With so many people across the globe currently experiencing financial uncertainties, banking customers are now relying on their banks, perhaps more than ever before, for support and guidance.

In his article on Finance Monthly, Ludviksson explains that banks now have a duty of care to preserve their customers’ financial well-being and ensure they remain financially fit, through digital banking solutions that encourage users to take control of their own finances.

“We have entered a critical point for the banking industry, where it is now absolutely crucial for banks to step up their innovation game to support their customers in a personalised and engaging manner through digital channels.”

Ludviksson highlights that the pandemic has significantly impacted the personal finance landscape by accelerating the rate of digital banking adoption and creating greater consumer needs for personal finance management.

Fundamentally, he believes that banks that fail to provide customers with the necessary digital tools they need to take ownership of their financial health at this time are at significant risk of losing customers to more innovation-focused competitors.

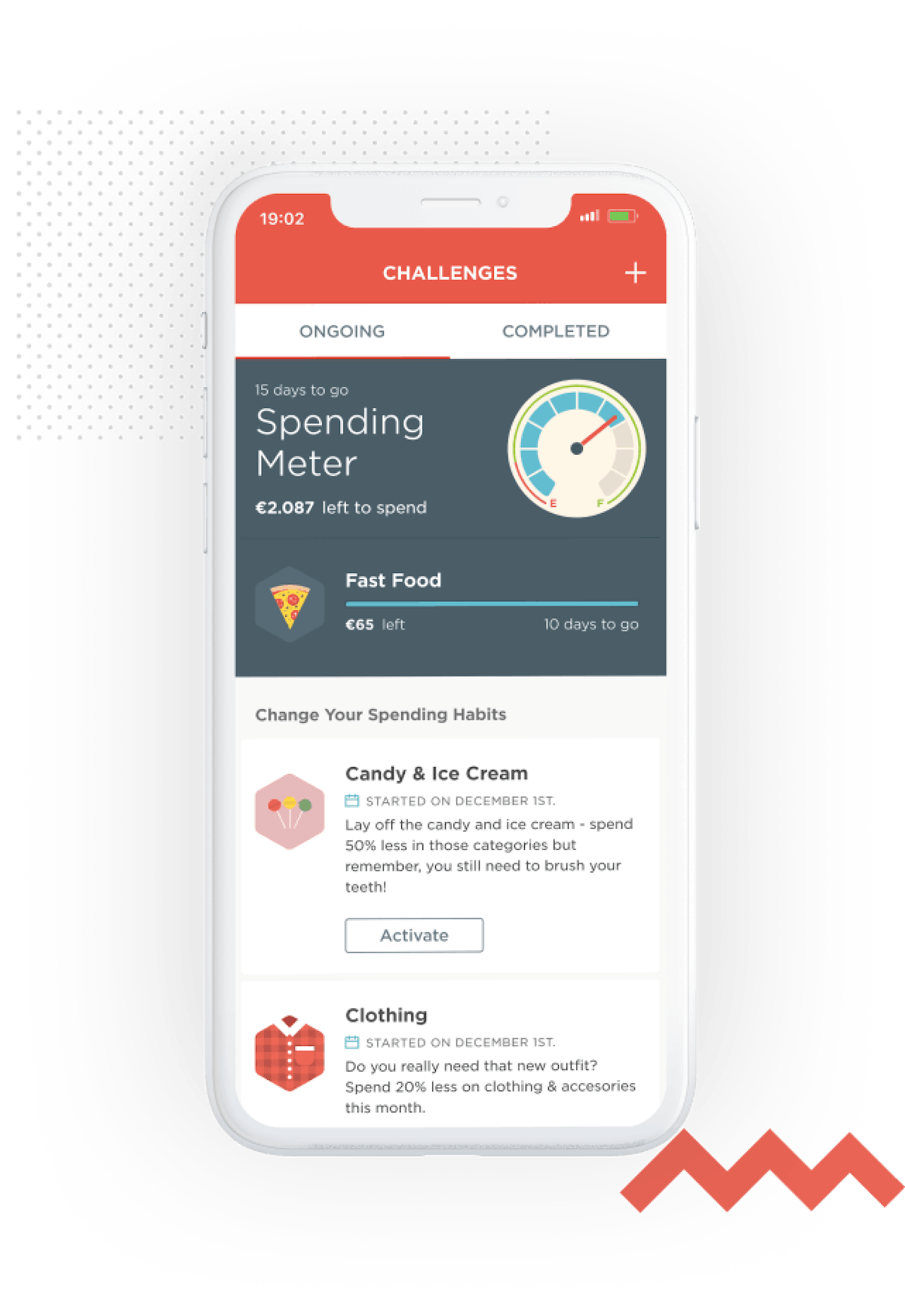

Ludviksson draws upon the physical health and fitness world and reveals that banks should consider studying what makes fitness apps so addictive and fun to use. When developing their own PFM solutions, he adds that banks should take inspiration from some of the features of these fitness apps, such as gamified challenges or social media-like activity feeds, which are so efficient at keeping users engaged and encouraging them to take control of their own health.

“Banks should analyse what makes fitness apps successful and replicate some of their gamified features and elements of their design to develop user-friendly banking apps which can be comparable to personal finance coaches and which focus on helping customers achieve goals and build healthier habits.”

Ludviksson concludes that with so much uncertainty caused by the pandemic, it is crucial that banks provide the support their customers need to build good financial habits. By focusing on elements of personal finance management and financial fitness, they will be able to stave off any competition and safeguard the loyalty of their customer base.

“It is impossible to predict exactly what the financial ramifications of COVID-19 will be.

However, we shouldn’t expect this pandemic to be a short-distance sprint but rather a marathon, and for this, banks need to be there for their customers to ensure that they are financially fit — or they will start training with somebody else.”

Read the full article here.

If you would like to know more about how you can ensure your digital bank is equipped for the post-COVID economy, check out our free insight paper Financial Fitness in a Post-COVID economy.

About Finance Monthly

Finance Monthly is a global publication delivering a balanced mix of insight, analysis and news which affects the financial world and which matters to those at the centre of the corporate sector, including CEOs, CFOs, investors, company directors, entrepreneurs, and SMEs. Finance Monthly is a multi-platform publication, offering global finance news coverage both online and in digital formats, distributed to 195,880 people each month.