How effectively are you using your data?

Meniga helps maximise the value of your data for better and more personal digital engagement.

As data is such a critical element, it also comes with the biggest challenges that every successful digital bank needs to get right.

Quality

Messy, nonsensical data coming from various different sources.

Accessibility

Late and inaccessible data making it unusable for real-time insights or analytics.

Effectiveness

When used to its full potential, data should stimulate exceptional customer experience, generate revenue and power innovation.

We help your bank strengthen your foundation of data for better and more personal digital engagement.

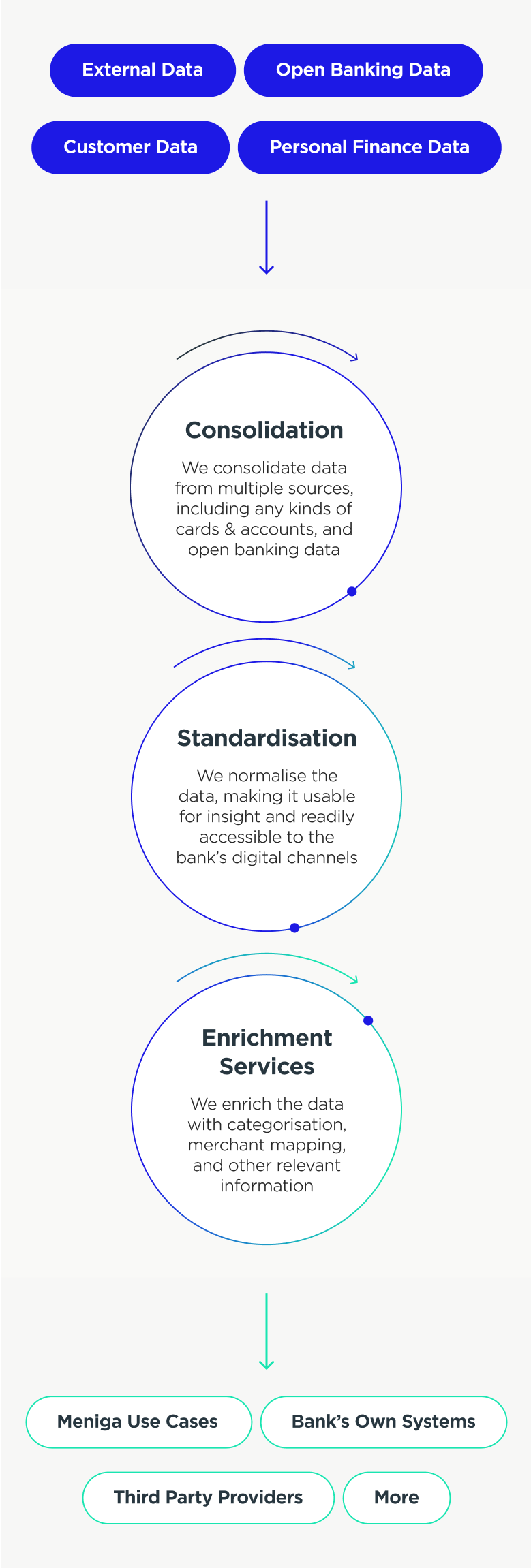

Meniga aggregates, consolidates, and enriches internal and open banking data to give banks a 360-degree view of their customers’ spending habits and finances, extracting maximum value from transaction data.

Meniga’s data solutions can help you release your data’s full potential.

Data Consolidation

Meniga’s data consolidation technology transforms fragmented and messy data into useful data that can provide valuable insight into the financial health and habits of your customers.

- Standardises and normalises data

- Collects from internal and external sources

- A holistic view of customer accounts

- Harmonised, easy-to-use data

Data Enrichment

We make transaction data insightful for customers.

Meniga Enrichment automatically categorises transaction data with astounding accuracy and fills in missing information, giving it a complete context

- 90% categorisation accuracy

- Adds merchant information and insightful analytics

- Supports personalisation

Open Banking

Meniga has extensive experience working with Open Banking data to allow banks to harness the potential of Open Banking.

This solution includes standard connectors to our partners to remove any pain points from banks.

- PSD2 compliant Payment Initiation Services

- Full support for consent management

- Advanced analytics & segmentation based on internal & external data