Your customers don’t want more products: they want the right ones, at the right time, delivered in a way that feels effortless.

And that’s where the problem lies. Despite massive investments in digital transformation, most banks still offer generic experiences that treat everyone the same.

The solution isn’t more features, but smarter, personalised banking.

Do it right and it will lead to higher engagement, better cross-sell performance, and stronger customer loyalty.

But how to do it in the right way?

Read on to learn how to do personalisation in banking that drives results, and how you can use it to your benefit.

What is personalisation in banking?

Personalisation in banking is tailoring financial products, services, content, and interactions to the individual needs, behaviours, and preferences of each customer.

It involves leveraging data, such as transaction history, financial goals, income patterns, and even lifestyle choices, to deliver relevant, timely, and contextual experiences across every channel: mobile app, website, in-branch, or customer support.

Thus, you can:

-

suggest a savings plan based on your customer’s spending habits,

-

offer a personalised loan rate after the customer hits a credit score milestone,

-

send a nudge to the customer to cut back on dining out when their monthly budget is at risk,

-

recommend investment products tailored to their risk profile, etc.

7 benefits of banking personalisation you shouldn’t miss

With customers expecting highly personalised experiences across all digital touchpoints, personalisation in banking has become a non-negotiable standard.

1. Enhanced customer loyalty and satisfaction

Impressive 74% of consumers across generations seek more personalised banking. What does this mean for your bank? Well, it signals a major shift:

-

It’s universal — Personalisation appeals to all age groups, not just younger users.

-

It’s expected — Customers now demand tailored, relevant financial experiences.

-

It’s urgent — Personalisation is no longer a differentiator but a baseline.

-

It’s profitable — Meeting this expectation can lead to higher engagement, more product uptake, and a stronger emotional connection with customers.

Although many traditional banks still view personalisation as a distant future, it’s very much present. It has moved from a nice-to-have to a must-have.

At the same time, just 6% of retail banks have a clear roadmap for scaling enterprise-wide, AI-driven transformation, highlighting a significant readiness gap in the industry.

Thus, if you start acting on it now, you can gain a serious competitive advantage.

2. Improved customer engagement

If you implement personalisation, you can see significantly higher engagement rates.

For example, personalised push notifications related to spending patterns can increase interaction rates by up to 300%, significantly enhancing user engagement compared to generic notifications.

Impressive statistics, but the reason behind it is rather simple.

When you deliver timely, relevant financial insights, customers feel understood.

When they get proactive alerts, such as reminders about upcoming bills, unusual spending spikes, or opportunities to save, they stay informed and in control.

And when budgeting tools adapt to their unique income and goals, managing money feels easier, not overwhelming.

This kind of ongoing support builds trust. It shows you aren’t just holding their money, but actively helping them succeed financially.

| Key elements of effective push notifications | Description |

| User permissions and opt-in transparency | Let users choose the types of notifications they want and clearly explain the benefits. |

| Segmentation for personalisation | Group users by by unique spending habits, behavioural signals, and financial goals to send tailored, relevant notifications based on specific financial needs. |

| Contextual and personalised Messaging | Use the customer’s name and provide real-time, context-aware content, such as recent transactions or location-based offers, to boost engagement. |

| Clear and concise content with strong CTA | Keep messages brief and actionable with clear CTAs, such as “View Payment” and “Update Card,” to guide user behaviour. |

| Optimised timing and frequency | |

| Rich media and visual appeal | Enhance engagement by adding emojis, images, or interactive elements that increase visibility and click-through rates. |

| Real-time, triggered notifications. | Send alerts instantly in response to actions like purchases, fraud warnings, or app inactivity to maintain relevance and urgency. Untimely communication can cause annoyance and reduce trust. |

| Deep Linking | Direct users straight to the relevant app screen or feature, minimising friction and improving conversion. |

| Security and Privacy Compliance | Avoid sensitive data in previews and ensure all notifications comply with data protection laws to maintain trust. |

| Continuous Testing and Analytics | A/B test messaging strategies and track performance metrics to optimise content, timing, and frequency for better outcomes. |

3. Higher cross-selling and upselling opportunities

When you truly understand your customers, not just who they are, but what they need right now, you get a powerful opportunity to grow relationships and revenue.

Advanced personalisation makes this possible by turning customer data into actionable insight.

By strengthening customer relationships and delivering targeted marketing, you can generate up to 40% more revenue from personalised activities compared to competitors with generic approaches

Thus, instead of sending generic credit card offers or savings plans, you can present the right product at the right moment:

-

A home loan offer just as someone starts browsing property listings, or

-

A travel insurance recommendation when flight purchases spike.

Not only is this timely and relevant engagement more helpful, but it also feels intuitive.

It sends a subtle message to your customers that you are paying attention and supporting real financial goals, not just pushing products.

As a result, customers are far more likely to explore and adopt new services, deepening their engagement.

When personalisation becomes proactive and contextual, cross-selling becomes a conversation, not a pitch.

4. Simplified customer acquisition

Closely related to the above benefit, personalised marketing allows you to speak directly to the right people with the right message, at exactly the right moment.

It starts with smart segmentation:

-

Understanding who your potential customers are,

-

What they care about, and

-

What they actually need.

From there, tailored messaging does the heavy lifting.

Instead of generic ads or one-size-fits-all emails, potential customers see content that feels made for them.

It is this kind of relevance that cuts through the noise, grabs attention, and builds immediate trust.

The outcome? Higher conversion rates, lower acquisition costs, and a smoother onboarding process.

Personalised acquisition is as effective as it is efficient. You're not spending more to reach more people. You're spending smarter to reach the right ones.

5. Reduced churn

You know very well that retaining customers is less expensive than acquiring new ones.

With personalisation, you can increase retention by not only reacting to customer behaviour but also anticipating it.

In fact, 62% of business leaders say that personalisation efforts have helped retain more customers.

Thanks to powerful AI-driven personalisation, you can deliver ‘next-best action’ recommendations in real time.

These aren’t random nudges.

They're intelligent, context-aware suggestions shaped by a deep understanding of each customer’s:

Suppose a customer is saving for a home, recently got a raise, or made a large purchase.

AI picks up on these signals and responds with the most relevant next step.

It might be an offer for a low-interest savings account, a reminder to update a budget, or a prompt to explore mortgage options.

Due to its timely nature, every interaction feels seamless, with customers feeling they don’t need to dig for help or advice. The advice finds them instead.

6. Greater cost efficiency

In addition to reducing churn, personalisation is also a smart way to cut costs.

By targeting the right, timely message to the right audience, you avoid wasting resources on broad, too generic campaigns that often miss the mark.

Instead of sending offers to everyone, AI-powered personalisation allows you to focus your marketing budget on customer segments most likely to respond.

It translates to fewer irrelevant messages, lower acquisition costs, and higher returns on each campaign.

Regarding customer services, personalisation streamlines operations too.

When customers receive timely, relevant information, they’re less likely to call support.

Therefore, you can reduce strain on call centres and let service teams focus on complex issues that really need a human touch.

7. Omnichannel convenience

Omnichannel personalisation keeps the customer experience connected and consistent across every touchpoint: online, in-app, and in-branch.

Thus, a customer can check their spending insights on their mobile app in the morning, chat with a virtual assistant on their laptop in the afternoon, and visit a branch the next day.

With a well-personalised omnichannel setup, each of those interactions feels like a continuation of the last.

There is no repetition of information or disjointed experiences.

This fluidity gives customers the freedom to engage on their terms, whenever and however they prefer, without losing context.

It’s convenient, it feels tailored, and it shows you understand their journey.

Examples of personalisation in banking with real impact: Meniga’s success stories

Discover how banks like yours are leveraging Meniga’s banking solutions to deliver personalised experiences that not only engage customers but also drive measurable ROI.

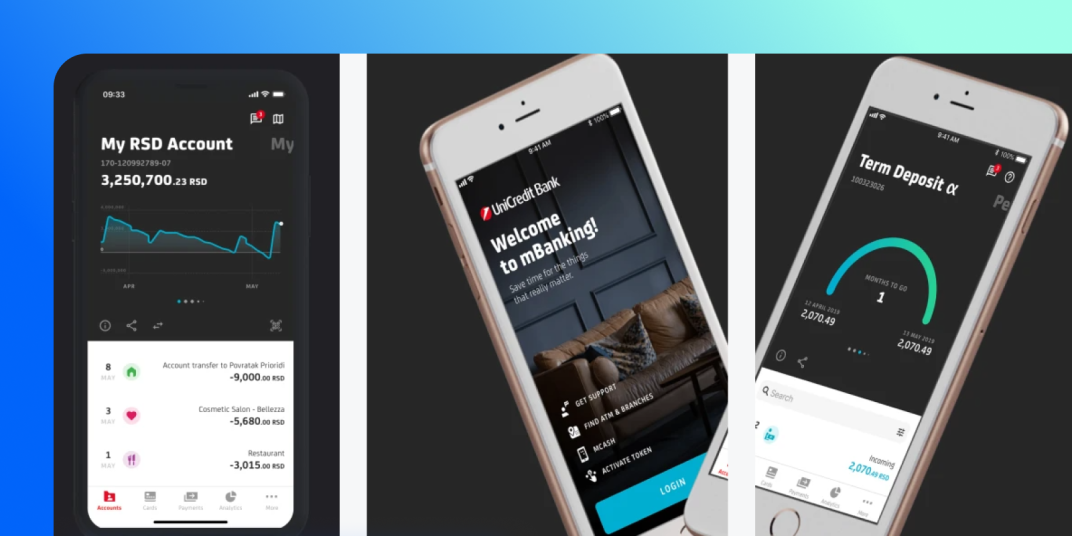

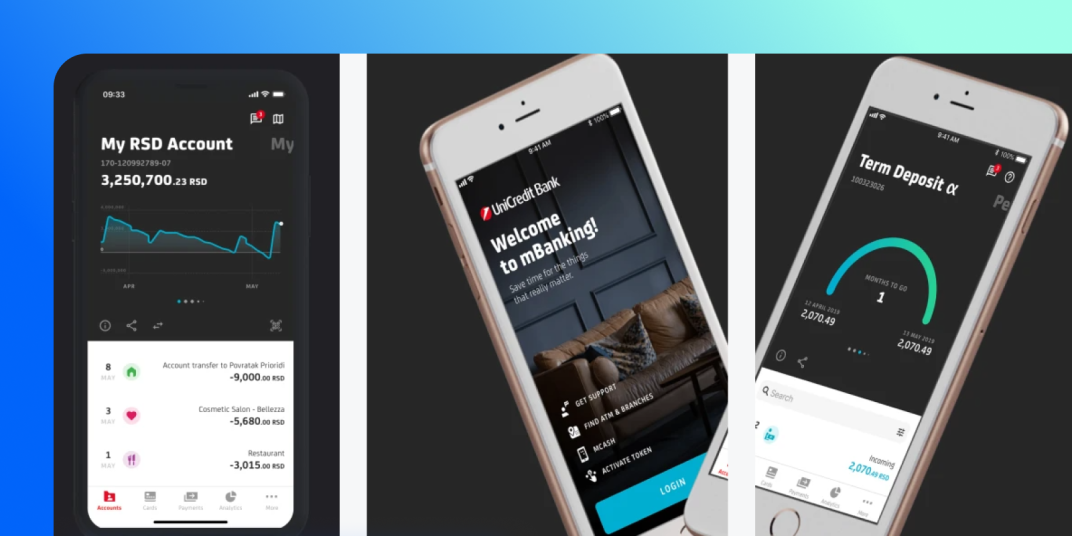

1. UniCredit: Prioritising customer experience

UniCredit is a leading pan-European bank, specialising in Retail Banking, corporate and investment banking, and Wealth Management across 31 markets worldwide.

The bank’s goal was to develop a data-driven app that enables customers to better understand and manage their finances, while delivering an engaging and delightful user experience to expand UniCredit’s customer base.

They opted to integrate Meniga’s digital banking software globally.

Key features of the solution:

-

Financial overview — Provides clients with a simple and clear overview of all their banking products in one place.

-

Spending overview — Offers a user-friendly app interface that presents a snapshot of customer finances using easy-to-understand infographics.

-

Notifications — Delivers important financial insights and nudges directly to customers within their digital banking platform, helping them make informed decisions.

The results?

-

50% increase in app user visits.

-

98% increase in through-app transactions.

-

40% increase in the number of active devices using the app.

-

>100% Average session length/ time spent on the app more than doubled.

-

49% increase in monthly active users.

-

33% increase in registered users.

2. Íslandsbanki: Driving loyalty and savings

Íslandsbanki is a leading financial institution in Iceland, holding roughly 35% market share across all domestic business segments and total assets of ISK 1,029 billion.

The bank aimed to transform its digital banking platform to help customers better manage and get more out of their personal finances.

Íslandsbanki’s vision was to build long-term customer loyalty and engagement by acting as a proactive, personalised financial coach.

Key features powered by Meniga:

-

Life goals — A tool that enables users to set, track, and achieve savings goals. Customers can allocate funds to specific goals and automate monthly contributions, making financial planning tangible and motivating.

-

Financial planning — Provides a clear, forward-looking view of accounts, including projected income and expenses for upcoming months, helping users make informed financial decisions.

-

Auto-calculated budgets — The platform automatically generates budgets for each spending subcategory based on users’ historical behaviour, allowing for detailed tracking and control over spending.

-

Cashback rewards — Delivers personalised cashback offers based on transaction history, helping customers save money on relevant purchases and increasing engagement with the bank’s ecosystem.

The results?

-

19.4% increase in the average number of accounts (including credit cards) for active PFM users.

-

71% of PFM users say that PFM increases their loyalty to their bank.

-

41% say they have improved financial behaviour after starting to use PFM.

-

66% of users say PFM has helped them see how they can improve financially.

-

9 out of 10 users say they‘d recommend the bank’s PFM to others.

-

Over 80% of users are pleased or highly pleased with their digital bank.

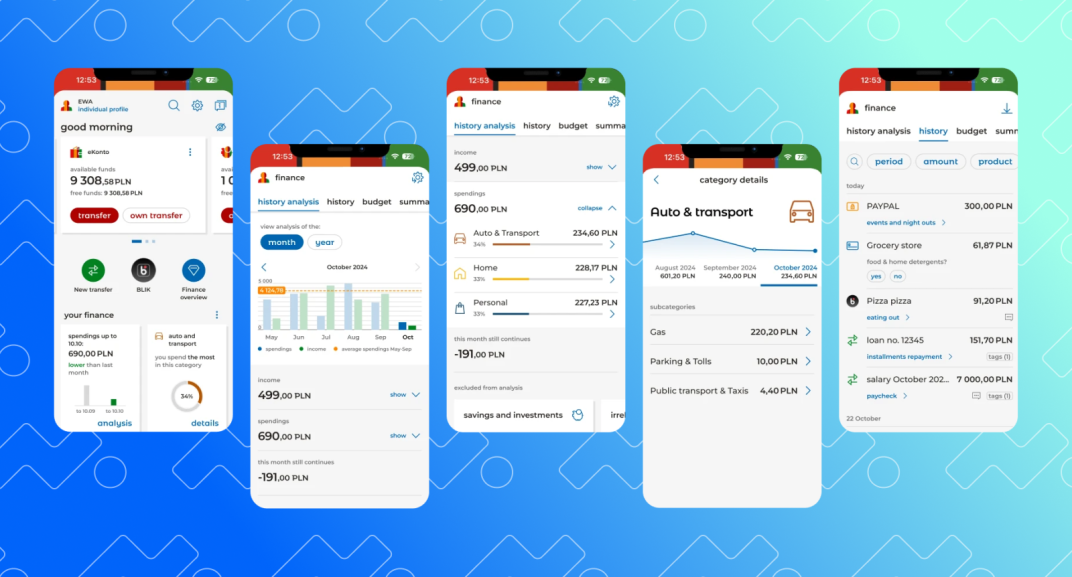

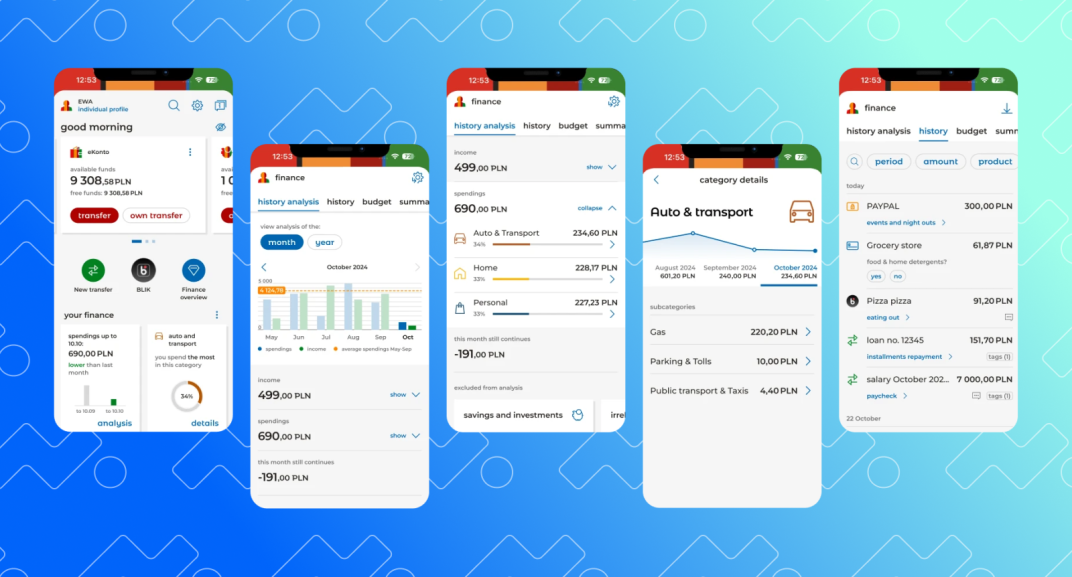

3. mBank: Transforming digital banking

mBank is recognised as Poland’s first fully online bank and remains one of the country’s strongest and fastest-growing financial brands, also operating in the Czech Republic and Slovakia.

The main challenge the bank faced was to help customers manage their current and future finances wisely by providing clear, structured information on inflows, expenses, and assets.

Key features delivered:

-

Advanced categorisation engine — Meniga’s categorisation technology enabled customers to better understand their income and expenses through automatic segmentation.

-

Google-like search engine — Allows users to quickly access a financial overview and define budgets using a powerful, intuitive search function, mirroring the ease of searching on Google.

-

Spending and budget tracking — An activity feed automatically segments expenses by category and subcategory, down to individual transaction details, helping users effortlessly track and control their finances.

The results?

-

200,000 new users in the first week.

-

70% increase in new client applications for new products.

-

In 2024, mBank received the award ‘The world’s most digitally advanced banking institution” in Deloitte’s international report 'Digital Banking Maturity 2024'.