With consumers and governments placing increasing pressure on banks to make sustainable banking a priority, now is the time for action. Let’s look at what’s required to make sustainable banking a reality.

See why Carbon Insight is the #1 green banking product on the market

Consumers have begun asking “How green is my bank?” for the first time.

Historically, people only moved bank accounts during a moment of transition such as starting a new job or getting married, then remain there unless a disruptive event happens. But the new carbon conscious consumer is assessing their bank’s sustainability credentials.

It’s not only consumers who are putting banks under increasing pressure to go green. So, too, are governments following the Paris Agreement, in which 191 nations have committed to keep the increase in global average temperature to well below 2 °C (3.6 °F) above pre-industrial levels, and to take steps to limit the increase to 1.5 °C (2.7 °F).

So, banks need to commit to finding ways to adopt sustainable banking into their processes and operations. Many banks have already committed to be net zero by 2030 or sooner. But now is the time for action.

Sustainable banking is not only better for improving a bank’s carbon footprint but also its bottom line, research suggests. Here are some of the ways a bank can set itself on a path to more sustainable banking:

- Green banking products – Supporting the transition by providing financing that is specifically focused on green activity, including for renewables, energy efficiency and sustainable transport. This includes specific products such as Green Loans, Green Project Finance, and Green Bonds.

- Supporting businesses – Tailor-made debt solutions for firms as they continue on their individual journeys to transition to a sustainable, low-carbon economy.

- Green investments – Investing in funds which will help advance innovative carbon-efficient technologies and supply chains.

- Going paperless – Reducing the excessive and unnecessary volume of printed documents such as personalised card carriers, inserts and PIN mailers, as well as paper products associated with delivering and activating cards.

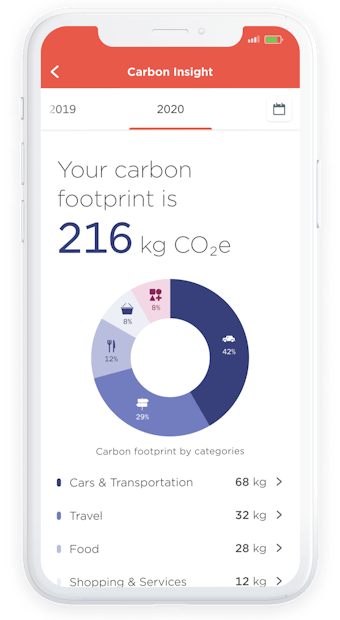

- Carbon footprinting – Giving customers more insight into how their spending habits are affecting the environment.

Partnerships will be crucial in enabling banks to be more sustainable. Partnering with Meniga will allow you to tick off the ‘carbon footprinting’ element of sustainable banking with relative ease.

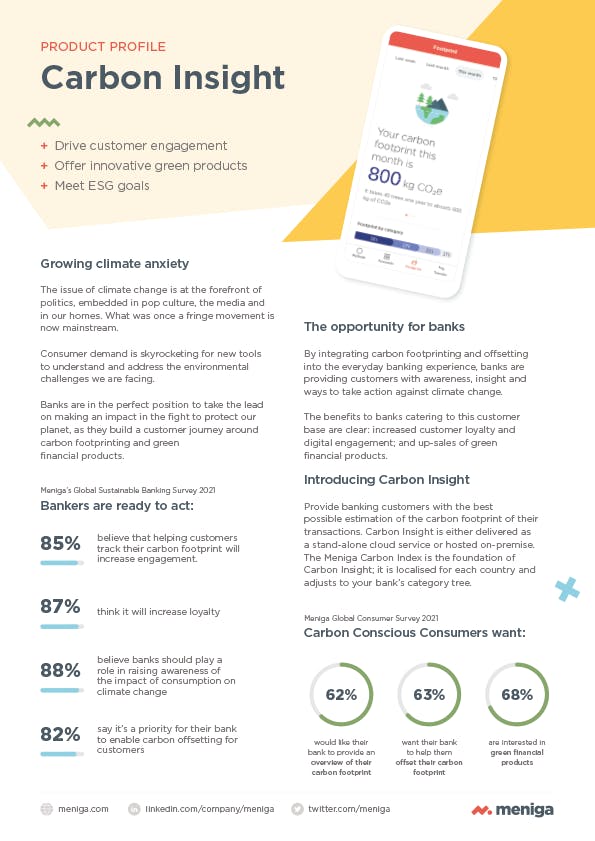

A white label solution, Carbon Insight gives an accurate estimate of customers’ carbon footprint based on their spending pattern. It provides unique insights into their carbon profile and empowers them to become a more sustainable consumer.

Carbon Insight has been shown to drive digital engagement, and our clients are using that increased interaction with their bank to great effect: directing them to green banking products.

As a sustainable banking tool, Carbon Insight is revolutionary in how it integrates carbon footprinting and offsetting into the everyday banking experience – doing wonders for your sustainability credentials.

To understand more about how Carbon Insight works, read our paper on Carbon Conscious Banking.