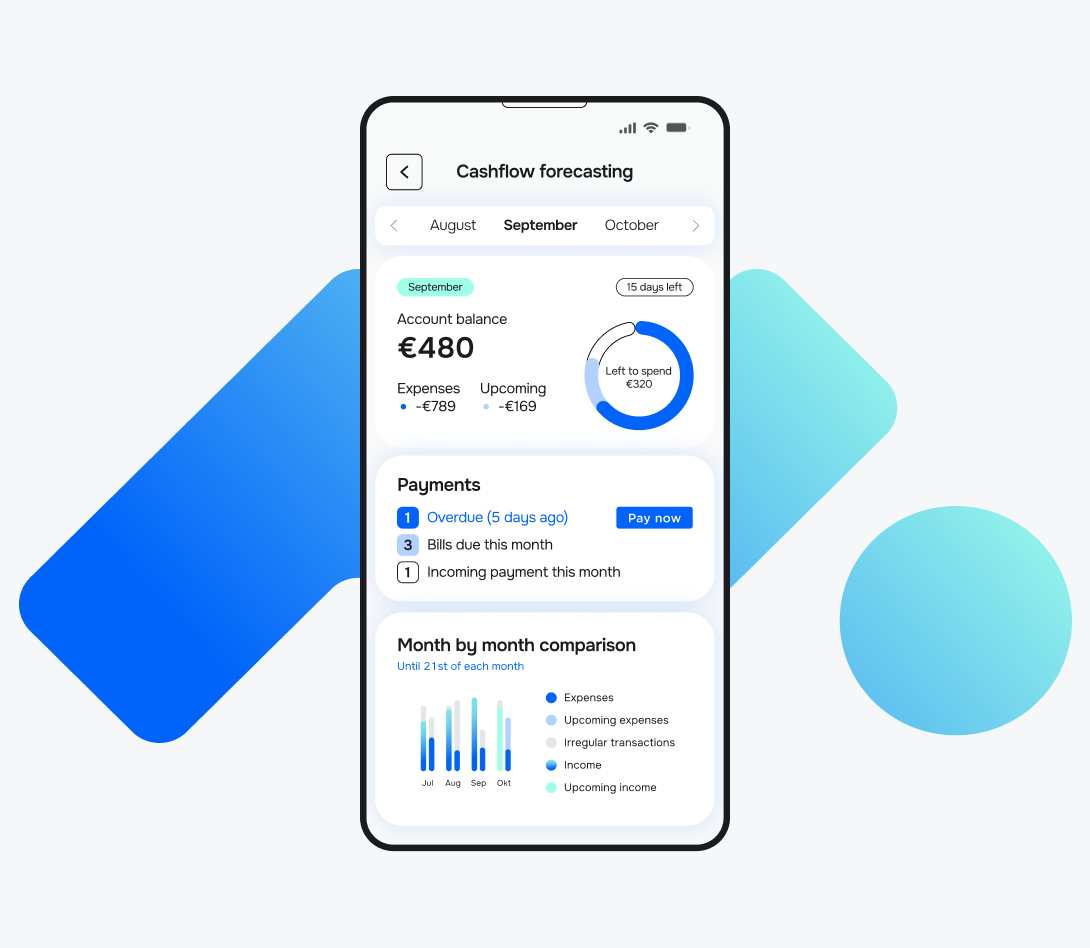

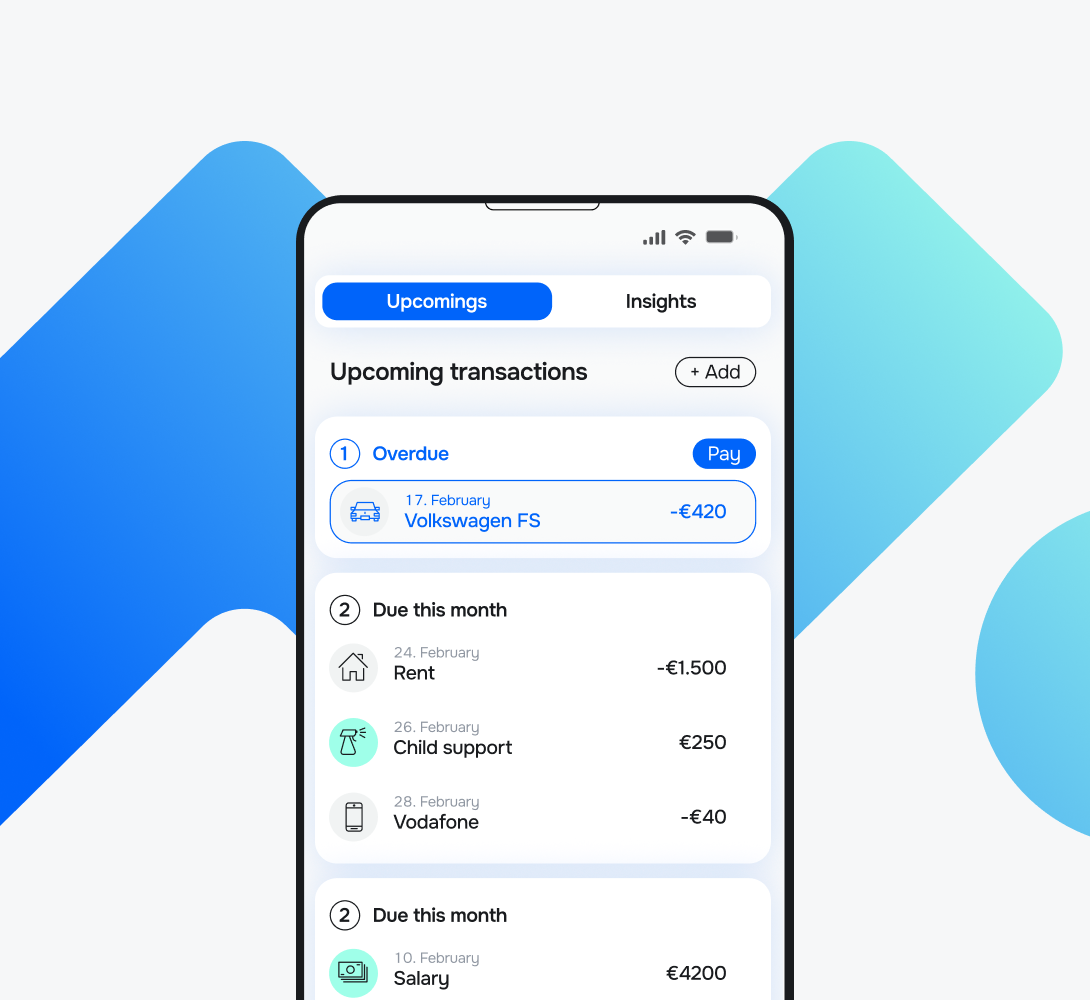

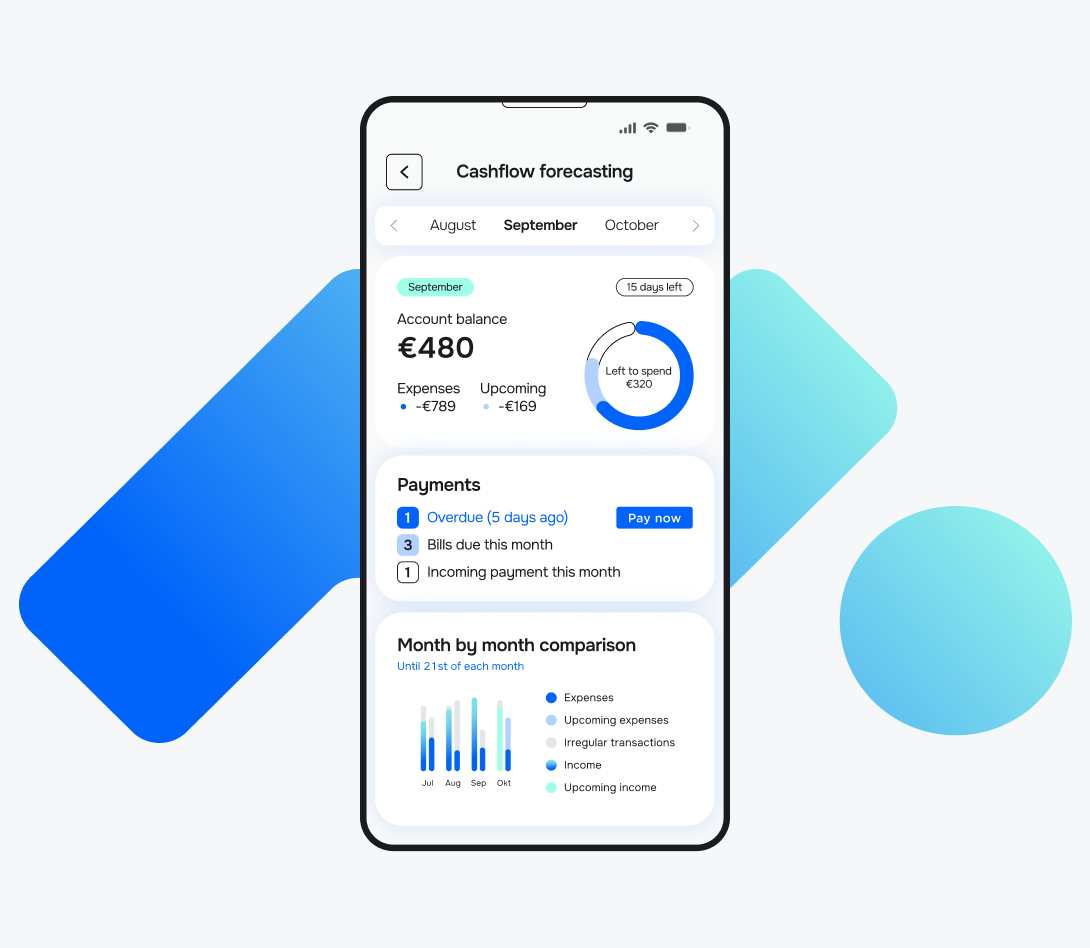

3. Cashflow forecast

Our ML-powered Cashflow Forecasting tracks balance trends and uses historical data to forecast future cash flow, helping your customers plan with confidence.

This feature automatically:

-

Spots recurring income and expenses,

-

Flags potential overdrafts or missed payments in advance, and even

-

Lets users test out “what-if” scenarios.

For example, how a new bill or salary change could impact their bottom line.

It’s a practical, proactive tool that puts customers in control of their money.

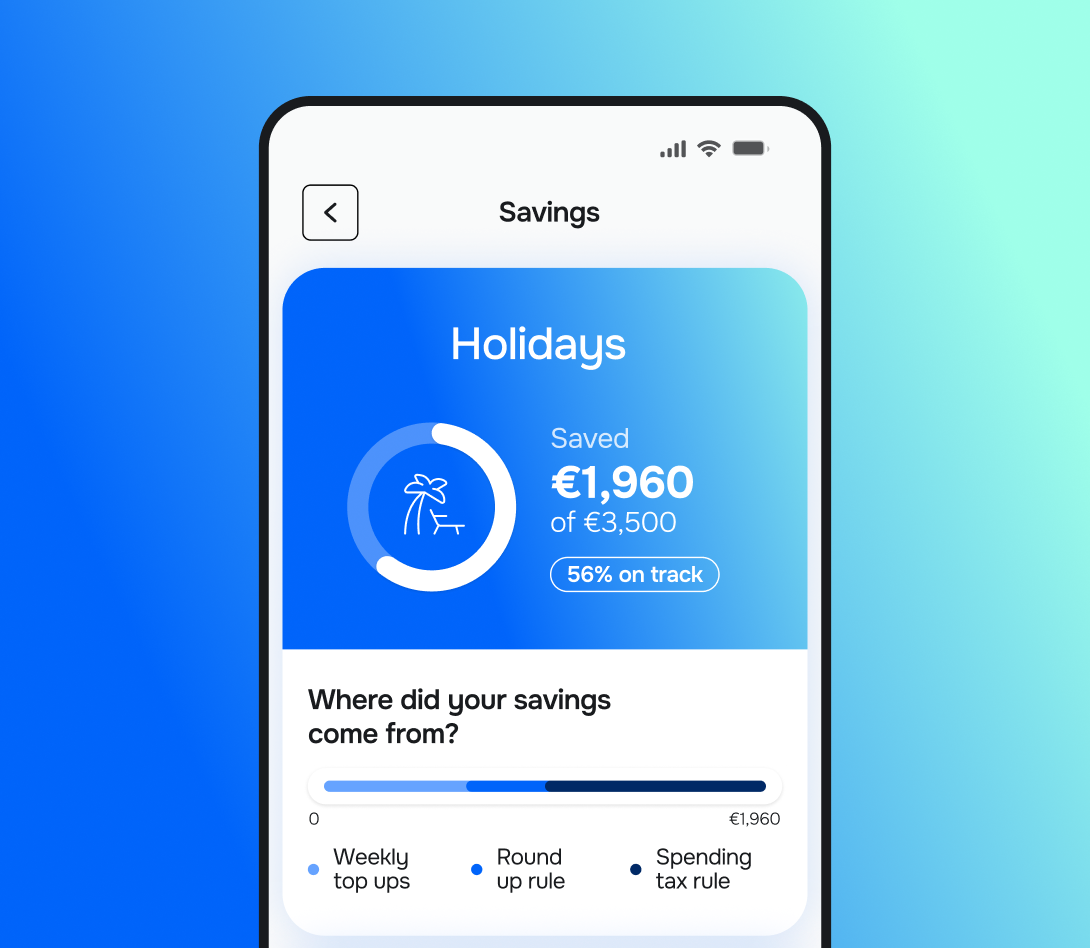

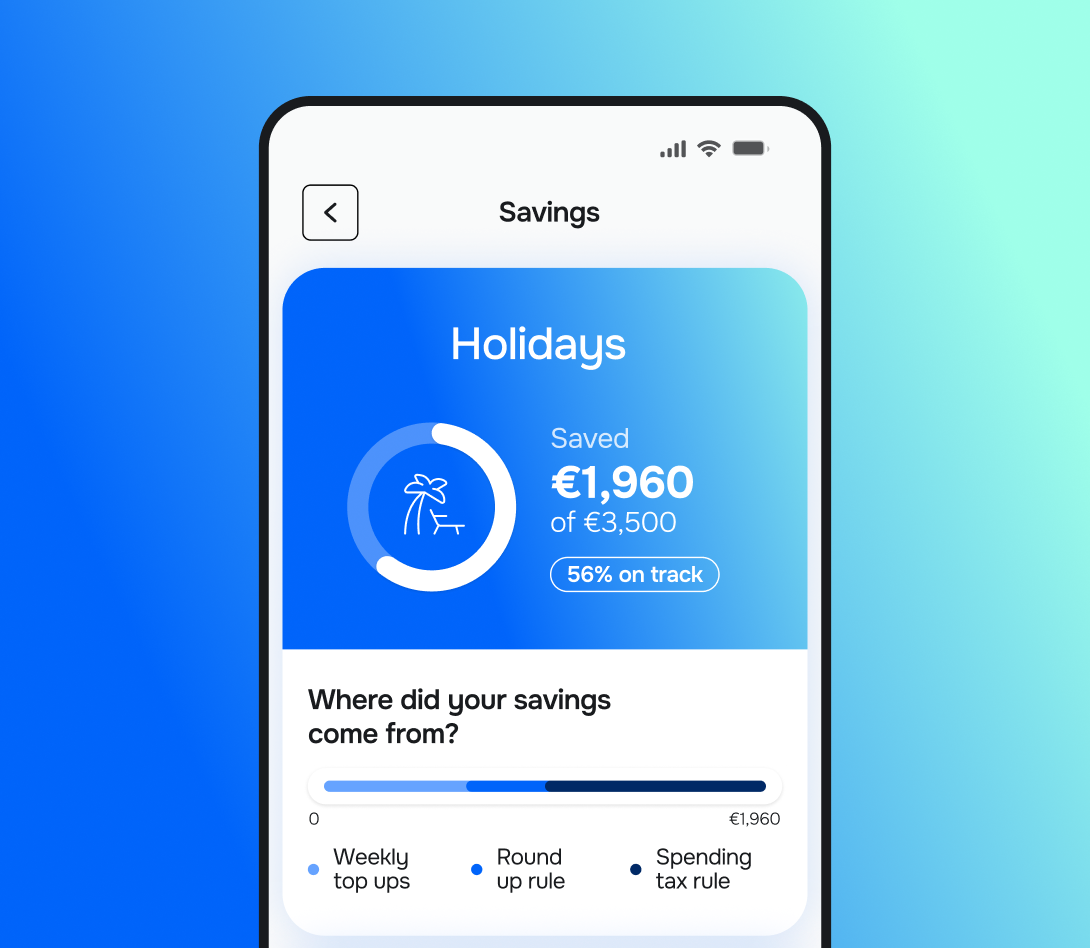

4. Automated savings

We provide various modules to boost savings and help educate your customers on building healthy spending habits.

-

Budgeting & spend tracking — Users can set category-based budgets and get real-time feedback on spending.

-

Savings goals — Easy-to-configure goals with progress tracking and auto-suggestions based on income and expenses.

-

Bill tracking & alerts — Helps users stay on top of recurring bills and avoid late fees.

Why it matters for your bank?

Meniga isn’t just about adding features but about helping you:

-

Launch features with unmatched speed and at a fraction of the cost of developing them in-house, thereby helping you keep up with market standards and fast-moving neobanks.

-

Boost engagement and turn passive users into active app users.

-

Gain insights to understand customer behaviour more deeply for smarter strategy and product design.

-

Increase revenue by using data-driven personalisation to improve cross-selling and customer lifetime value.

If you’re serious about digital transformation, contact us today and start modernising your digital offering with speed and depth.