As banks embark on their green transformations, they need to be careful not to leave their customers behind. With consumers lacking an understanding of green banking products, we look at how banks can educate them.

See why Carbon Insight is the #1 green banking product on the market

Banks are currently undergoing a green transformation – and green banking products will play a big part in this effort to operate more sustainably. But banks will need to ensure they warm customers up to the concept of green finance first.

Green finance has been around for more than a decade, with the 2015 signing of the Paris Agreement on climate change introducing the concept to a much wider audience. However, many consumers are still unsure what it looks like exactly.

A UK survey commissioned by Tandem Bank in 2020 found that over half of consumers still have no idea what green finance is, or how it contributes to the UK’s commitment to a zero-carbon economy by 2050.

Dig a little into the research and you can see the appetite for green finance is there:

- Over 60% of consumers say they would change their bank if a competitor offered them a greener and more environmentally responsible product or service.

- Over 50% say they would move their savings to a bank account that only invested their money in green causes.

While many consumers clearly have an awareness of green finance products, the majority have yet to truly understand them, and where they can add value to their lives.

For example, they might realise that green car loans exist – but not that they can be obtained at lower interest rates for purchases of electric or low-emission vehicles.

So, for banks to enjoy success in selling green financial products, they need to build education and understanding into the digital customer journey – in a way that feels completely natural.

But, how is that best achieved?

Consumers are still at the start of their journey on not only green banking, but going green in all aspects of their lives.

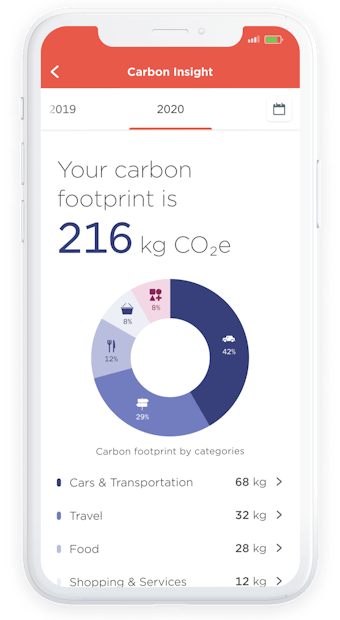

Carbon footprinting is the natural first step as it brings them an understanding of the emissions they produce, plus where they can make improvements.

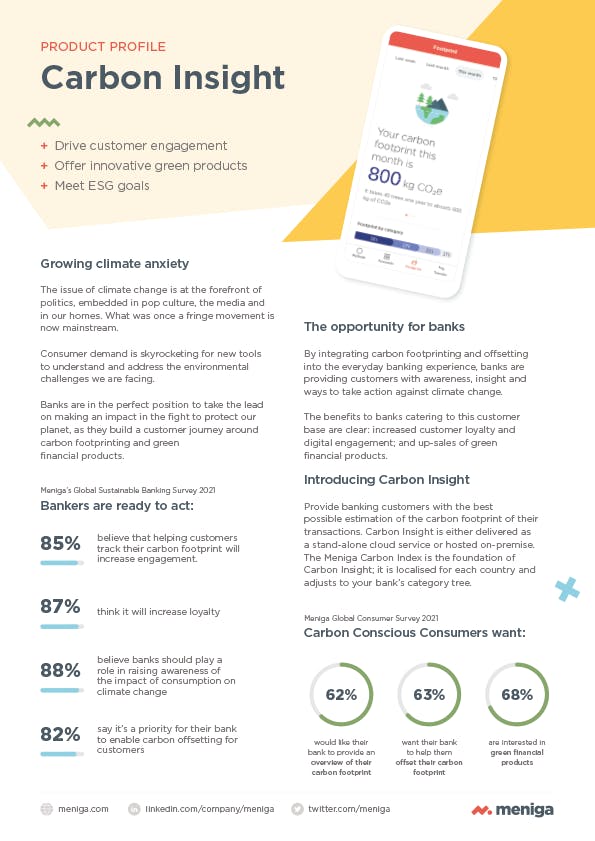

Meniga has made it easy for banks to provide carbon footprinting services with its Carbon Insight tool, which can be integrated as a stand-alone cloud service or hosted on-premise.

Providing unique insights into consumers’ carbon profile, Carbon Insight empowers them to become more sustainable. From there, banks have a much more solid footing to sell green banking products to their customers as ‘another way to cut your carbon footprint’.

With Carbon Insight, you’re building seamless digital customer journeys from carbon footprinting to eco-friendly financial products.

Understand how you can make green banking products part of the customer journey via the Carbon Insight product profile.